The Platinum Group Metals (PGM’s) and Nickel both outperformed the equity markets, 30 year bond and other  metals in 2014 and such performance should continue going forward for many years to come. Here’s why.

metals in 2014 and such performance should continue going forward for many years to come. Here’s why.

The above are edited excerpts from an article* by Jeb Handwerger (goldstocktrades.com) as posted on SeekingAlpha.com under the title 10 Reasons Why Nickel, Palladium And Platinum Are Outperforming In 2014.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Handwerger goes on to say in further edited excerpts:

Palladium

South Africa (38%) and Russia (41%) control the PGM market with North America only producing 14% of global supply. Palladium is at multi-year highs.

Nickel

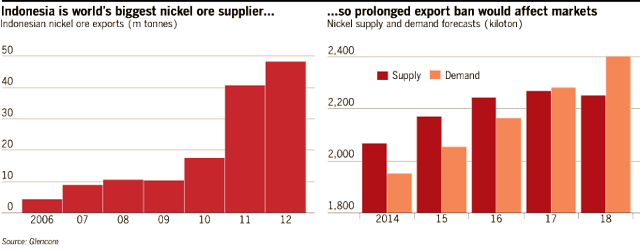

Nickel is up more than 50% on the year as a result, primarily, of a recent export ban by Indonesia which controls nickel supply.

PGM’s and nickel are outperforming for the following 10 reasons:

- Labor strikes in South Africa are ongoing

- Economic sanctions with Russia which could add to nickel and palladium shortage [Read: Palladium Breaks $800 As Economic Sanctions Stifle Russian Miners]

- Auto sales continue to increase in China to record levels and PGM’s are used in catalytic converters to control air pollution

- Indonesia’s export ban of nickel is comparable to announcing the OPEC nations cutting off oil supply

- Rapidly growing cities in emerging economies are building skyscrapers, pipelines, bridges, power plants, etc. all of which require stainless steel

- Existing PGM and nickel production growth.

- China, the largest growing consumer of these metals, has very little domestic production.

- Very few high quality and advanced mining projects in stable jurisdictions are in the project cupboard.

How to Invest

- Focus on either the Platinum (PTM), Palladium (PALL) and Nickel (JJN) ETFs tracking the commodities.

- If looking for leverage to PGM and nickel prices look at the large cap miners…

- For more speculative investors looking for outsized gains with additional risk…[consider] the junior miners who control advanced PGM and nickel projects preferably with Preliminary Economic Assessments and Feasibility Studies in top notch jurisdictions. Most of these stocks are smaller cap and trading on the Canadian Exchanges and will be the focus of additional articles.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://seekingalpha.com/article/2238143-10-reasons-why-nickel-palladium-and-platinum-are-outperforming-in-2014?ifp=0 (© 2014 Seeking Alpha)

Related Articles:

1. All the Facts About Physical Platinum & Palladium and How to Easily Invest in Them

With demand rising and supply under pressure, the outlook for investment in physical platinum and palladium is compelling. What are they used for? Where are they produced? What is the global supply/demand for each? Learn the full story from the infographic below. Read More »

2. A Direct Comparison Between Gold, Silver, Platinum and Copper

Here’s an updated analysis of physical gold, silver, platinum and copper regarding their respective versatility of use, durability, fungibility, store of value, liquidity and aesthetics. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Good article!

I agree that PGM + N will all do well since they are in limited supply and who knows, if Governments crack down on owning Gold and/or Silver perhaps next we will have PGM and N rounds take their place…