For the past few months, existing home sales levels have been weaker than expected. The focus, however, should not be on the weakness of the headline numbers. In actuality, the softening in existing home sales is showcasing the potential for acceleration in new home sales. [Let me expain.] Words: 1205

expected. The focus, however, should not be on the weakness of the headline numbers. In actuality, the softening in existing home sales is showcasing the potential for acceleration in new home sales. [Let me expain.] Words: 1205

So says Jeffrey Rosen (www.briefing.com) in edited excerpts from his original article* posted on Seeking Alpha under the title No More Wishful Thinking: Evidence Solidly Confirms The End Of The Housing Crash.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Rosen goes on to say, in part:

The key is where the unexpected slowdown in existing home sales is taking place.

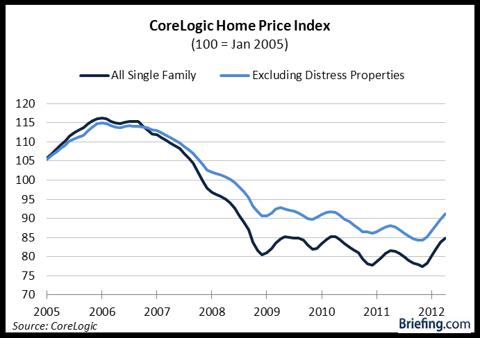

If sales demand was suffering from broad-based demand declines across the existing home space, then the weak sales numbers would suggest a downturn in the new home sector would be coming soon as well. The weakness, however, is coming from only one area of the existing home space: distressed properties.

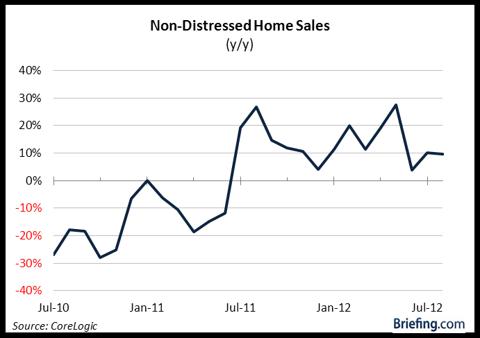

Existing home sales are falling because investor demand has slowed. Non-investor demand has not wavered and has been showing double-digit growth.

Investor Fallout

Typically, a distressed property sells for about 20% less than a comparable existing home. The price differential has caused investors to become a key market group for existing home sales. Investor influence on the housing market, however, is beginning to wane.

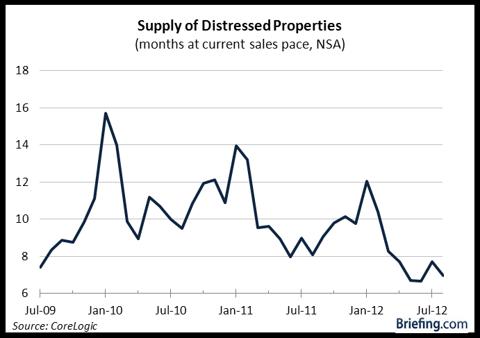

Over the last several months, the increase in demand for distressed properties has led to shortages of desirable distressed inventories.

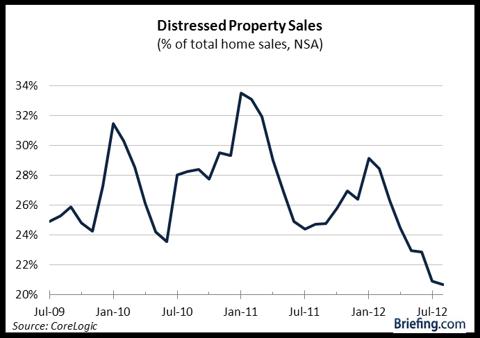

Consequently, sales of distressed properties as a percentage of total home sales have diminished greatly since January and are not expected to recover unless foreclosure rates suddenly worsen and supply/inventories return.

There is no reason to suspect a sudden acceleration in the number of available distressed properties anytime soon.

