“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report (Recipients restricted to only 1000 active subscribers)

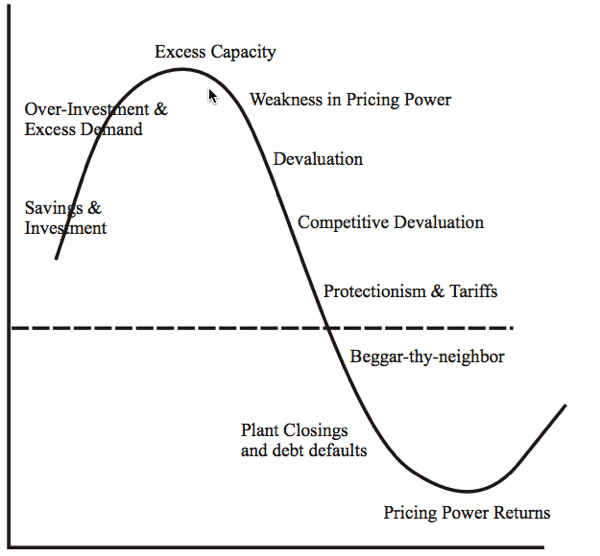

We believe that we are in the “competitive devaluation” stage presently [see graph  below] as country after country is printing money in order to lower rates and doing whatever possible to devalue their currency – to have the fastest currency in the…race to the bottom – in order to export their goods and services. [The next stage will be protectionism and tariffs. This article gives an update on the race to debase.]

below] as country after country is printing money in order to lower rates and doing whatever possible to devalue their currency – to have the fastest currency in the…race to the bottom – in order to export their goods and services. [The next stage will be protectionism and tariffs. This article gives an update on the race to debase.]

So say Comstock Partners (http://comstockfunds.com) in edited excerpts from their original article* entitled Currency Wars will only get worse.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say in further edited excerpts:

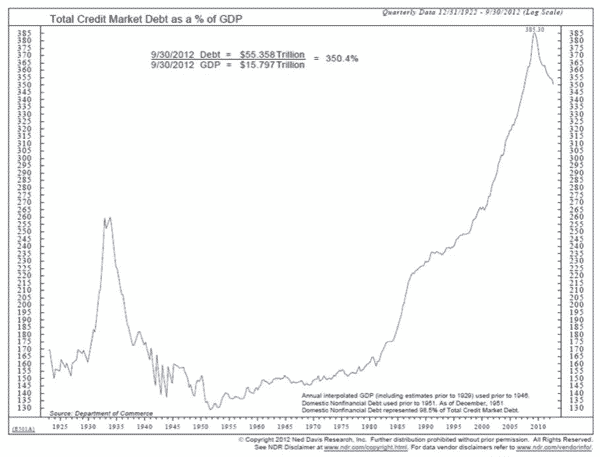

When massive private and public sector debts result in a credit collapse and recession, the efforts to pare down the debt is deflationary. Measures to inflate…out of the situation are likely to fail as households attempt to pay down debt and increase savings, rather than start a new round of debt accumulation.

- World Debt 101

- Consumer Indebtedness Leading to Currency Devaluation & Beggar-Thy-Neighbor Economic Policies

In addition, financial institutions are willing to lend to only the strongest borrowers…This is called a “liquidity trap” and it is very difficult to extricate from….

- “Liquidity Trap” is Fast Approaching

- We’ve Reached the Tipping Point: Are Consumers Prepared to Save the Day?

The Cycle of Deflation

Trying to remedy the significant amounts of debt the global economy[has] built up could lead to a debt collapse and depression if not dealt with aggressively….We have warned numerous times about the “Cycle of Deflation” and the potential “competitive devaluations”, and “beggar-thy-neighbor” policies that are all symptoms of the deflation we expect to take place very soon….

