…If your retirement plan has you selling shares no matter where we are in the business cycle, you could be in trouble but, with the right batch of investments, you could still count on income from dividends no matter what the markets are doing….[Here’s how you can do that.]

1. Make friends with dividends

Remember that market volatility often has little to do with a company’s business fundamentals. In times of panic, a company’s stock price might drop steeply even though nothing (or nothing much) has changed with its underlying business. That’s partially because a lot of companies are committed to making dividend payouts year-in and year-out. Of course that doesn’t mean that they will always be able to do so, but if they have a history of it–and there are plenty of firms out there that have increased their dividend payouts every year over 20, 30, or even 50 years running:

- Coca-Cola (KO) has paid out increasing dividends for 57 consecutive years and currently has a forward yield of 3.5%.

- ExxonMobil (XOM) has paid out increasing dividends for 36 consecutive years and currently has a forward yield of 4.15%.

- Altria (MO) has paid out increasing dividends for 49 consecutive years and currently has a forward yield of 6%.

[The above stocks are]…the beginning of an industry-diversified, income-producing portfolio right there but if you’re not into picking stocks yourself, there are well-diversified, low-cost mutual fund and ETF options that can get you a portfolio yielding 4% or so with no trouble at all–and with some dividend growth too, [namely]:

- Invesco S&P 500 High Dividend Low Volatility Fund (SPHD) which yields around 4%). This 50-stock ETF portfolio is pretty close to a one-stop shop for domestic dividend investors, and its fees are low for an actively managed fund.

- Vanguard Global ex-US Real Estate Fund (VNQI) which yields around 4.25%. This fund carries some emerging-markets risk, but with that risk comes opportunity for growth, all with a relatively big yield and of course Vanguard’s ridiculously low fees.

- iShares International Select Dividend Fund (IDV) which yields around 5%. This low-fee fund gets you 100 holdings that skew more toward developed markets than emerging ones, with only a very small portion in the U.S.

Here’s a simple back-of-the-envelope before-and-after.

- Say you have a $1,000,000 portfolio of stocks at retirement, and you’re planning on needing around $50,000 a year to live on. You’ll be drawing down 5% the first year, and somewhere close to that in the years immediately following. That percentage could ramp up over time, depending a lot on what the stock market does.

- If that portfolio gets cut down to $750,000 due to a bear market, you’re suddenly looking at a nearly 7% draw-down rate right out of the gate, assuming no change to your living expenses. Your portfolio will likely be depleted about 25% faster than before…

- If you could get a 4% dividend (and/or distribution) yield on that initial million-dollar portfolio, however, that would get you $40,000 without touching the principal. Taking the remaining $10,000 by selling some securities will be a lot less painful in a down market than taking $50,000. If the portfolio did get cut down in value by a bear market, those dividends would likely still keep coming.

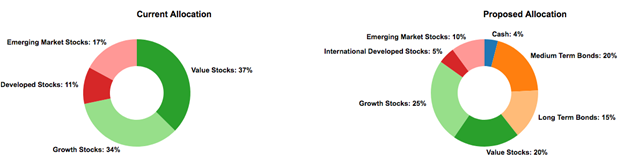

2. Diversify, but don’t worsify

The funds above are great for exposure to stocks but do you probably need to be in other assets too – especially as retirement nears. We’re thinking of fixed income (bonds) here. How much of your portfolio should be in bonds will depend on your risk tolerance more than anything else…

- Vanguard Total Bond Market ETF (BND) is a great place to start for any budding bond investor. Its .05% expense ratio is about as low as it gets, and while it might skew conservative (toward Treasury bonds) for some tastes, it’s tough to beat in its category. BND currently yields around 3%.

- On the more aggressive side, iShares iBoxx $ High Yield Corporate Bond ETF (HYG) could be a good option for boosting your fixed-income yields, though with a fair amount more risk than BND. HYG’s current yield is more than 5%.

Downside Protection

Market volatility isn’t going away. If you’re going to be an investor, it’s just part of the game but you can do more than just let it happen, hoping for more of it in your early investing years and less of it later.

- Getting a passive stream of income (like dividends) is a great place to start;

- getting your asset balance right as part of an overall retirement plan should also be near the top of your personal finance to-do list.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money