Gold prices have been trending higher in the last twelve years and might continue to do so over the next decade. This article is in defense of current gold prices from a money creation perspective. Further, this article completely rules out a bubble in gold. Hence, the expectation is that the long-term bull market for gold is intact and gold will surge higher over the next decade. Words: 914

continue to do so over the next decade. This article is in defense of current gold prices from a money creation perspective. Further, this article completely rules out a bubble in gold. Hence, the expectation is that the long-term bull market for gold is intact and gold will surge higher over the next decade. Words: 914

So says Economics Fanatic (www.economicsfanatic.com/) in edited excerpts from an article posted on Seeking Alpha entitled Justifying Gold Prices From A Money Creation Perspective.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

As mentioned earlier, the focus is just on gold price appreciation from a money creation perspective. The simple logic that works here is that if the supply of gold can’t be increased at the same pace as the supply of money, gold will appreciate in fiat money terms even if demand remains stable or relatively sluggish.

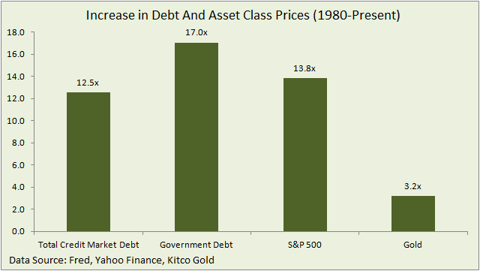

In the modern banking and money creation era, debt is essentially money. Had there been no debt, there would have been no money. Therefore, it would be interesting to look at the debt growth multiple from 1980 and the number of times gold has appreciated since the 1980’s. I am particularly selecting the 1980s as a reference point because expansionary monetary policies began in the United States way back in the 1980s after the bear market for Treasury bonds ended.

The total credit market debt in the United States has increased from $4.4 trillion in 1980 to $55.0 trillion by the second quarter of 2012. During the same period, the total government debt increased from $930 billion to $15.8 trillion.

Looking at the impact of this money creation on asset markets, the S&P 500 index has increased from 106 in 1980 to 1460 currently. I am certainly not suggesting that only liquidity has resulted in the index surging by 13 times in 3 decades. However, liquidity does play an important role in asset markets. The best evidence comes from the credit freeze as a result of the Lehman collapse in late 2008. The S&P 500 index touched a low of 666 during that period. Very clearly, two quarters of earnings slump did not justify the S&P slipping to 666 levels. The liquidity factor was the most important factor.

Finally, gold prices have increased from $560 at the beginning of 1980 to $1780 as of October 2012. That’s a 3.2x increase over a period of three decades.

As evident from the chart, appreciation in gold prices has been much lower when compared to the increase in money in the system over a period of three decades. Clearly, purely from the perspective of the amount of money present in the system, gold looks undervalued and not overvalued or fairly valued.

(click to enlarge)

Another interesting chart given below can be used to talk about current gold valuations. The foreign reserves in Asia has swelled from $2 trillion at the beginning of 2006 to $5 trillion now – exceeding 45% of GDP. Therefore, over a period of six years, Asian currency reserves have increased by 2.5 times. During the same period, gold prices have increased by 3.4 times.

The important point to note here is that deficits in the advanced economies have been a source of excess reserves and liquidity in the emerging economies. Further, the 2.5 times increase in reserves does not account for all the new money creation during this period. One can therefore conclude with some conviction that the 3.4 times increase in gold prices during this period is justified.

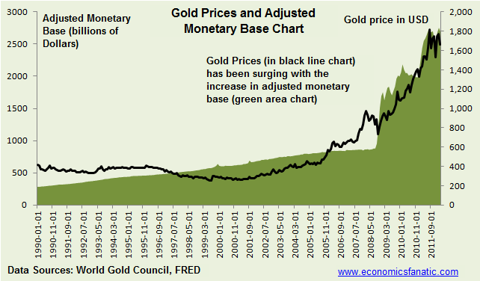

A strong relation also exists between the US adjusted monetary base and gold prices. As the chart below shows, the gold price has surged in the recent past, along with a surge in the US adjusted monetary base.

(click to enlarge)

Going forward, with the Fed expected to continue with its expansionary monetary policies, the adjusted monetary base will trend higher and gold prices should also trend higher. It is also worth mentioning here that the CBO expects $10 trillion of budget deficits in the United States over the next ten years. This will result in significant additional money creation in the system. In line with this, gold prices should be supported at higher levels.

