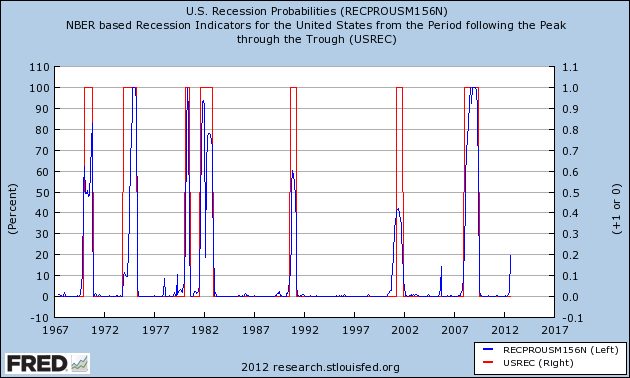

The U.S. Recession Probabilities Index is currently at a level that has ALWAYS been followed by a recession. Interestingly, however, I don’t see recession signals in the internal indicators that I follow and which have been right for a long time now so this clearly puts that opinion in the “this time is different” category – or does it? Words: 255

by a recession. Interestingly, however, I don’t see recession signals in the internal indicators that I follow and which have been right for a long time now so this clearly puts that opinion in the “this time is different” category – or does it? Words: 255

So says Cullen Roche (http://pragcap.com) in edited excerpts from his original article* entitled USA Recession Odds: 100%?.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Roche goes on to say, in part:

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities:

“Recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. “

Interestingly, I still don’t see recession in my internal indicators…[which] have been right for a long time now (in the face of some very public recession predictions by reputable people)…

[Given the above, when my internal indicators point to “no recession,”…an indicator like the above clearly puts that opinion in the “this time is different” category….

*http://pragcap.com/usa-recession-odds-100

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

Over the past few years, policy leaders worldwide have grown accustomed to kicking the can down the road with each step in this ongoing financial crisis making incremental moves rather than cultivating viable long term solutions. More recent attempts seem to have evolved into simply just trying to kick the can out of the driveway. Now we fear there may not be enough firepower left to simply kick the can over. [Having done so, we are left between the proverbial rock and a hard place.] If lawmakers do nothing, by all accounts we are likely to see a recession. Should lawmakers extend the Bush-era tax cuts, you make no progress towards long term deficit reduction, potentially raising the risk and magnitude of a future financial crisis. [Let me discuss this predicament further and how best to invest in such precarious times.] Words: 1602

2. We’ve Reached the Tipping Point: Are Consumers Prepared to Save the Day?

Injecting massive amounts of liquidity into the banking system can spur dramatic economic growth if that liquidity is used. On the other hand, if public perception is negative and fearful, that liquidity remains untapped and no growth occurs. We are in a new earnings season and for the most part – based on lowered expectations – the numbers are looking OK so what should we expect based on these modestly improving numbers? Words: 2176

3. U.S. Economy In the ‘Eye Of The Storm’ – Here’s Why

Optimism has seized stock markets in the past month on the back of better economic data in the United States and a late-summer lull in the euro crisis. Market volatility is at its lowest level in years. [That being said, however,] BofA’s top economist Ethan Harris…thinks the U.S. economy is “in the eye of the storm” right now. Below is what Harris sees on the horizon. Words: 363

4. QEunlimited is NOT Going to Save the U.S. Economy – Period!

With the pop from the USFed’s latest attempt at financial shock and awe already seeping from lackluster markets, and the teleprompter news networks losing steam over their promotion of the same, it is time to take a look back at the decisions made on 9/13/2012 and set the record straight on some things.

5. QE 3 Will Actually SUPPRESS the Economy! Here’s Why

The Fed professes that QE 3 or as I call it, QE Infinity (QEI), will create jobs but I am not sure how they can expect anybody to buy their rationale. As we know, QE 1 and QE 2 did very little in the way of creating jobs. Might the Fed realize that QE Infinity could actually be counter-productive to economic growth?

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money