There is a substantial debate about what asset, if any, gold price relates to or responds to….We think the most logical factor in its price as a form of money would be the ratio of the currency in circulation versus the amount of gold that could be associated with that currency…We have heard some strong opinions to the contrary…that perhaps some other assets other than currency in circulation could be used to explain gold price behavior, and therefore provide some gauge of over and under valuation in the market price. [We look at 14 different assets below.] Words: 586

responds to….We think the most logical factor in its price as a form of money would be the ratio of the currency in circulation versus the amount of gold that could be associated with that currency…We have heard some strong opinions to the contrary…that perhaps some other assets other than currency in circulation could be used to explain gold price behavior, and therefore provide some gauge of over and under valuation in the market price. [We look at 14 different assets below.] Words: 586

So says Richard Shaw (http://qvmgroup.com) in edited excerpts from his article* entitled Gold’s Graphic Relationship To Other Major Assets

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), may have edited the article below to some degree for length and clarity – see Editor’s Note at the bottom of the page for details. This paragraph must be included in any article re-posting to avoid copyright infringement.

Our Preferred Gold Valuation Metric

We like the ratio of the currency in circulation in the United States and Europe to the gold held in their combined central banks. That number is around $4,000; and would grow as the issued paper money increases, assuming no increase in the gold held by the central banks.

Who in the world is currently reading this article along with you? Click here

The $4,000 round number comes from summing the U.S. dollar equivalent of all Dollar and Euro currency in circulation ($2.64 Trillion) and dividing it by the sum of the gold held by the U.S. and European Monetary Union central banks (667.4 million ounces), which comes out to be $3,955 per ounce. In other words, if there were ever a return to full convertibility to gold, that is the price at which all currency if converted would cause the payout of all central bank gold holdings.

We don’t think convertibility will return, but so long as central banks continue to hold gold, they keep the concept of potential convertibility alive, and as long as a large number of gold buyers think gold is a “real money” alternative to fiat currency, this convertibility calculation has some bearing on the current investment value of gold at any time. [For example,] should…another major market problem like that in 2008 should arise, gold could drop as much as it did in 2008. That drop was 30%. If you take 30% off of the most recent high for gold, you get $1,300. That is plausible, not probable, and would likely be temporary, but it could happen.

Other Investments vs. Gold

You may… feel that other assets are better correlates or value drivers, so we put together this batch of charts that show gold versus various other investments on an indexed basis that may help you think through which, if any, you find to be a good yardstick to help you know when gold is priced too high or too low versus some sense of value.

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

- It’s FREE

- It contains the “best of the best” financial, economic and investment articles to be found on the internet

- It’s presented in an “edited excerpts” format to provide brevity & clarity of content to ensure a fast & easy read

- Don’t waste time searching for articles worth reading. We do it for you and bring them to you each day!

- Sign up HERE and begin receiving your newsletter starting tomorrow

The data is either from the U.S. Federal Reserve or from StockCharts.com. Data is from 1969 for most of the Federal Reserve charts and for 20 years for most of the charts from StockCharts. In each case we present the data on an indexed basis so the relative change in each plot is more easily discernible. The comparisons may be interesting if nothing else.

