Gold prices are up sharply in 2016. Single family house prices are also up sharply, and are now close to all time highs on a national basis (in nominal terms). Where is the relative value between these two tangible assets categories, and what has been happening so far this year? Fifteen key conclusions and a compelling new quartiles based analysis are included.

to all time highs on a national basis (in nominal terms). Where is the relative value between these two tangible assets categories, and what has been happening so far this year? Fifteen key conclusions and a compelling new quartiles based analysis are included.

The comments above and below are excerpts from an article by Daniel Amerman (DanielAmerman.com) which has been edited ([ ]) and abridged (…) to provide a faster and easier read.

The Gold/Housing Ratio

…History shows that if you can buy gold “cheap” while real estate is relatively “expensive”, then on an asset price basis over the long term, gold is likely to strongly outperform real estate as an investment, all else being equal. Conversely, when real estate is “cheap” and gold is “expensive” relative to its long-term averages, then it is real estate that is likely to powerfully outperform gold as an investment over the long term.

What exactly is “cheap” and what is “expensive”? Answering that question is where the Gold/Housing ratio is quite useful. As there is no dollar component in the ratio itself, inflation index and measurement concerns drop out, and we are left with the value of two of the most popular tangible investments relative to each other.

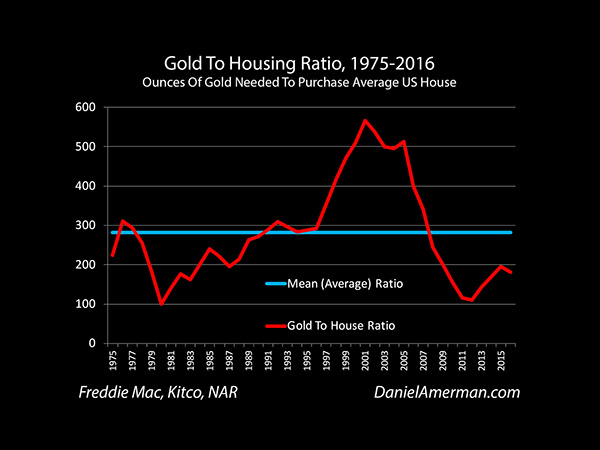

The long-term average is represented by the blue line in the above graphic. Over the 40+ years that gold has been a legal investment in the modern United States, it has taken an average of 282 ounces of gold to purchase an average single family home, meaning the current price of 180 ounces is equal to 64% of the long term average.

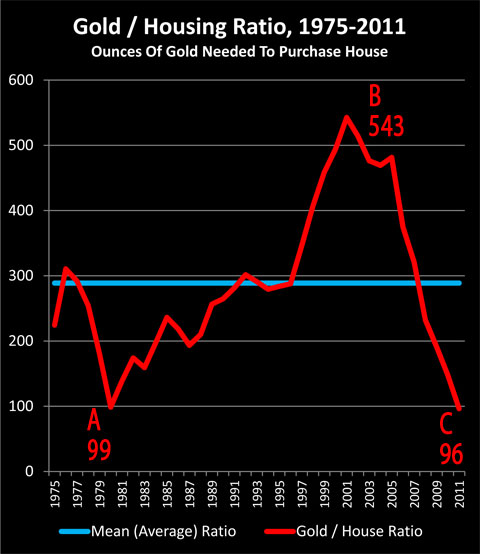

There have been three major turning points in the valuation relationship between gold and real estate over those years.

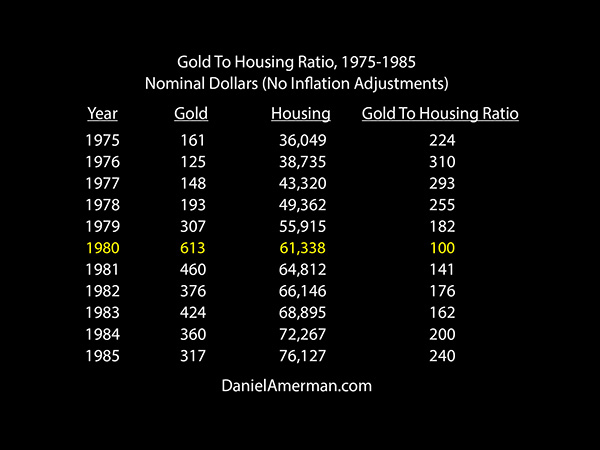

- The first turning point occurred at the peak of financial crisis in 1980, when it took only 100 ounces of gold to buy a house (on an annual average basis) [See the first table below]. Real estate was remarkably cheap relative to gold – and real estate investments would outperform gold by a huge margin over the next 21 years to come.