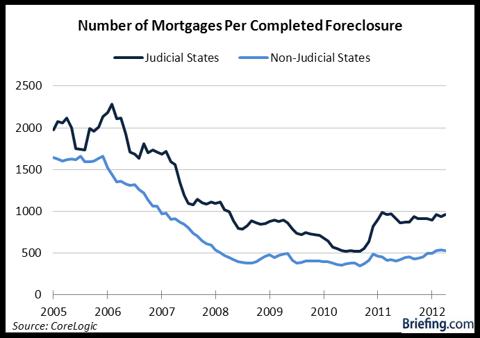

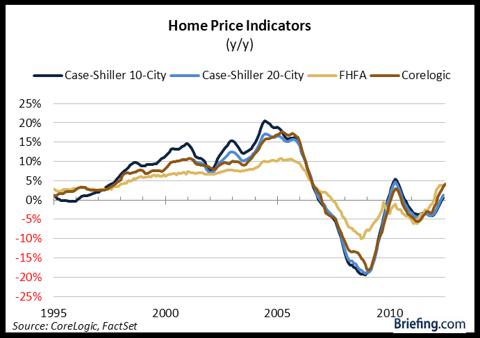

Foreclosure rates have declined precipitously since 2006. That decline has essentially choked off the incoming supply of distressed properties.

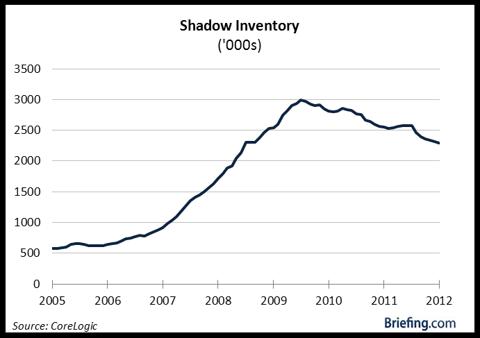

As a result, the number of shadow inventories – homes that are currently severely delinquent, in foreclosure, or held as real estate owned (REO) by mortgage servicers but not currently listed on the multiple listing services (MLS) – peaked in 2009 and have fallen at a fairly steady -10% y/y pace each month since early 2011.

Absent another recession, a pullback in investor sales will likely drag on the overall home sales recovery. Non-investors, who are likely to purchase non-distressed properties, will have to provide the bulk of demand growth in order to keep home sales levels moving higher.

Non-Investors to the Rescue

Even though the economy is currently growing at a tepid pace, conditions are, thankfully, still ripe for non-investor demand to strengthen in the near term.

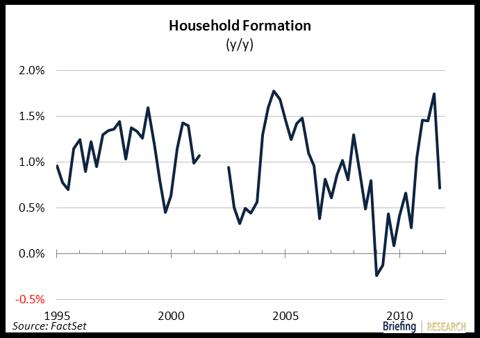

Household formation rates have returned to normal following an almost two-year collapse. The recent recovery, however, still leaves a sizable backlog of households that have not formed, but would have if the recession had not taken place. In other words, there is a tremendous amount of pent-up housing demand that should keep sales demand moving steadily higher.

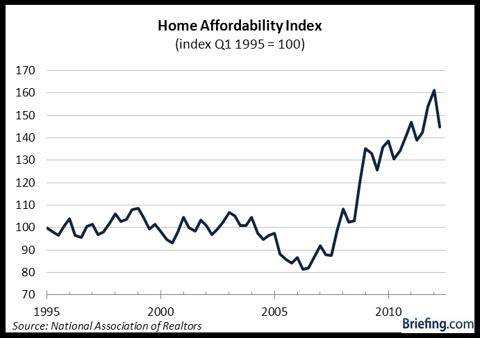

Furthermore, all-time low mortgage rates and depressed housing prices have driven home affordability levels to their highest point since data started being collected in the early 1990s.

The conditions that helped elevate home affordability levels, along with strong pent-up demand, have caused sales of non-distressed home to grow more than 10% year-over-year.

As long as the economy continues to expand – which we expect – non-distressed home sales growth should remain solidly positive.

