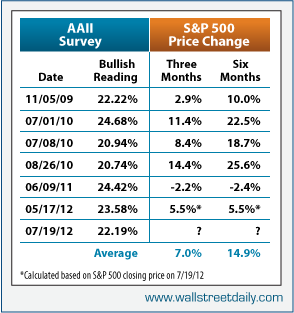

The American Association of Individual Investors (AAII) released its latest sentiment readings yesterday…[which showed that] bullish sentiment dropped a full eight percentage points to 22.19%, the largest weekly decline since April 12….Now that virtually no one is optimistic about the stock market, that’s all the more reason we should be bullish. You see, during the current bull market, when bullish sentiment drops below 25%, there is roughly an 80% chance stocks rally over the next three and six months. Take a look. Words: 384

sentiment readings yesterday…[which showed that] bullish sentiment dropped a full eight percentage points to 22.19%, the largest weekly decline since April 12….Now that virtually no one is optimistic about the stock market, that’s all the more reason we should be bullish. You see, during the current bull market, when bullish sentiment drops below 25%, there is roughly an 80% chance stocks rally over the next three and six months. Take a look. Words: 384

So says Lou Basenese (www.wallstreetdaily.com) in edited excerpts from his latest article”.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Basenese goes on to say, in part:

If you’re worried this frame of reference is too short, fear not. If we extend our analysis back to 1987, when AAII started tracking sentiment, the same tendency holds true.

According to Bespoke Investment Group, when the bullish reading is one standard deviation below the long-term average, stocks rally 78.7% of the time. When the reading drops to two standard deviations below, stocks rally 100% of the time over the next six months.

Take Note:

Here’s the key, though. If the reading drops another three-and-a-half percentage points, it would be a full two standard deviations below the long-term average. That would mean there’s a 100% chance stocks will rally over the next six months.

Long story short: Based on the extremely low bullishness in the market, the time to buy stocks is now especially when we consider the other bullish fundamentals working in our favor like analyst sentiment, unemployment trends, earnings reporting season and the fact that it’s an election year, not to mention that stocks are trading on the cheap. The price-to-earnings ratio for the S&P 500 Index rests at 14, which is about 10% below the long-term average.

Bottom Line:…

When bullishness drops below 19%, stocks rally 100% of the time. By double-digit margins, too, and with the latest reading within spitting distance of that threshold, I suggest that you act like a contrarian and do what’s extremely unpopular – buy stocks! Six months from now, I bet you won’t regret it.

*http://www.wallstreetdaily.com/2012/07/23/when-this-indicator-hits-19-stocks-always-rally/ (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. S&P 500 Prospects Not Good Given Economic Situations in Europe & Asia – Here’s Why

…[V]iewed objectively, the world currently stands at the precipice of an even greater crisis than the one in 2008-2009 but you wouldn’t know it by looking at US stock prices. The S&P 500 is down only about 10% from its peak levels in October 2007 compared to the leading indicator stock markets in Spain, Italy and China which…are all down by 60% or more since their peaks. It is folly to think that the S&P 500 index can long withstand simultaneous conflagrations in those countries because, as their economies go, so too will the entire global economy and [that is bound to adversely affect the U.S. as] close to 50% of all S&P 500 earnings are derived from outside the U.S.. Words: 840

2. S&P 500′s Performance Will Determine If, and When, We Have QE3 – Here’s Why

If you are angry about LIBOR – angry that 18 banks can set one of the world’s most important interest rates in such a poorly supervised, ill-understood manner – you should be even angrier that just 12 people sitting in a room can set the world’s single most important interest rate to suit the needs of the stock market, all under the pretence of controlling inflation? Let me explain. Words: 810

3. Black-Scholes “Volatility Smile” Suggests S&P 500 Could End 2012 15% Higher – Here’s Why

According to all sorts of financial media, the end of the fiscal world as we know it is about to occur. All rational individuals surely would come to the same conclusion, right? Wrong! For the past 3 years, the “world has been ending” according to nearly every publication. The market however, simply does not agree with this prognosis. Throughout the past 3 years, despite the negative headlines, the markets have rallied over 50% in wave after wave of briefly interrupted momentum. Given this continuous counter-intuitive bullish onslaught, and according to the volatility smile and the current positioning of money in the options market, I believe it is entirely possible for the S&P 500 to end the year…up 15% from its current price. [Let me explain.] Words: 829

