As I see it, worsening financial crises lead initially to lower gold prices which are followed by some form of government intervention to alleviate the crises and that action, in turn, eventually results in renewed appreciation in the price of gold. The basic steps in such a transition are really quite straightforward. (Words: 477; Charts: 2)

are followed by some form of government intervention to alleviate the crises and that action, in turn, eventually results in renewed appreciation in the price of gold. The basic steps in such a transition are really quite straightforward. (Words: 477; Charts: 2)

So said Plan B Economics (www.planbeconomics.com) in edited comments from their original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Who in the world is currently reading this article along with you? Click here

The article goes on to say, in part:

Gold Behavior During Financial Crises

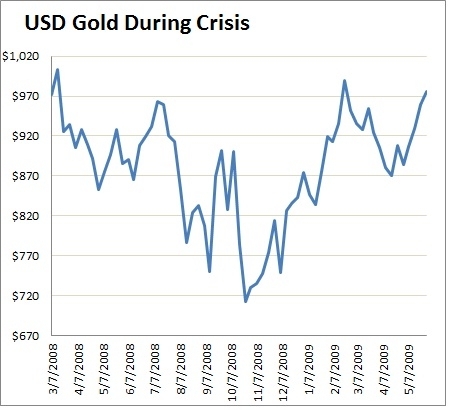

One only has to go back a couple years to see how gold reacts during a financial crisis. The chart below shows the price of gold during the financial crisis…in March 2008…During this time, gold prices fell by about 25% and subsequently recovered all losses. This was a scary ride for anyone holding gold at the time, but it’s an incomplete view of gold’s performance during the crisis.

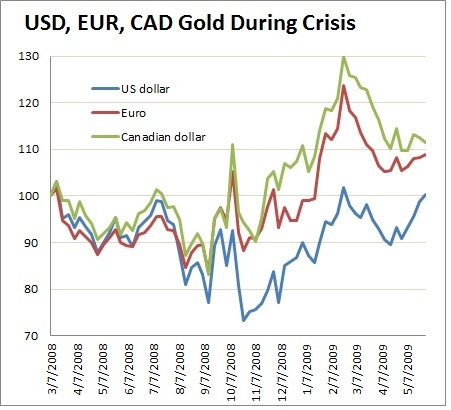

The second chart below shows gold during the same period priced in US dollars, euros and Canadian dollars (indexed to 100 for comparison purposes). During the 2008/2009 crisis…the US dollar was rising while the euro and Canadian dollar were falling and this is reflected in the different gold prices. Gold priced in Euros and Canadian dollars fell less and recovered faster than gold priced in US dollars. This is precisely because the US dollar was so strong during that period. However, as the monetary response began to unfold (QE1 announced December 2008) and trillions of US dollars were unleashed to backstop the financial system, gold in all currencies began to rally dramatically.

Worsening financial crises lead initially to lower gold prices which are followed by some form of government intervention to alleviate the crises. That action, in turn, eventually results in renewed appreciation in the price of gold. [As the author of the article puts it] really, the basic steps are straightforward:

- Economic/financial crisis leads to asset liquidation and dollar shortage

- Dollar shortage leads to dollar appreciation and gold depreciation (in dollar terms)

- One form of asset liquidation – forced gold selling – leads to gold depreciation (in all currencies)

- Eventual monetary response creates surplus of dollars

- Surplus of dollars causes dollar depreciation and gold appreciation…

*http://www.planbeconomics.com/2011/09/23/how-gold-performs-during-a-financial-crisis/

Related Articles:

1. Why Does Gold Fall When Financial Crises Worsen?

What’s going on? If gold is the great anti-asset, the thing to hold when everything else is in collapse why is it now trading…[below $1,700 and] not $2,000? Words:1147

3. Back Up the Truck: It’s Time to Buy Gold With Both Hands! Here’s Why

Over the past few years, pretty much every investor has become familiar with gold. The shiny precious metal has surged in price and has managed to hold strong while broad indexes have slipped, highlighting its appeal as a diversification agent and safe haven investment. This has prompted many investors to ramp up their allocations to the space in order to take advantage of these favorable trends and lead their portfolios to broad gains…[but] there are a number of other issues that investors need to be aware of when considering allocating capital to the space, as there are several reasons to avoid the precious metal from an investment perspective. Below, we highlight seven reasons for why investors may want to temper their expectations for the metal and consider a more diversified approach that doesn’t include such a large allocation to the ‘barbaric relic’. Words: 2030

5. Hold On! It’s Far Too Early to Sell Your Gold and Silver

We are at an important crossroads in this commodities bull market,,,[where] even the most fearless bulls are tempted to give up – to sell out of their positions and consider themselves lucky that they were able to be along for the ride and to escape with any profits at all – but I have posted a chart below to help remind you of the real danger in “getting out” now. Words: 350

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money