Below is a synopsis of a report* by none other than John Mauldin in his latest Outside the Box commentary** on Hoisington Investment Management Quarterly Review and Outlook Third Quarter 2012. Words: 507

Box commentary** on Hoisington Investment Management Quarterly Review and Outlook Third Quarter 2012. Words: 507

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Mauldin says, in part:

Van Hoisington and Lacy Hunt do a masterful job of turning data points into cogent, well-argued themes and this month they waste no time in dissecting the Fed’s recent move to QE3 and similar efforts in Europe, arriving at the conclusion that:

While prices for risk assets have improved, governments have not been able to address underlying debt imbalances. Thus, nothing suggests that these latest actions do anything to change the extreme over-indebtedness of major global economies.

Their expectation: global recession. The only issue left to sort out, they say, is How deep will the downturn be?

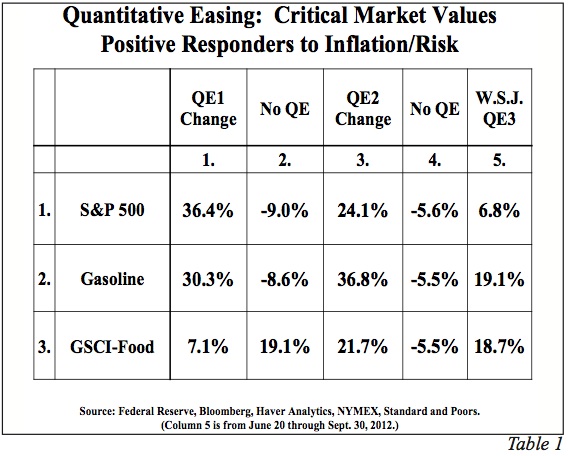

They make the interesting observation that with each injection of liquidity by the Fed, commodity prices have surged:

During QE1 & QE2 wholesale gasoline prices jumped 30% and 37%, respectively, and the Goldman Sachs Commodity Food Index (GSCI-Food) rose 7% and 22%, respectively. From the time the press reported that the Fed was moving toward QE3, both gasoline and the GSCI Food index jumped by 19%, through the end of the 3rd quarter.

The QE picture gets even muddier. The unintended consequence of the Fed’s actions, say Lacy and Van, has been to actually slow economic activity:

“The CPI rose significantly in QE1 and QE2 (Chart 1).

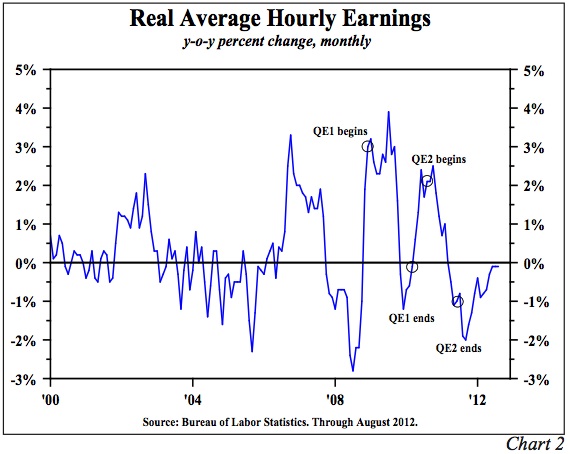

These price increases had a devastating effect on worker’s incomes (Chart 2).

Wages did not immediately respond to commodity price changes; therefore, there was an approximate 3% decline in real average hourly earnings in both instances. It is true that stock prices also rose along with commodity prices (S&P plus 36% and 24%, respectively, in QE1 and QE2), however, median households hold a small portion of equities, and thus received minimal wealth benefit.”

Don’t Delay!

– Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com

– It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time

– Join the informed! 100,000+ articles are read every month at munKNEE.com

– All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read

– Get newly posted articles delivered automatically to your inbox

– Sign up here

They proceed to tear apart the wealth effect that the Fed is banking on to restimulate the economy, drawing on several solid studies. They also make the key point that:

“When the Fed actions lead to higher food and fuel prices, the shock wave reverberates around the world, with many foreign economies being hit adversely. When prices of basic necessities rise, the greatest burden is on those with the lowest incomes since more of their budget is allocated to the basic necessities such as food and fuel.”