- The second turning point occurred in 2001, with the Gold/Housing ratio reaching a high of 565 ounces of gold [see the third table below] being needed to buy a single family home. Gold was remarkably cheap relative to real estate – and it was then gold asset prices that would outperform real estate asset prices by a huge margin over the next 11 years.

- On an annual average basis, the third turning point occurred in 2012, when 110 ounces of gold was enough to purchase an average single family home. Real estate was once again remarkably cheap when compared to gold, and real estate has powerfully outperformed gold in the years since that time.

Gold/Housing Ratio from 1975 to 2006 in Nominal Dollars (No Inflation Adjustments)

Inflation-Adjusted Gold & Housing Prices from 1975 to 2006

…The popular theory was that gold would be the perfect inflation hedge but, in practice over the long term, gold failed spectacularly as an inflation hedge as shown in the tables below:

…The advantage to the Gold/Housing ratio is that because the value of one tangible asset is being measured in terms of another tangible asset, the dollars drop out of the equation – and so do any concerns about the accuracy of the inflation measure.

It is also worth noting that the Gold/Housing ratio works differently in the other direction. That is, it did not call the peak in the real estate bubble – far from it. Instead, this ratio of relative values said that real estate was starting to get historically expensive compared to alternative investments right at the very time that the bubble was just starting to make an appearance. So the information value of the ratio was not to provide market timing for speculative trading within a bubble – but rather was a signal to long-term investors that a bubble was beginning.

Conclusion

…The long-term average for the Gold/Housing ratio is 282 ounces to buy a house, and the current ratio is 180 ounces to buy a house. On a long term average basis, if we take the current average single family price of $243,301 and divided by 282, we get a value for gold of $863 per troy ounce. This would indicate that at a price of $1,350 per ounce, gold is overvalued by 56% relative to average single family residence prices in the United States.…

Whether one wants to think of housing being undervalued relative to gold, or gold being overvalued relative to housing, either way that is clearly the current situation, and it is not even close on a national basis when compared to long-term averages. This means that, all else being equal, over a long enough period, an investment in housing will more likely than not outperform an investment in gold – possibly by a substantial margin – assuming that each investment tends to revert to the mean (i.e. return to average valuations) over time in the future, even as they have in the past.

In a long-term strategy which employs both investments, there is a case for putting an over-weight on housing, and an under-weight on gold, given current relative price levels unless one is specifically investing for financial crisis.

As I stated in an article way back in 2011:

If we assume a return to history as we’ve seen over previous decades and centuries, then what the Gold / Housing ratio shows us is that gold is valued at an extremely high level, and real estate is remarkably cheap in comparison. To choose gold long-term while avoiding real estate long-term is to fight not only the averages but history itself – which by definition, has never worked so our solution is to not choose between the two assets but to purchase both kinds of contrarian assets with different objectives.

- We choose precious metals to the extent that we are concerned about currency and financial system meltdown (although real estate has some powerful advantages as a precious metals complement in this situation as well).

- If there isn’t a currency meltdown then, for someone attempting to build long-term value, buying real estate at current prices is likely to be a far better source of long-term returns than gold, and likely to act as a much better inflation hedge.

- The relative amount of assets devoted to each of these contrarian investments then depends on the individual investor’s personal assessment of the likelihood of actual financial meltdown.”

Judge for yourself – does that conclusion stand the test of time of the last five years? If so, might an understanding of the implications of the Gold/Housing ratio provide meaningful insights (once appropriately adjusted for the current ratio and conditions) for the years and decades ahead?

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money