Buffett’s measure – the percentage of total market cap (TMC) relative to the U.S. GNP crossed 100% last week into stretched territory for the first time since 2007 which implies a mere return of around 3.3% annualized (including dividends) over the following years. [This post presents the components of the ratio and the conclusions drawn.]

the U.S. GNP crossed 100% last week into stretched territory for the first time since 2007 which implies a mere return of around 3.3% annualized (including dividends) over the following years. [This post presents the components of the ratio and the conclusions drawn.]

So writes Katchum in edited excerpts from a recent post* on his blog (http://katchum.blogspot.ca) entitled Correlation: Total Stock Market Index Vs. GDP: How to Value Dow Jones.

This post is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Katchum goes on to say in further edited excerpts:

The Dow Jones U.S. Total Market Index

The total stock market index…stands at $15.879 trillion on 15 February 2013 (Chart 1). It measures the market cap of the U.S. companies. (Don’t confuse this chart with the Dow Jones chart.)

The U.S. GDP

|

| Chart 2: U.S. GDP |

Total Market Cap to Gross National Product (TMC:GNP) Ratio

If you then divide Chart 1 by Chart 2, you get Chart 3. If the chart goes above 100%, then the stock market is overvalued.

|

| Chart 3: Market Value to GNP ratio |

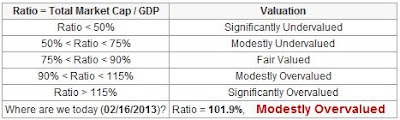

Valuation Table

|

| Chart 4: Valuation Table |

Conclusion

If this correlation is true between the Total Stock Market Index and GDP, then you have to take in mind that GDP is very important to watch. If the GDP drops, then the stock market will most likely drop. If the GDP rises, then the stock market will most likely rise.

The U.S. GDP will not go up, due to the zero hour debt problem [see here] so the stock market, theoretically, cannot rise. The only way GDP will go up again is when debt is significantly reduced and we’re not at that point yet.

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://katchum.blogspot.ca/2013/02/correlation-total-stock-market-index-vs.html (Written by Albert Sung; Subscribe to Katchum’s macro-economic blog; Sung is also an accomplish pianist and composer as well as financial analyst. Listen to an assortment (24) of his classical compostions here.)

Register HERE for Your Daily Intelligence Report Newsletter

It’s FREE

Only the “best-of-the-best” financial, economic and investment articles posted

Edited excerpts format provides brevity & clarity for a fast & easy read

Don’t waste time searching for informative articles. We do it for you!

Register HERE to automatically receive every article posted

Recipients restricted to only 1,000 active subscribers!

“Follow Us” on twitter & “Like Us” on Facebook

Related Articles:

1. Get Out of the U.S. Dollar and Buy Physical Gold Before It’s Too Late – Here’s Why

Evidence suggests that the “Zero Hour Debt” line has been reached. Get out of the U.S. dollar [U.S. treasuries] and buy physical gold [or equities] before it’s too late. It is the only way to protect yourself against a massive U.S. dollar devaluation to come in the next few months. [Let me explain why that is the case.] Words: 719; Charts: 5

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money