If you really want to be sure you’re keeping pace with inflation and own assets that can survive a crisis then forget gold. [A look at the evidence] tells us that over long periods of time, investors are better off holding stocks than gold. Words: 665; Table:1

So says Marc Lichtenfeld (www.investmentu.com) in edited excerpts from his original article* entitled Protect Yourself From Gold.

This post is presented compliments of Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds), www.munKNEE.com (Your Key to Making Money!) and the Intelligence Report newsletter (It’s free – sign up here). You can also “Follow the munKNEE” daily posts on Twitter or Facebook. The article may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that these paragraphs must be included in any article re-posting to avoid copyright infringement.

Lichtenfeld goes on to say in further edited excerpts:

Gold may make investors feel better in times of crisis and financial uncertainty, but it’s hard to argue with the fact that it’s a volatile asset… That’s why I say if you really want to be sure you’re keeping pace with inflation and own assets that can survive a crisis forget gold. Instead, you should be looking at Perpetual Dividend Raisers – the stocks that raise their dividends every year.

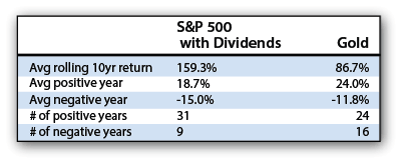

I’m sure many of you are thinking, stocks safer than gold? That’s ridiculous, but [a] look at the numbers over the last 40 years, starting right after the U.S. dollar left the gold standard, [confirms that contention]:

Since 1973, long-term investors who went with dividend-paying stocks outperformed the folks piling into gold. An investor who held the S&P 500 for 10 years made an average of 159.3%, while those holding gold earned 86.7%.

What do these numbers tell us? They tell us that over long periods of time, investors are better off holding stocks than gold…

Do Gold or Stocks Do a Better Job Outpacing Inflation?

Over the past 40 years, inflation has pushed prices higher. Something that cost $100 in 1973 will cost $524 today. In contrast, $100 worth of gold in 1973 is now worth $1,481. However, $100 worth of the S&P 500 is now worth $1,931 (including dividends received). So stocks win that battle. They have done a better job outpacing inflation.

Do Gold or Stocks Do a Better Job in Times of Crisis?

…Think about how many times the spit has hit the fan since the early ’70s – Vietnam, Watergate, high inflation, gas shortages, the Cold War, Iran-Contra, 9/11, the dot-com collapse, the war in Iraq, the financial crisis, etc. – and through it all… stocks have performed better than gold.

The good news for gold bugs is that during the years gold rose in value, the shiny metal was a better performer than stocks – and during gold’s down years, it lost less value but, as the table shows, gold had almost as many down years as positive years.

How Best to Invest

…What’s an investor to do? Simple, buy stocks that raise their dividends every year. These solid companies, such as Johnson & Johnson (NYSE: JNJ) and Kimberly-Clark (NYSE: KMB), not only have been paying dividends every year, but have raised them every year for decades.

- Johnson & Johnson, which has boosted its dividend for 50 years in a row, raised it an average of 11.7% per year over the past 10 years.

- Just as appealing, Kimberly-Clark’s average dividend hike was 9.5% per year over the past 10 years.

Conclusion

Gold has made a lot of money for investors over the years but stocks have made a whole lot more. Remember that the next time there’s a crisis.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.investmentu.com/2013/April/protect-yourself-from-gold.html (Copyright © 1999 – 2013)

Disagree? Concur? Have your say on the subject via:

We’d like to know what you have to say.

Related Articles:

1. Manage Your Own Portfolio? Then These Articles Are For YOU

The vast majority of people who have money saved have it invested in the stock market, be it stocks, bonds, mutual funds, ETFs or warrants, and have it “managed” by their financial advisor/planner. Very, very few individuals manage their assets in self-directed accounts either through a full-service brokerage firm or totally on their own via an internet account. As such, very few articles are written for such an audience. This post changes all that with links to some very informative articles on virtually everything you need to know to succeed in today’s marketplace.

2. “Graham Stocks” Dramatically Outperform the S&P 500 – Why Invest Any Other Way?

My portfolio version of Benjamin Graham’s time- tested strategy for defensive investors has has only trailed the markets in 3 of the last 12 years and has dramatically outperformed the S&P 500 during that period realizing a 19% (annualized) return vs. only 2% (annualized) for the S&P 500. Let’s take a look at the method and this year’s group of Graham stocks. Words: 790

3. Using a Momentum Investing Strategy Is the Way to Go – Here’s Proof

In volatile markets you must be able to go to cash when markets become dangerous. That is exactly what the momentum selection model does well. It protects your capital on the downside and enables it to grow on the upside! If you insist on staying in the stock market at all times, even perfect foresight cannot protect you. The ability and willingness to periodically run away beats the macho strategy of holding on.

4. Stock Market Alert! These Articles Say What’s Up (& Possibly Going Down)

With the stock market forging ahead it is imperative that those who manage other peoples money (and/or their own) become extremely well read – beyond their normal corporate reports, opinions and analyses – on the reality of what is evolving in the marketplace from as many different perspectives as possible. Because it would take days to gather such information we have gathered together a number of such articles on the subject with introductory paragraphs and hyperlinks to each. They are well worth your time to read.

5. These 5 Events Will Lead to Higher Gold & Silver Prices

It is my contention that the move in precious metals…[from] late 2008 through 2011 was largely a result of the expansion in central bank balance sheets and the perceived threat of runaway inflation. Since 2011, [however,] we’ve seen economic growth improve and inflation rates across the globe subside. As a result, investment banks and market strategists are arguing against owning gold, and making the case that, with a lack of inflation and an improved economy, the need for owning gold as an insurance hedge against inflation and currency debasement is no longer present. I strongly disagree.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Remember the old adage, Don’t put all your eggs into one basket…

By having a percentage of your portfolio in real PM’s is one way to cover all your bases!