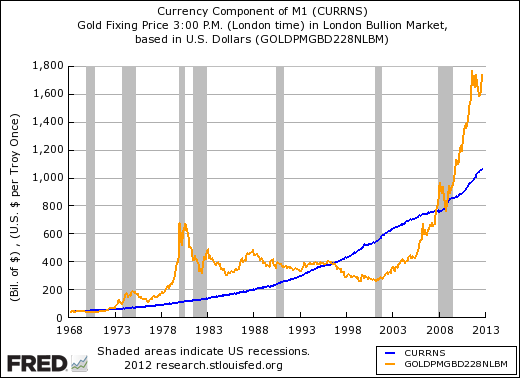

Our Preferred Way: Gold vs. U.S. Currency In Circulation

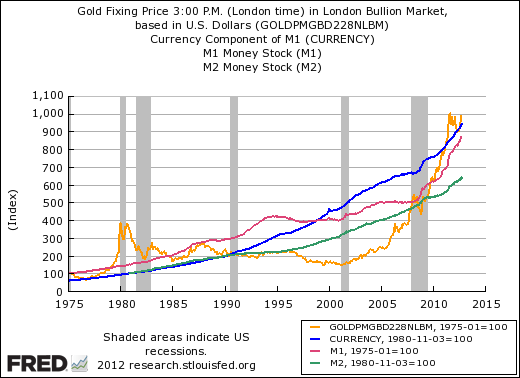

1. Gold vs. M0 (currency), M1 And M2

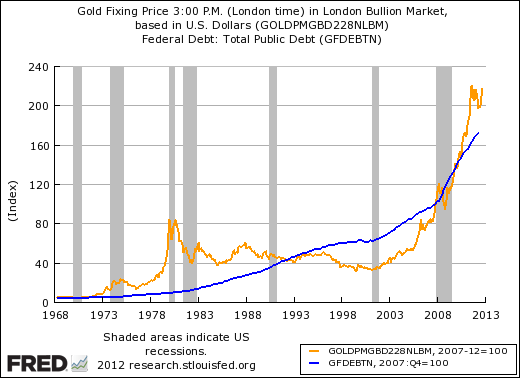

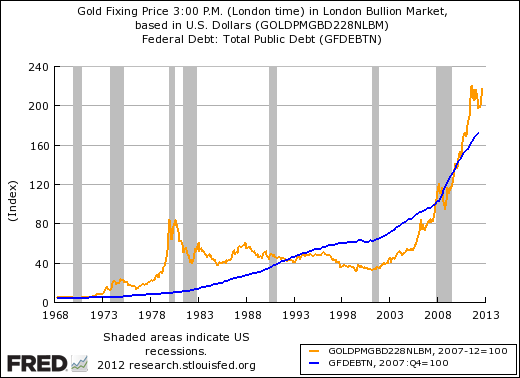

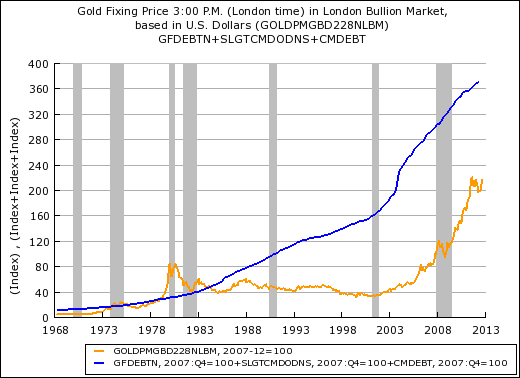

2. Gold vs. U.S. Federal Debt

3. Gold vs. Combined Federal, State And Local Debt

4. Gold vs. Federal, State And Local Debt, Plus Household Debt

5. Gold vs. GDP

6. Gold vs. Cost Of Living (as measured by “all items” CPI)

7. Gold vs. U.S. Stocks (S&P 500)

8. Gold vs. West Texas Crude Oil

9. Gold vs. Copper

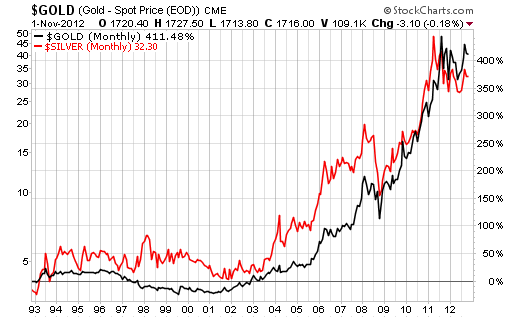

10. Gold vs. Silver

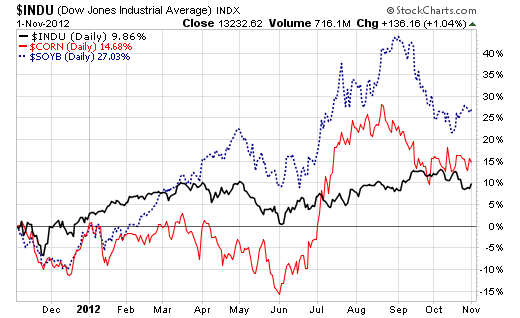

11. Gold vs. Corn And Soybeans

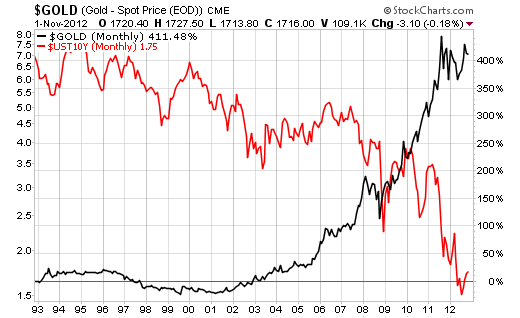

12. Gold vs. 10-Year Treasury Yield

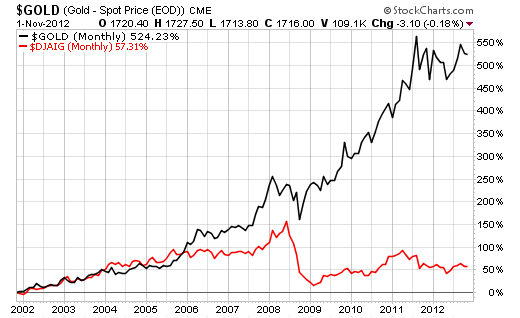

13. Gold vs. Dow Jones AIG Commodity Index (includes gold)

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

2. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

3. Gold Should Be At $4,666 These Days – Here’s Why

Since the Financial Crisis erupted in 2007, the US Federal Reserve has engaged in dozens of interventions/ bailouts to try and prop up the financial system…and the amount of money printed is absolutely staggering. As a result of this, inflation hedges, particularly Gold, have been soaring…[but] for gold, for example, to hit a new all time high adjusted for inflation, it would have to clear at least $2,193 per ounce. If you go by 1970 dollars (when gold started its last bull market) it would have to hit $4,666 per ounce. Words: 581

4. Alf Field: Gold STILL Targeted to Reach $4,500 – Preceded By Violent Upside Action

We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085

5. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

6. Egon von Greyerz: Gold & Silver Off to the Races – to $4,500+ & $100+ Each – Here’s Why

