“Follow the munKNEE” via twitter & Facebook or Register to receive our daily Intelligence Report

Precious Metals are now at an important crossroad….Over the last  several quarters, this sector has under-performed against equities as well as bonds but that might change very soon [as it is at several key decision points as to whether it goes up or down. Let me explain.] Words: 1080; Charts: 10

several quarters, this sector has under-performed against equities as well as bonds but that might change very soon [as it is at several key decision points as to whether it goes up or down. Let me explain.] Words: 1080; Charts: 10

So writes Tiho Brkan (http://theshortsideoflong.blogspot.ca) in edited excerpts from his original article* entitled Precious Metals At Decision Point.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Brkan goes on to say in further edited excerpts:

Charts 1/2: Precious Metals at technical decision points

The chart below shows Gold and Silver technical triangles, as well as major support and resistance lines. The major support levels for the metals are $1,550 and $27, while major resistance levels are $1,800 and $35 respectively.

Interestingly, the triangle battle between bulls and bears is currently right in the middle of those trading ranges and an eventual decision point is coming very shortly. Furthermore, the current price action for both metals is coiled between the 50 day MA on the upside and the 200 day MA on the downside. A breakout or a breakdown will most likely set a trend for the next few months.

Source: Short Side of Long

Chart 3: Post election seasonality supports a bullish breakout

While the US stock markets almost always tends to rally into an election period, Precious Metals tend to decline. More importantly, the post election period tends to be one of seasonal strength for the Precious Metals sector, as seen in the chart below. Usually some type of an intermediate low occurs at the beginning of February and the current technical triangle could be a perfect catalyst for a price rally.

Source: Seasonal Charts

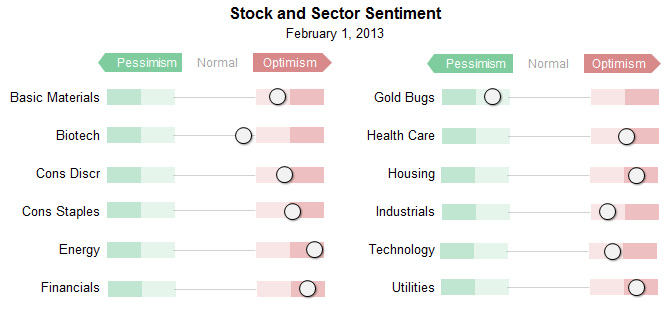

Charts 4/5: Unlike equities, sentiment in Gold is one of disinterest

Sentiment also supports a possibility of an upside breakout too…Consider the charts below which show that physical Gold holdings within the GLD ETF continue to bleed out, while hedge funds have reduced net long positions to the lowest level since August 2012, when Gold bottomed at $1,530. While neither of these indicators signal that we will definitely rally, the probability of a bullish case scenario continues to increase. One thing is for sure, bullish expectations seen in October 2012, when the majority of strategists, analysts and newsletter writers expected Gold at $1,900 has subsided.

Source: Short Side of Long

Chart 6: Gold Miners are oversold on relative basis

Gold Miners also remain oversold and out of favour… Traders and investors everywhere have been throwing in the towel, which usually indicates that a bottom is near. Furthermore, Rydex PMs Fund Flows indicate extreme pessimism only witnessed during the panic of 2008 as well as a major sell off into May of 2012.

Source: SentimenTrader

Furthermore, looking at the recent breadth numbers within the whole sector, we note that only 15% of all miners are trading above the 50 MA and 23% above the 200 MA. Also, breadth indicators like McClellan’s Oscillator and Summation Index both signal an intermediate bottom is at hand. Comparing these oversold readings against the general stock market, which is currently in euphoria, shows a large contrast. Financial stocks have more than 90% of components above both the 50 MA and 200 MA. Just about every other major equity sector is also overbought. Therefore, a correction in equities could send some money back into Gold Miners, as we experience somewhat of a mean reversion.

Chart 7: Long term demand will remain robust as global currencies are devalued

In his recent newsletter, Frank Holmes showed [see chart below] that just about every major central bank has plans to increase their balance sheets well beyond 2013. In other words, important currencies around the world are being devalued and the only way one can protect themselves in the long run is to own assets which will adjust to this currency devaluation. While some prefer equities and others prefer real estate, history shows that the best way to protect yourself during times like these is to own very rare and mostly precious assets.