- World’s Largest Economies Have NO Choice But to Engage in Massive Money Printing – Here’s Why

- Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

- Eric Sprott: More Government Spending Is NOT the Answer to Our Economic Woes – Here’s Why

Deflation is a product of too much debt….[Countries must] either default on their debt or pay it off. When we get to the dashed line in the “Cycle of Deflation” chart below, right after “protectionism and tariffs,” is when deflation sets in and economic pain becomes unbearable.

Different Race Strategies Abound

The main driver of the recent currency movements has been the various monetary policies of the world’s major central banks. The U.S. Federal Reserve, the Bank of England, the Bank of Japan, the Peoples Bank of China, and the European Central Bank (ECB), are all attempting to grow their economies with different policies. These are just the major central banks. Actually, there are 38 central bankers around the world either printing money or initiating loose monetary policies. Some, as was the case just a few days ago in Venezuela, just devalue their currency (the Bolivar).

- Peter Schiff: The Federal Reserve is Now 100% Committed to the Destruction of the Dollar

- This Chart Proves That Your Currency Is Being Debauched At An Accelerating (Parabolic) Rate! Got Gold?

- What Will the Outcome of All the QE Mean for the U.S. (and the World)?

The Euro Zone Has Fallen Behind

Some countries/zones have it easier than others. In fact, because the ECB is not able to pinpoint exactly which of the 17 countries in the Euro Zone need the most help they were forced to offer three year loans to banks at the cheap interest rate of 1%….over a year ago but the Euro vs. the dollar…[has risen] by almost 10% since then, and…[has been] up more than 20% for the last 3 months. This put the Euro Zone under economic pressure as they found it difficult to export goods to their trading partners with [such] an increasing currency. In fact, the latest statistics…show the 4th quarter annualized GDP of Germany to be down 2.3%, France down 1.1%, Italy down 3.7%, Spain down 2.8%, and Portugal down 7.2 %. Also, the ECB forecasted zero growth for the Euro Zone this year.

Japan Has Spurted Ahead

…[Recently] Japan, realizing that they were not aggressive enough with competitive devaluation over the past couple of decades, has decided to do whatever is possible to lower the value of the Yen and increase inflation. So far, they have been very successful…[but, as a result, have become] the target of all of their trading partners. It is clear this is not over yet.

Conclusion

The competition to have the fastest currency in the…race to the bottom is not over. Stay tuned to the “Cycle of Deflation” as we continue to update it.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://comstockfunds.com/default.aspx?act=Newsletter.aspx&category=MarketCommentary&newsletterid=1703&menugroup=Home

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

Only the “best-of-the-best” financial, economic and investment articles posted

Edited excerpts format provides brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE to automatically receive every article posted

Recipients restricted to only 1,000 active subscribers!

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Consumer Indebtedness Leading to Currency Devaluation & Beggar-Thy-Neighbor Economic Policies

The current move up over the past 4 years is being driven by the Fed’s loose monetary policies (just as other global markets have been driven by their Central Banks). Most bulls believe the loose polices will stimulate enough consumer demand to lead to a significant U.S. economic recovery. We, however, continue to believe the debt – laden consumer, along with the still other unresolved debt burdens, will be a major drag on the U.S. economy, (we are convinced that the market will turn down and make a triple top at levels below the peaks made in 2000 and 2007 while we resume the secular bear market that started in 2000) and that will have negative affects on the global economy.

2. We’ve Reached the Tipping Point: Are Consumers Prepared to Save the Day?

Injecting massive amounts of liquidity into the banking system can spur dramatic economic growth if that liquidity is used. On the other hand, if public perception is negative and fearful, that liquidity remains untapped and no growth occurs. We are in a new earnings season and for the most part – based on lowered expectations – the numbers are looking OK so what should we expect based on these modestly improving numbers? Words: 2176