Homebuilders to Reap the Benefits

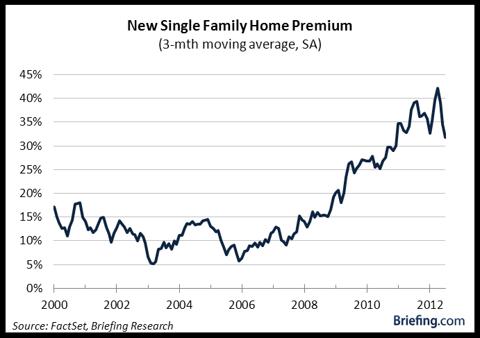

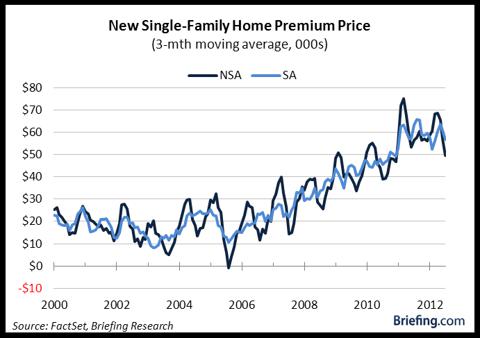

Distressed properties tend to sell at about a 20% discount to comparable existing homes. Prior to the housing crash, new home prices were at a 10% premium to existing home prices.

As the housing market crashed, the massive influx of distressed properties caused existing home prices to plunge. New home prices, however, remained elevated as sunk costs prevented homebuilders from immediately dropping prices. The premium to buy a new home widened to more than 40% in early 2012.

The extended markup – which was well above normal economic conditions – led to depressed sales conditions and eventually an exodus of buyers from the new home space to the existing home sector.

Don’t Delay!

– Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com

– It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time

– All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read

– Get newly posted articles delivered automatically to your inbox

– Sign up here

Now that inventories of distressed properties have fallen, their negative effect on overall existing home prices has lessened. Essentially, the combination of stronger demand for existing homes and low distressed sales should translate into upward trending home prices.

Higher existing home prices will eventually shrink the new home premium back to its pre-crisis levels and pull buyers from the existing home sector back into the new home sector.

The premium for prices on new homes appears to be on the verge of becoming more attractive in relation to existing homes, which should be enough to push new home sales higher.

Stable Construction Growth Is Finally Here to Stay

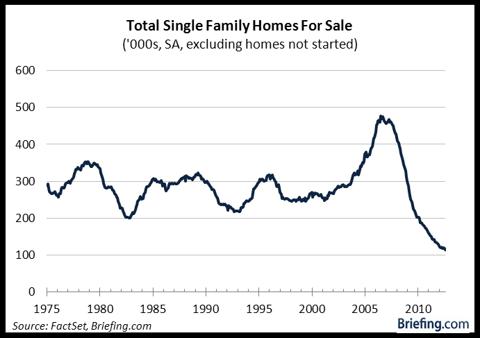

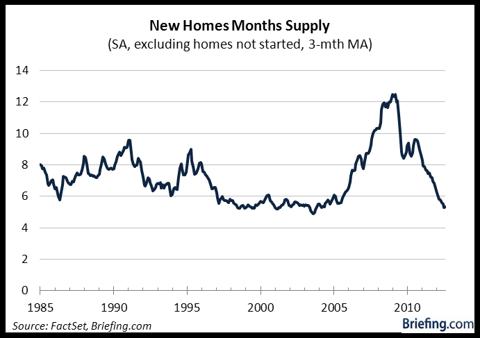

With demand for new homes expected to increase, homebuilders will need to change their inventory management activities. Inventories of new homes available for sale are at their lowest level in the nearly 40 years that data have been available.

Even with the extraordinarily high new home price premium, the number of months of supply of available new homes has returned to its pre-housing crash norm.

Any increase in new home sales from the current level will require construction growth or new home inventories to fall further below normal market levels. That means builders have an incentive to break ground on new homes or run the risk that low inventories will turn off potential homebuyers and drive them to the existing home space.

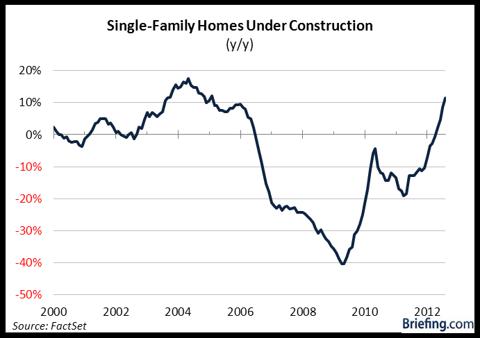

For the first time since 2006, the number of homes currently under construction has increased on a year-to-year basis. That means sales at large home improvement stores…should benefit over the next several quarters from increased demand from smaller private construction firms.