Source: Frank Holmes

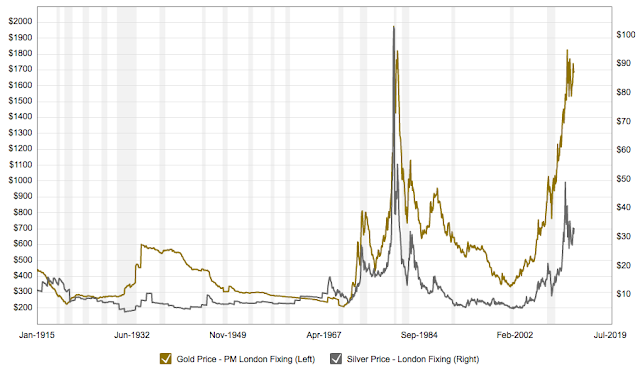

Chart 8: Gold is not in a bubble…

I do admit that Gold has risen very sharply over the last 12 annual years and since middle of 2011, I have been calling for a prolonged consolation period and even a major cyclical bear market. It is only normal for assets to correct 30% to 40% every few years, especially great performers such as Gold over the last decade. However, the talk of a Gold bull market end is very premature and the talk of Gold being in a bubble is ludicrous. The Macro Trends chart below shows that overlapping Gold with previous major bubbles in the Nasdaq, Crude Oil and even Gold throughout the 1970s, shows the current price at very un-elevated and inexpensive levels.

Source: Macro Trends

Chart 9: … and could surprise on the upside!

Simone Alberizzi shows in his chart [below] that for Gold to mimic the Nasdaq euphoric of the late 1990s, it would have to reach over $10,000 per ounce. Considering this historical data, we can see that during the secular stock bull market of 1982-2000, Nasdaq managed to achieve a return of 26 times its value. Also consider that during the 1970s and into January of 1980, Gold also managed to return more than 23 times its value. When one compares those astronomical moves to the current bull market, hopefully we all come to a conclusion that Gold still has a long way to go.

Charts 10/11: Silver has under performed in the last two years…

While realising Precious Metal fundamental conditions continue to improve and assets like Gold are likely not anywhere close to the bubble stage, I once again turn my attention back to the shorter term time frame [as seen in the chart below]. In particular I favour playing the Silver triangle right here and will consider entering long if and when the price breaks from its current formation.

Source: Objective Trader / Simone Alberizzi / Short Side of Long

Chart 12: … and still remains inexpensive when adjusted for CPI

Just to return to its nominal value of $50 per ounce, last seen in January 1980 and April 2011, Silver would have to rally almost 60% from the current levels. That in itself would be an amazing return, but the true value of this speculative metal [lies] with its possibility [of re-testing] its inflation adjusted highs of January 1980. For that to occur, Silver will have to enter a mania and most likely clock a triple digit handle.

Source: Macro Trends

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://theshortsideoflong.blogspot.ca/2013/02/precious-metals-at-decision-point.html

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

The “best of the best” financial, economic and investment articles

An “edited excerpts” format to provide brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE and automatically receive every article posted

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. With Gold Stocks Suffering So Badly Should You Sell Out or Buy In?

Gold stocks are down between 20% and 30% over the past year yet, in that same timeframe, the price of the gold has risen. As a result, sentiment toward gold stocks is pitiful. Even diehard gold bugs are tired of losing money in gold stocks and have been dumping their shares in disgust. This article discusses 4 main reasons I can think of why gold stocks might be so cheap. Words: 444

2. Equities Should Outperform Gold in the First Half of 2013- Here’s Why

I expect gold to move sideways or trend down in the first half of 2013 [and, as such,] I would consider this as a good opportunity to buy gold as there is still no long-term fix in place for the economic and financial problems [that the U.S., and indeed the world, face. Here’s why]. Words: 665; Charts: 5

3. Gold Miners Watch: Much Further GDX/HUI Weakness Could Result in a MUCH Further Decline – Here’s Why

GDX is currently at approx. 42 but should it drop below the 39 & 40 levels reached last May and July our analysis shows that a good deal of sellers could come forward and push GDX a large percentage lower. That double bottom needs to hold in GDX!!! Take a look at the chart below and you will clearly see why that is the case.

4. Finally the Final Bottom in Gold Stocks Is Coming – Finally!

The mining stocks have been a disaster if you’ve invested in the average fund, GDX or GDXJ and if you’ve invested in the wrong stocks, they’ve been a total disaster and you will now hate the sector forever. We’ve certainly been surprised by this protracted struggle. In my articles you’ve heard me talk about accumulating on weakness, buying support, being patient and waiting for better opportunities. Folks, this next week is one of those opportunities. The gold stocks are setting up similarly to the bottom in 2005 [and, as such,] are set to test a major bottom and could be on the cusp of a major reversal. Let me explain. Words: 438; Charts: 3

5. Goldrunner Update: Gold, Silver & PM Stock Sentiment Sucks BUT the Fundamentals Are Off the Wall!

Sentiment in the precious metals sector is in the toilet yet the fundamentals for the sector are off the walls positive. That is not secret, but it is what creates huge market moves in the direction of the fundamentals. In fact, market management will never move price against the underlying fundamentals for too long a period of time.