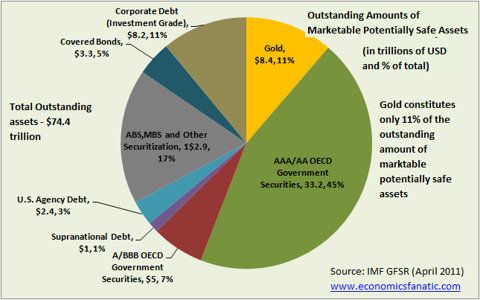

I also strongly believe that gold is far from being in a bubble territory. The chart below would serve as a good point in defense of my argument.

Of the total amount of marketable potentially safe assets, the holding of gold is only 11%. In times of a bubble, the holding of any asset is abnormally high. From that perspective, the government bond sector, and not gold, is in a bubble.

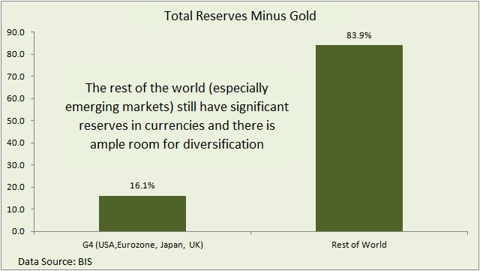

Also, for central banks around the world, gold as a percentage of total reserves is at relatively low levels. This is especially true for emerging markets, which have high reserves.

Going forward, one can expect central banks to increase their gold holdings as the prolonged economic problems in the advanced world impact their currencies negatively.

Conclusion

All… [of the above] factors combined make a strong case for another decade of the bull market for gold. I would personally look to accumulate physical gold, gold ETFs and gold stock in my portfolio on every correction in the precious metal.

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time.

Join the informed! 100,000 articles are read every month at munKNEE.com.

All articles are posted in edited form for the sake of clarity and brevity to ensure a fast and easy read. Don’t miss out.

Get newly posted articles delivered automatically to your inbox.

Sign up here.

*Source of original article: http://seekingalpha.com/article/910021-justifying-gold-prices-from-a-money-creation-perspective

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Goldrunner: Gold to Rocket To Around $4,000, And Then on to $10,000-$12,000

The Fractal Gold chart work is a direct comparison of Gold, today, to the late 70’s Gold Parabola. Thus, “timing” is taken directly from the late 70’s cycle, with price targets created from a combination of the late 70’s Gold price and different technical analysis techniques. We developed a price target back in 2006/ 2007 for Gold to reach the $10,000 to $12,000 range during this Gold Bull. Anything above that range would mean that the “Stagflation” comparison to the late 70’s was exceeded and “Hyper-inflation” would become a real possibility. Let me explain where we are at this point in time.

2. Alf Field: Gold STILL Targeted to Reach $4,500 – Preceded By Violent Upside Action

We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085

3. Aden Forecast: Bubble Phase in Gold to Begin in 2013 and Possibly Reach…

Gold has been moving within a mega upchannel since 1970 and still has a ways to go before reaching the top side of this mega uptrend. How high is anyone’s guess but were gold’s price rise to match the 2300% rise realized in the 1970s (and our research suggests we could see the start of the bubble phase by next year) we’d see a $6000 gold price, which would blow the gold price well above the mega upchannel. [Let us explain our conclusions with the use of 2 charts.] Words: 495

4. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767.

5. von Greyerz: Gold Going to $3,500-$5,000 in 12-18 Months – and $10,000 Within 3 Years!

There will be a catalyst coming soon, probably some concerted action of money printing between the Fed, IMF and the ECB. That will happen as a result of the economies, worldwide, collapsing….The catalyst could come from anywhere but the money printing will be part of the next move in gold, that’s for certain….[and it] will lead to collapsing currencies, and investors buying gold at any price…I see gold reaching $3,500 to $5,000 in the next 12 to 18 months. Within 3 years, I see the gold price reaching at least $10,000.

6. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

7. Gold’s Current Bull Market Will Be Even Bigger Than The One In The 1970s – Here’s Why

8. Contracting Fibonacci Spiral Puts Gold Near $4,000 by 2013 and $7-10,000 by 2020

9. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

10. Surf’s Up: Here’s Specific Suggestions on How to Ride the Coming Wave of Higher Gold Prices

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money