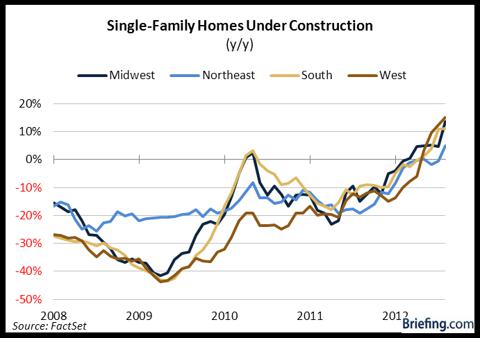

Furthermore, the pickup in construction was not limited to just one area. All four census regions saw year-over-year growth. The growth in homebuilding is happening across the entire country.

With demand expectations on the rise, the homebuilding sector should continue to expand on a stable, upward trend for the foreseeable future. As a result, the residential construction sector will likely be a leading contributor toward GDP growth over the next several quarters.

Conclusion

Sales in 2011 were buoyed by strong demand from investors for distressed properties. Available inventories of distressed properties have fallen in recent months, however, and investor demand has softened as a result.

- The underlying trends – high affordability levels combined with a glut of pent-up demand – point toward a rise in non-investor sales that should be more than enough to offset the decline in investor sales.

- The shift from investor to non-investor sales growth is expected to be a boon for homebuilders.

- As homebuyers buy more non-distressed properties, the prices for existing homes will rise.

- In turn, the premium that is currently needed to buy a new home will shrink. Essentially, new homes will become more competitively priced in the coming months, which will lead to more new home sales.

- New home inventory levels are at their all-time historic lows. Any increase in demand in the new home sector will require additional construction or homebuilders will risk not having enough inventories to support sales.

- We expect builders will satiate the increase in demand by beginning new construction and actively adding to their inventories.

- As a result, the residential construction sector will likely be a leader for GDP growth over the next several quarters.

*http://seekingalpha.com/article/926431-no-more-wishful-thinking-evidence-solidly-confirms-the-end-of-the-housing-crash

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Many Not So Sure That Our Housing Problems Are Behind Us – Here’s Why

With recent numbers positive for housing realtors, politicians, and others with vested interests, are quick to claim we are on our way back – but are such numbers really meaningful and sustainable? Many more objective analysts, however, are less sure or disagree with this conclusion that the bottom has been reached yet. Here’s what some of them have to say. Words: 1377

2. Recent Data Suggest a Tidal Wave of Foreclosures is Coming! Here’s Why

The real estate market had started to stabilize on signs that foreclosure inventory was decreasing but a rise in foreclosure starts suggests that a tidal wave of foreclosures is building, especially in states with a judicial foreclosure process.

3. Housing NOT Coming Back Any Time Soon! Here’s Why

“Ben Bernanke is trying like mad to stimulate credit and lending but to no avail. It’s an uphill battle because of demographics, student debt, and lack of jobs. [Frankly however, given such an environment,] prospects for family formation are fundamentally very weak and overall economic fundamentals are very weak as well” [and that certainly does not bode well for housing coming back anytime soon. Let me explain.] Words: 650

4. Housing Prices Expected to Rebound in 2013 – 2014 – Here’s Why

We are currently seeing bullish indicators regarding housing demand coupled with bearish indicators regarding housing prices. Let’s take a look at the past relationship between house demand and house prices and see what it suggests for the future in real estate prices. Words: 450

5. This Hard Data Clearly Says: Real Estate is in Recovery Mode!

Auto sales, consumer confidence, manufacturing, retail sales, exports – you name it – over the last six months, nearly every facet of the U.S. economy has shown improvement and the real estate market is no exception. [Here are 11 irrefutable signs that such is the case.] Words: 800

6. What Does the Latest Rent vs. Buy Index Have to Say?

If you have been on the fence trying to decide if you should rent or buy, the market may be in your favor. According to Trulia’s Winter 2012 Rent vs. Buy Index it is now cheaper to buy a home rather than rent in 98 of the 100 largest U.S. metropolitan areas. How can that be? Take a look!

7. Your House: A Home, An Investment or a Ponzi Scheme?

In the past few decades, the concept of home ownership has been completely turned on its head. Previously, homes were considered a very long-term consumption good…[No one] ever considered tripling the value of their homes by retirement time and selling them to move beachside yet, somehow along the way, this became a reasonable investment expectation. Even today, home buyers still make their purchases with the hopes of escalating prices. [It begs answers to these questions: Is a house just a home? Should a house be expected to behave like an investment? Is the housing game nothing more than a Ponzi scheme where the end buyer before the market corrects becomes the “greater fool”? Let’s try and answer those questions.] Words: 935

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money