3. Mohamed A. El-Erian: Bad Economics Led to Bad Politics and Will Further Undermine Economy Unless….

The warning bells are ringing, and they are ringing loudly. We’ve already allowed bad economics to lead to bad politics. Now, it’s high time to put a stop to the cycle where bad politics undermines an already fragile economy. [Let me explain.] Words: 1085

4. US “Recovery” Needs More Fiat Money Steriods to Continue! Here’s Why

This time is far worse than any other modern recession. What we are seeing now is a depression, despite what the NBER would have you believe. If you are still looking for the “Big One” to happen, you are too late. It happened here and it is still happening here and in Europe. They, like us, have tried to paper over most of the effects of the boom-bust business cycle malinvestment, and they have failed and the piper is at their door [as it is here in the U.S.]. The current economic “good news”, this supposed “recovery”, is largely based on fiat money steroids and will not last without continuous injections of new fiat money into the economy. [Let me explain.] Words: 2300

5. “Liquidity Trap” is Fast Approaching

When velocity is low the nation essentially winds up in a “liquidity trap” which is a situation where monetary policy is unable to stimulate the economy either through lowering interest rates or increasing the money supply. This was the condition that Japan found itself enveloped in from 1989 to present. We expect the same problem in this country and hope (really hope) to be wrong. Words: 672

If you are clearly watching, listening and paying attention to what is going on around you, and not what the press ‘conjures up’ and the political apparatus ‘spins’, then the following lessons, in the following sequence, should resonate with you. [Unfortunately, however,] the captains of world monetary policy have not and, as such, they have put the world on a course that history has warned us against [and we will eventually pay the price of their ignorance and ineptitude. Take a look. These words of wisdom (lessons) are as timely today as when first spoken/written.] Words: 865

7. Peter Schiff: The Federal Reserve is Now 100% Committed to the Destruction of the Dollar

In order to generate phony economic growth and to “pay” our country’s debts in the most dishonest manner possible, the Federal Reserve is 100% committed to the destruction of the dollar. Anyone with wealth in the U.S. dollar should be concerned that economic leadership is firmly in the hands of irresponsible bureaucrats who are committed to an ivory tower version of reality that bears no resemblance to the world as it really is. By upping the ante once again in its gamble to revive the lethargic economy through monetary action, the Federal Reserve’s Open Market Committee is now compelling the rest of us to buy into a game that we may not be able to afford. Words: 1410

[According to the chart in this article,] all currencies are being debauched. The price of gold in each currency approximates a parabola, meaning the use of printing presses is accelerating. Each unit of currency is losing purchasing power at an increasing rate. The trend points to a worldwide currency collapse unless the creation of money stops. [Take a look!]. Words: 282I keep wondering to myself, do our money-printing central banks and their cheerleaders understand the full consequences of the monetary debasement they continue to engineer? [Below is what I think awaits us.] Words: 1013

10. World’s Largest Economies Have NO Choice But to Engage in Massive Money Printing – Here’s Why

The choice facing the leaders of the world’s largest economies is a simple one: Either they engage in massive money printing, or they let the world slip into another great depression. This article examines why they have no choice but to print money, something which will have significant consequences for everyone. Words: 560

11. Spend Your Bernanke Bux Now on PHYSICAL Gold & Silver! Here’s Why!

If Venezuela were any guide, we would have to say “Buy gold and silver, right here, right now!”…For those of you who hold Bernanke Bux, aka fiat paper, pay close attention. Those Venezuelan citizens who held paper Bolivars took a 46% hit on their purchasing power. Those citizens there who held gold and silver saw an equivalent 46% jump in their holdings. If you think it cannot happen here, you are wrong. It already has. Words: 295