The closing of the gold window back in August 1971 has led governments worldwide to create endless amounts of worthless paper money and the resulting credit bubble has created a world debt exposure of over US$ 1 quadrillion (including derivatives). It has also created perceived wealth for big parts of the world’s population – a wealth which is only backed by promises to pay and by grossly inflated assets. Few people realise that this wealth is totally illusory and will implode considerably faster than the time it took to create it. [Let me explain.] Words: 890

7. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

I believe that the price of gold will… reach… $3,000, $4,000, and even $5,000 [per troy] ounce…during the course of this long-lasting bull market, a bull market that still has years of life left to it…[although] prices will remain extremely volatile – with big swings both up and down along a rising trend…The future price of gold is a function of past and prospective world economic, demographic, and political developments [and in this article] I review some of these developments and trends – so that you can come to your own “golden” conclusions. Words: 3800

8. Gold’s Recent Price Action Suggests Ultimate Top of $5,000/ozt.

The correlation between the gold price from 1968 until 1979 and from early 2000 until today is an amazing 89.65%! More specifically, the correlation from 1975 until April 1979 and from January 2008 until today is an astonishing 97.83% suggesting that gold will reach an ultimate top of $5,000 per troy ounce before the bubble bursts. Words: 330

Our subscription service provides detailed technical analysis of where the price of gold, silver and precious metal stocks are going short term (in the next week or two), intermediate term (within the next 3-6 months) and long term (the ultimate top) in each stage of their respective bull runs. This service comes with detailed charting based on conventional technical analysis and our proprietary fractal analysis based on the ’70s. Below are some of our latest comments and rationale for expected price movements in gold without illustative charts which are only available to subscribers. Words: 1000

My previous article on gold & silver went viral with almost 30,000 reads on munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money