Conclusion

The next few years are not going to be pretty. We’re looking right into the teeth of a rolling global deleveraging recession—the End Game, I’ve called it – and the decisions we make in the next couple years about how to handle our debts and budget deficits here in the U.S., in Europe, in China, in Japan, and elsewhere, are going to be absolutely crucial.

*Original report: http://www.hoisingtonmgt.com/pdf/HIM2012Q3NP.pdf

** Original source of article: http://www.mauldineconomics.com/outsidethebox/hoisington-quarterly-review-and-outlook/

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. This Is What “Falling Off The Fiscal Cliff” Really Means – and It is DIRE!

We all know that high debt is a growth killer and, at the moment, the U.S. has a budget deficit of about $1 trillion. That’s a very big number…The question is, at what point do countries have to deal with high debt levels? How high do debt levels have to be before one has to deal with the problem by lowering budget deficits? Also, what are the consequences of such debt and budget reductions? Words: 500

2. The “Great Crisis” Is Well On Its Way and Will Make 2008 Look Like a Joke!

For over two years now, I’ve been warning that the 2008 Crash was just a warm up and that the REAL Crisis would occur when the stock market realized that the Central Banks, lead by the US Federal Reserve could NOT actually hold the financial system together. Well, the Crisis I’ve been warning about is here. [Let me explain.] Words: 306

3. Current Long Wave Kondratieff Winter Snow Storm to End in an Economic Avalanche – Here’s Why

There are several variations of Long Wave theory, but the most famous is based on the work of Nicolai Kondratieff, a Russian economist who gave the various stages seasonal names, with summer and autumn denoting the peak of financial speculation and winter the aftermath of the resulting crash. The conditions for a global catastrophic failure are in place. Snow (in the form of trillions of new dollars and euros) is falling. There’s no way to know which dollar (or which external event) will start the avalanche, but without doubt something will. [Let me expand on why I hold that view.] Words: 888

5. Fiscal Tightening in 2013 and Its Economic Consequences

6. The Fiscal Cliff: Everything You Need To Know About It & Its Implications

8. The Fiscal Cliff: What We Think Will Happen and What Investors Should Do

9. What Follows Will Not be Pretty for U.S. Stock Market & Financial System – Here’s Why

10. Bernanke’s Actions – or Inactions – Won’t Prevent Coming Collapse! Here’s Why

12. The U.S. Economy is Going to Collapse…It is Unavoidable…It’s a Mathematical Certainty…Here’s Why

The level of debt has surpassed the possibilities of being serviced. Mathematically, the debt problem cannot be solved, regardless of economic policies. That, unfortunately, is written. For it to be serviceable would be to violate the laws of mathematics and that cannot happen. [As such, America is quickly approaching a catastrophic economic collapse. As repelling as that sounds, it’s in your own best interest to learn just how bad the situation is. This article is an attempt to do just that.] Words: 310

13. The U.S. Debt Spiral: When Will it End? More Importantly, HOW Will it End?

The U.S. already has more government debt per capita than the PIIGS (Portugal, Italy, Ireland, Greece and Spain) do and it just keeps getting worse and worse thanks to both political parties. We are on the road to national financial oblivion yet most Americans don’t seem to care. They don’t realize that we have enjoyed the greatest prosperity we will ever see…and that when the debt bubble bursts there is going to be an immense amount of pain. That is a very painful truth, but it is better to come to grips with it now than be blindsided by it later. [Let me explain.] Words: 1140

14. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

15. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

16. Events Accelerating Towards an Ultimate Dollar Catastrophe! Here’s Why

With the U.S. election just months off, political pressures will mount to favor fiscal stimulus measures instead of restraint. Such action can only accelerate higher domestic inflation and intensified dollar debasement culminating in a Great Collapse – a hyperinflationary great depression – by 2014. [Let me explain why that is the inevitable outcome.] Words: 2766

18. Nothing Can Be Done to Avoid Coming World-wide Depression! Here’s Why

20. The $64 Trillion Question Is: “When and How Does the Debt Death Spiral End?”

21. What Will the Outcome of All the QE Mean for the U.S. (and the World)?

23. Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

25. An Inflation Inferno is Expected – but When?

26. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

28. Current Distortion of Interest Rates is Unsustainable & Will Have Dire Consequences

29. Eventual Rise in Interest Rates Will Be Downfall of U.S. – Here’s Why

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money