I expect the eventual endgame to this whole Keynesian monetary experiment that has been going on ever since World War II [will] finally terminate in a global currency crisis. [That being said,] I’m starting to wonder if we aren’t seeing the first domino – the Japanese yen – start to topple…[It has] cut through not only the 2012 yearly cycle low, but also the 2011 yearly cycle low and never even blinked [and should it continue its steep decline] and break through the 2010 yearly cycle low [of 105.66] I think we have a serious currency crisis on our hands. Needless to say, if the world sees a major currency collapse… it’s going to spark a panic for protection – to gold and silver. Wouldn’t it be fitting that at a time when they are completely loathed by the market they are about to become most cherished? [This article analyzes the situation supported by 3 charts to make for a very interesting read.] Words: 620; Charts: 3

13. Nouriel Roubini: 5 Downside Risks to Global Economy Are Gathering Force

…[F]iscal austerity will envelop most advanced economies this year, rather than just the eurozone periphery and the United Kingdom. Indeed, austerity is spreading to the core of the eurozone, the United States, and other advanced economies (with the exception of Japan). Given synchronized fiscal retrenchment in most advanced economies, another year of mediocre growth could give way to outright contraction in some countries. Words: 780

14. World Debt 101

“World Debt 101″ examines some of the world’s largest economies and illustrates just how much they have borrowed and what measures many of their governments are now taking to curb spending and narrow those deficits.

15. Eric Sprott: More Government Spending Is NOT the Answer to Our Economic Woes – Here’s Why

In today’s overleveraged world, greater deficits and government spending, financed by an expansion of public debt and the monetary base (“the printing press”), are not the answer to our economic woes. In fact, these policies have been proven to have a negative impact on growth. [Therefore] as long as we continue down this path, the “solution” will continue to be the problem. There is no miracle cure to our current woes and recent proposals by central planners risk worsening the economic outlook for decades to come. [Let us explain.] Words: 1510

16. What Will the Outcome of All the QE Mean for the U.S. (and the World)?

At the risk of looking/sounding like some crazed religious fanatic usually seen carrying a sign or proclaiming: “Repent, the end is near,” I shall avoid the word “repent”. To me, the rest of that proclamation appears accurate and reasonable, at least with regard to our economic condition. [Let me explain:] Words: 1896

17. Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

Our civilization would not be able to handle such a transition from an expansionary credit based economy where goods and services were readily available into a paradigm of credit contraction, supply shortages and destitution and this is what is coming. There is no way to prevent it – only to defer it until a later date – and that day will soon be upon us. Words: 590

18. These 25 Videos Warn of Impending Economic Collapse & Chaos

The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each.

“The end of the world as we know it” is what David Korowicz predicts is coming sometime this decade – an “ultimate” crash that will be irreversible – TEOTWAWKI! Words: 1395

20. Gov’t Debt Will Keep Increasing Until the System Implodes! Are You Ready?

Why are so many politicians around the world declaring that the debt crisis is “over” when debt-to-GDP ratios all over the planet continue to skyrocket? The global economy has never seen anything like the sovereign debt bubble that we are experiencing today. This insanity will continue until a day of reckoning arrives and the system implodes. Nobody knows exactly when that moment will be reached, but without a doubt it is coming. Are you ready? Words: 1270

21. If You Are Not Preparing For a US Debt Collapse, NOW Is the Time to Do So! Here’s Why

Timing the U.S. debt implosion in advance is virtually impossible. Thus far, we’ve managed to [avoid such an event], however, this will not always be the case. If the U.S. does not deal with its debt problems now, we’re guaranteed to go the way of the PIIGS, along with an episode of hyperinflation. That is THE issue for the U.S., as this situation would affect every man woman and child living in this country. [Let me explain further.] Words: 495

22. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

Over the past few years, policy leaders worldwide have grown accustomed to kicking the can down the road with each step in this ongoing financial crisis making incremental moves rather than cultivating viable long term solutions. More recent attempts seem to have evolved into simply just trying to kick the can out of the driveway. Now we fear there may not be enough firepower left to simply kick the can over. [Having done so, we are left between the proverbial rock and a hard place.] If lawmakers do nothing, by all accounts we are likely to see a recession. Should lawmakers extend the Bush-era tax cuts, you make no progress towards long term deficit reduction, potentially raising the risk and magnitude of a future financial crisis. [Let me discuss this predicament further and how best to invest in such precarious times.] Words: 1602