6. Gold Stocks Go Up Dramatically In Inauguration Years – Will Another +20% Increase Occur This Year?

President Obama will be sworn into office for a second term on January 21 and that’s good news if you own gold stocks. Why? Because gold stocks, [as represented by the XAU] have increased, on average, by 20% during inaugural years since 1985 (28% in 2005; 36% in 2003). While there’s no real rhyme or reason as to why gold stocks thrive in inauguration years – statistical anomaly or otherwise – it is yet another reason to buy gold stocks right now. Words: 312; Charts: 1

7. Keep the Faith – This Bull Market in Gold STILL Promises to Be One for the History Books! Here’s Why

Seeing the S&P 500 outperform gold and seeing gold stocks get decimated…has been enough to create suicidal sentiment…in the precious metals (PM) sector…but, as the many calls for an end of the PM bull market…[are expressed,] the risk in the PM sector gets lower and lower. The bigger picture hasn’t changed and isn’t going to for some time [so] keep the faith and hold onto your PM sector items tight. Don’t let the short and intermediate-term noise distract you from what STILL promises to be a secular bull market for the history books. The Dow to Gold ratio will hit 2 and might even go below 1 this cycle. [Let me explain.] Words: 873

The timing of this article may seem incongruous given the current weak performance of gold and gold stocks but that was the identical situation in each of the past manias – both the metal and the equities didn’t excel until the frenzy kicked in. The following documentation (exact returns from specific companies during this era are identified) is actually a fresh reminder of why we think you should hold on to your positions – or start accumulating them, if you haven’t already. (Words: 1987; Tables: 7)

9. A Peek at Possible Developments in Gold, Silver, Mining Shares & the Dow

There are countless articles available for free suggesting what to expect short- and long-term in the markets but what are those analysts who charge a fee for their insights and recommendations saying these days? Same old, same old or unique and actionable? One such subscription market timing service has pulled back the veil to give us a peek at what could well be unfolding. Words: 906; Charts: 8 links

What is developing in the markets is not the beginning of another leg down in gold, but a second chance to get positioned for what should be a very profitable intermediate degree rally over the next 2-3 months. [Let me explain further with a number of charts to support my position.] Words: 460

11. Goldrunner: HUI Index Could Go As High As 1000 in 2013! Here’s Why

The prospects look great for Gold and Silver to move sharply higher into 2013 to mimic the moves made in the 2005/ 2006 period and especially in 1979. In both cases back then the PM Stock Indices made big runs along with Gold and Silver. As such, the current HUI looks good for a major bottom to now be in place and to mimic the PM Stock Surrogate chart from the late 70’s. This would see the HUI go as high as the 1000 area in 2013. Let me explain further. Words: 640

12. We Are Certain Gold Producers Will Soar – Here’s Why

For the past eighteen months, gold stocks have been pummeled…What’s going to move these darn stocks? Will their day ever come? Could our research – gulp – be wrong? Jokes have even started circulating…[such as] a) What’s the difference between a seagull and a gold stock investor? The seagull can still make a deposit on a Mercedes. b) Gold equities may be bad, but I slept like a baby last night. I woke up every hour and cried. Laugh or cry, however, underneath this heap of stock-certificate debris is the contrarian opportunity of a lifetime. That’s a strong statement, I know, but below I present numerous well-researched reasons why I’m convinced gold stocks are one spark away from igniting the portfolios of those with the cash to buy, courage to act, and patience to hold. Words: 2800

13. Here’s An Easy Way to Identify Gold & Gold Miner Market Tops and Bottoms

It’s amazing! Every day I learn something new. I have just come across a very powerful tool that identifies market tops and bottoms in both the gold price and the gold mining industry valuation. Let me share it with you. Words: 352; Charts: 4

14. The Charts Tell ALL and THIS Is What They’re Saying About Gold & Silver for 2013

It is impossible not to read some source…touting the “fact” that the price of gold and silver will be…[“$x”, “$y”, etc.] in the “coming months” or in the “next year or two,” etc. The market, however, does not echo those…sentiments because that is exactly what they are, sentiments. When it comes to sentiments or opinions, regardless of how close to source or how well reasoned, the market does not care. The charts are all-knowing, and they present everything known about the price, sans any opinion(s). Just deal with the facts and plan accordingly. Trust the markets – they never lie – [and this is what they are saying about the price of gold and silver in 2013]. Words: 1889; Charts: 6

15. The Good News – and Bad – Regarding Gold, Silver & PM Stocks Going Forward

As we begin 2013, there has been an important shift in regards to precious metals…the decoupling that has taken place between the equity market and the precious metals complex…[which] began nearly 17 months ago (decouplings of three or six months are not significant). Since the Euro crisis in summer 2011, the equity market has rallied nearly 30% and reached a five-year high, but gold stocks are down by more than 30%…[and, as such,] precious metals cannot begin an impulsive sustained bull move if the equity market continues to move higher. The equity market has to struggle with resistance and begin a mild cyclical bear move. While over the near-term precious metals can confirm a higher low, the 2013 success of the sector depends on the struggles of conventional stocks. [This article explains why that is the case and uses several charts to illustrate the point.] Words: 899

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money