Savers will not stand idly by and watch their savings get wiped out by taxes and  inflation….[which] is good news for investors who buy and hold commodity assets today – and it’s also a stark reminder to not be fooled by the short-term head fakes that might make it look like the commodity bull is over. Stay the course – the biggest profits are yet to come. [Here’s why.] Words: 405

inflation….[which] is good news for investors who buy and hold commodity assets today – and it’s also a stark reminder to not be fooled by the short-term head fakes that might make it look like the commodity bull is over. Stay the course – the biggest profits are yet to come. [Here’s why.] Words: 405

So says Kevin McElroy (www.wyattresearch.com) in edited excerpts from his original article* entitled Why the Next Few Years Will Be Incredible for Commodity Investors.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

McElroy goes on to say, in part:

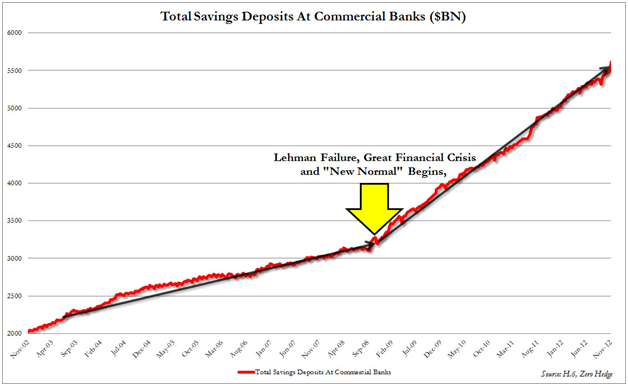

…With the fiscal cliff looming, and a variety of other “uncertainties” plaguing the market, people seem to want to save in the safest way possible. So much so that in the past four years since the start of the financial crisis (which, you might recall, centered around banks) deposits have nearly doubled from $3 trillion to nearly $5.5 trillion!

These savings deposits, though they’re not one single entity, are the most liquid and largest pile of dollars in existence which begs the question:

“What will happen to this giant pile of money when one of the following inevitable scenarios plays out?

- Taxes are raised on savings deposit interest.

- Inflation rises.”

Now ask yourself:

“What asset class typically outperforms savings deposits during inflation and high taxation?”

The answer is commodities. All of this money will someday come crashing into the commodity space. It will be joined by money fleeing the Treasury market (when rates rise and Treasuries crash) as well as money fleeing stocks (when taxes rise on corporations, capital gains and dividends).

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- It’s FREE

- It contains the “best of the best” financial, economic and investment articles to be found on the internet

- It’s presented in an “edited excerpts” format to provide brevity & clarity of content to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you and bring them to you each day!

- Sign up HERE and begin receiving your newsletter starting tomorrow

The masses will realize that the only sane place to store their savings is in an asset class that the government can’t inflate away – and that indeed benefits from their efforts to inflate the currency to pay down debt – is commodities. They’ll also be inclined to buy portable stores of wealth (like gold and silver) which are harder to track and tax.

Conclusion

Savers will not stand idly by and watch their savings get wiped out by taxes and inflation….[which] is good news for investors who buy and hold commodity assets today – and it’s also a stark reminder to not be fooled by the short-term head fakes that might make it look like the commodity bull is over.

Stay the course – the biggest profits are yet to come….

*http://www.wyattresearch.com/article/why-the-next-few-years-will-be-incredible-for-commodity-investors/29013

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

The biggest danger to our society will be food prices and food costs….Productivity of grains has fallen to 1.2% per year which matches population growth exactly leaving society with no safety margin. [In addition,] there is a coming shortage of two fertilizers which occur exclusively in nature…so once the supply is gone, it’s gone forever – and this can only mean that commodity prices are going higher – much higher. Words: 585

2. Grantham: Paradigm Shift Taking Place In Commodity Prices

We are undergoing a Paradigm Shift in the price trend of virtually all commodities – perhaps the most important economic event since the Industrial Revolution. [Let me explain why that is the case.] Words: 765

3. Gold Belongs in EVERY Portfolio – Including Yours! Here’s Why

I like gold because it’s a risk-reducing, portfolio-diversifying asset. It’s also been a strong-performing asset over the past decade – up nearly 400%. What’s more, it’s been reliable. In 2008, when the major U.S. indices plummeted 37% (and more into early 2009), gold returned nearly 6%. In addition to being an exceptional investment, however, gold has also been an exceptional investment within a portfolio context. That is, it has provided return while reducing portfolio risk. Gold has, in essence, been a free lunch. Words: 490