24. John Mauldin: The Next Few Years Are Not Going To Be Pretty – Here’s Why

The next few years are not going to be pretty. We’re looking right into the teeth of a rolling global deleveraging recession—the End Game, I’ve called it – and the decisions we make in the next couple years about how to handle our debts and budget deficits here in the U.S., in Europe, in China, in Japan, and elsewhere, are going to be absolutely crucial. Words: 507

25. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

26. U.S.’s Runaway Financial Train is About to Destroy the Status Quo

People riding a runaway train can party and remain oblivious to the fact that the train is about to crash into a huge obstacle. Our runaway financial train is about to destroy the status quo as it crashes into the obstacle of mathematical consequences – the inevitable financial train wreck. “If something cannot go on forever, it will stop.” [Let me explain.] Words: 974

27. Take Note: Don’t Say You Weren’t Forewarned!

It is relatively easy to predict further commodity price inflation as a result of the massive money printing going on worldwide and that hard assets, not paper assets, will help protect purchasing power but it is much more difficult to project where else this money printing leads and to what extent a crash is inevitable. What is the endgame? Will it be another financial crash such as in 2008 or will it be a more destructive financial and economic crash that causes a severe but temporary disruption in the delivery of goods and services? Words: 1470

28. A Must Watch Video On Why America Is In A “Death Spiral”

The video* below is one of the best overviews of what is going on and one of the best explanations of what lies ahead that I have heard. As such, in my opinion, it is A Must Watch!

29. These 25 Videos Warn of Impending Economic Collapse & Chaos

The internet is awash (drowning?) in hundreds of doom and gloom videos providing dire warnings of coming world depression, food shortages, rioting in the streets, rampant (hyper) inflation, deepening banking crisis, economic apocalypse, financial Armageddon, the demise of America – well, you get the idea. Below is a small sample of such videos with a hyperlink to each.

Warning: New evidence points toward an imminent financial collapse and the destruction of American wealth. Income, investments, retirement, and even personal safety are now at severe risk. In this new video I lay it all out for you. Words: 515

31. The Top 18 Economic Documentaries

Economic Reason has gathered together the Top 18 ‘reality’ economic documentaries which are bought to you by www.munKNEE.com.

32. Almost 3 Million Views! Why U.S. Debt & Budget Will NEVER Balance

This short video – on the sustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom.

33. The U.S. Economy is Going to Collapse…It is Unavoidable…It’s a Mathematical Certainty…Here’s Why

The level of debt has surpassed the possibilities of being serviced. Mathematically, the debt problem cannot be solved, regardless of economic policies. That, unfortunately, is written. For it to be serviceable would be to violate the laws of mathematics and that cannot happen. [As such, America is quickly approaching a catastrophic economic collapse. As repelling as that sounds, it’s in your own best interest to learn just how bad the situation is. This article is an attempt to do just that.] Words: 310

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Like children playing with wooden matches and daring their “friends” to strike theirs first, so the Central Banks are each playing a part in the devaluation of the Planet, as first one country then another devaluates their currency putting additional pressure upon the rest to do the same thing. The Ultra Wealthy (UW) with their insider connections while having far more to loose are much better positioned to escape getting burned and quite possibly be the ones to yell FIRE, once they have leveraged their money to take advantage of yet another “short” position.

In short, we are now witnessing the “Third Worlding” of what is now known as the “Developed Countries”, as the UW continue to further raise their own standard of living at the expense of all those that used to be part of the middle class who are now all working longer for less and becoming part of the “New Poor”. As the existing home owners in the US retire and later split their assets with their now adult children and/or grandchildren, expect to see a dramatic shift DOWNWARD in personal wealth, as the true impact of our current monetary policies becomes clear.