4. Richard Russell: Market Caught in Standstill Between 2 Opposing Forces – Which Will Win Out?

The whole world of fundamental and technical analysis seems to be in a state of chronic confusion – confounded by this seemingly trendless stock market….[Usually] the stock market possesses the ability to forecast coming events but the periodic spates of Fed stimulation have thrown some sand into the stock market’s delicate machine….Thus, we see the stock market ‘up on Fed-created stilts’ and at the same time we see depressing economic news in the newspaper headlines. Meanwhile, Treasury yields are sitting on near-record lows. We’re seeing a strange paradox here.

5. The Bulls vs. the Bears: Which Direction are Stock Prices Going?

We are continuing to see ongoing pessimism among individual investors about the short-term direction of stock prices [but if you are a contrarian you should bet on a continued rise in stocks despite the continued sense of unease. Let’s take a look at a few charts that tell the story.] Words: 510

6. Fitzpatrick: Consumer Confidence Double-Top Suggests Stocks Could Plunge

Looking at the charts we…[see] a very strong double-top formation – very similar to what we saw back in 1980….[which suggests] that we are headed all the way back down again, possibly even to the lows that we saw in 2011….This is likely to weigh on equities. Words: 291

7. What Does the Current “Q Ratio” Say About U.S. Equities?

The Q Ratio is a popular method of estimating the fair value of the stock market developed by Nobel Laureate James Tobin. My latest estimates [suggest] that the broad stock market is about 33% above its arithmetic mean and 42% above its geometric mean……Periods of over- and under-valuation can last for many years at a time, however, so the Q Ratio is not a useful indicator for short-term investment timelines [and, as such,] is more appropriate for formulating expectations for long-term market performance. [Let me review the Q ratio with you, along with several graphs, so you can clearly understand what the Q ratio is, how it works and what it is currently conveying.] Words: 800

8. Goldman Sachs’ Leading Indicators Signal Steep Market Crash Ahead

Goldman Sachs reports their Global Economic Indicators (GLI) show the world has re-entered a contraction and…is predicting a market crash worse than that of the early 90′s recession and one slightly less than the sell-off at the turn of the millennium. [Below are graphs to support their contentions.] Words: 250

9. Marc Faber: We Could Have a Crash Like in 1987 This Fall! Here’s Why

Marc Faber has stated in an interview* on Bloomberg Television that “I think the market will have difficulties to move up strongly unless we have a massive QE3 (something Faber thinks would “definitely occur” if the S&P 500 dropped another 100 to 150 points. If it bounces back to 1,400, he said, the Fed will probably wait to see how the economy develops)….. If the market makes a new high, it will be with very few stocks pushing up and the majority of stocks having already rolled over….If it moves and makes a high above 1,422, the second half of the year could witness a crash, like in 1987.” Words: 708

10. Pento: Markets Will Fall Significantly This Summer – Here’s Why

Investors are being told that the worsening sovereign debt crisis in Europe will leave the U.S. economy unscathed….[because,] since we don’t make many things to export to Europe, our GDP won’t suffer a significant decline at all…. What [has been] conveniently overlooked, [however’] is the fact that 40% of S&P 500 earnings are derived from foreign economies and the seventeen countries that make up the Eurozone have collapsed into recession. [Let me explain what effect that will have on the performance of the S&P 500 this summer.] Words: 325

11. This New ‘Peak Fear’ Indicator Gives You an Investment Edge

We are at a major crossroads in the equity and bond markets. We could see a major ‘risk-on’ rally in the S&P 500 BUT if no equity rally ensues, and U.S. Treasury note yields keep falling, then something terrible is about to strike at the heart of the global capital markets…. [As such, it is imperative that you keep a close eye on this new ‘Peak Price’ indicator. Let me explain.] Words: 450

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money