NOone is expecting rampant inflation. After all, the CPI is low with nothing happening in spite of all this money printing. While there has been no fallout I think that is the critical point. You cannot do these kinds of things we are doing forever and not experience any consequences. Sooner or later there are going to be consequences to what we are doing, and my fear is that it is going to be nasty, catch a lot of people off guard, and really hurt our society. That is the bottom line and why I am buying gold and silver, still, to this day. Words: 795

What is developing in the markets is not the beginning of another leg down in gold, but a second chance to get positioned for what should be a very profitable intermediate degree rally over the next 2-3 months. [Let me explain further with a number of charts to support my position.] Words: 460

7. Gold: What Does a “Troy” Ounce or “18/24 Karat” Gold Really Mean?

8. Take Note: Gold and Silver are NOT an Investment!

Gold and Silver are not an investment! Let me repeat that. Gold and silver are not an investment! Gold and silver are (excuse the pun) the most “solid” form of money you can possess. Yes, these two precious metals are money!…Don’t fear owning gold my friends. Fear not owning gold and silver, especially if you are a saver. [Let me explain.] Words: 795

9. If You Don’t Think Gold IS a ‘Safe Haven’ Then You Don’t Know the Meaning of the Term!

It would seem that there is a considerable lack of understanding about what the term “safe haven” actually means when it comes to gold. Let me explain just what it means – and does not mean. Words: 740

10. Why, Pray Tell, Would I Want to Own Gold??

Comments I have made that “when this [financial crisis] finally ends the big winners are apt to be the ones who have lost the least purchasing power. Keeping score in nominal dollars is likely to be meaningless. Gold tends to hold its purchasing power regardless of what happens to fiat currency.” have prompted questions about a) how to achieve such purchasing power with physical gold when this stage is reached, b) how to go about buying things with gold coins and c) how gold would be utilized under the assumption that a barter system would develop when dollars become worthless. [Let me explain.] Words: 700

11. Physical Gold and Gold Stocks Should be in Your Portfolio – Here’s Why

Do you own enough gold and silver for what lies ahead? If 10% of your total investable assets (i.e., excluding equity in your primary residence) aren’t held in various forms of gold and silver, we…think your portfolio is at risk. Here’s why. Words: 625

12. Gold is Not an Investment – Gold is Money – and Here’s Why

13. Buy Gold to Protect Your Wealth – Not As Speculation! Here’s Why

14. Surprise, Surprise – Gold Is A Safer Investment Than Any Other!

A look at the gold price over the past 177 years reveals that – surprise, surprise – gold could be the safest investment out there! Words: 1377

15. What is Money – Really – and Why Do We Need to Own Gold – Really?

Have you ever wondered what money really is [and why we need to own some gold as a result]? You’ll notice that everyone you read has a strong opinion , but who’s right? [Let look at the situation and see if we can come to an answer that we both can agree on.] Words: 3086

16. A Message to Newly Minted (or Potential) Gold Bugs

I was taught years ago that “gold is not about price… gold is about value.” Be measured, be balanced and don’t make more of it than it is. Gold is just a tool, an anchor to sound money; to value. [Let me explain.] Words: 1120

17. Don’t Laugh – Invest At Least 65% of Your Portfolio In Precious Metals!

18. Believe It or Not: Only 1 Fund Has Outperformed Physical Gold Since 2007!

19. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

20. Which Gold and Silver Assets (and How Much) Should You Own?

21. It is Imperative to Invest in Physical Gold and/or Silver NOW – Here’s Why

22. Protect Your Portfolio By Including 15% Gold Bullion – Here’s Why

23. Passport Potash Inc. (TSX.V:PPI): Your Passport to Profits?

24. Major Investment Opportunities Exist In Agriculture! Here’s 50

25. The “Ins” and “Outs” of Investing in Commodities

26. Jim Rogers: Stop Buying Gold! These Other Commodities are a Better Buy!

27. Soros and Rogers Agree: Greater Returns from Farmland Than Gold! Here’s Why

28. 7 Agricultural Stock Buying Opportunities

29. Here’s Why Agricultural Stocks Are a Better Buy!

30. Outlook Mixed for Gold, Silver & 12 Other Major Commodities

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I expect the Government to start a new sales tax for all PM transactions which would be happily approved by all those without any PM to buy or sell, much like the taxing of cigarettes, which non smokers all endorse because it does not affect them!