![]() The July 2011 Consumer Price Index for Urban Consumers (CPI-U) released

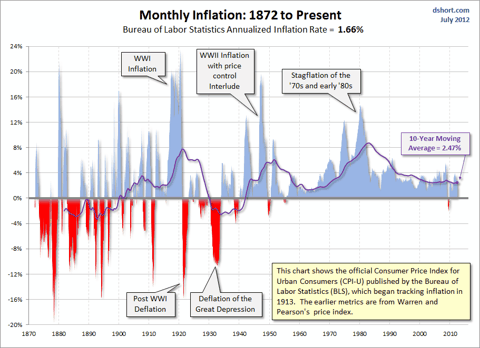

The July 2011 Consumer Price Index for Urban Consumers (CPI-U) released yesterday puts the June year-over-year inflation rate at 1.66%, which is less than half the 3.82% average since the end of the Second World War. That being said the ShadowStats Alternate annualized rate of inflation is 9.26%. [Which is more accurate?] Words: 384

yesterday puts the June year-over-year inflation rate at 1.66%, which is less than half the 3.82% average since the end of the Second World War. That being said the ShadowStats Alternate annualized rate of inflation is 9.26%. [Which is more accurate?] Words: 384

So says Doug Short (www.advisorperspectives.com) in edited excerpts from his original article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Short goes on to say, in part:

Bureau of Labor Statistics CPI Data

The Bureau of Labor Statistics (BLS) has compiled CPI data since 1913, and numbers are conveniently available from the FRED repository (here). My long-term inflation charts reach back to 1872 by adding Warren and Pearson’s price index for the earlier years….This look further back into the past dramatically illustrates the extreme oscillation between inflation and deflation during the first 70 years of our timeline.

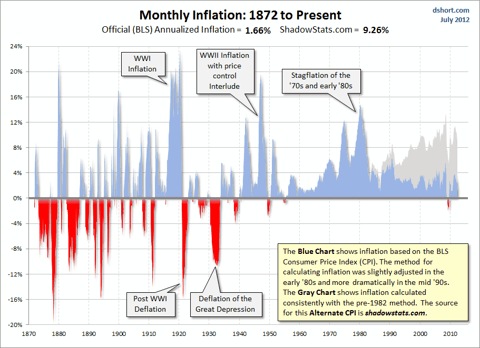

ShadowStats Alternate Inflation Data

The chart below includes an alternate look at inflation *without* the calculation modifications the 1980s and 1990s (Data from www.shadowstats.com) and shows a ShadowStats Alternate annualized rate of inflation is 9.26%

Bureau of Labor Statistics’ CPI Data vs. ShadowStats Alternate Inflation Data

On a personal note, the more I study inflation the more convinced I am that the current BLS method of calculating inflation is reasonably sound. As a first-wave Boomer who raised a family during the double-digit inflation years of the 1970s and early 1980s, I see nothing today that is remotely like the inflation we endured at that time.

Moreover, government policy, the Federal Funds Rate, interest rates in general and decades of major business decisions have been fundamentally driven by the official BLS inflation data, not the alternate CPI. For this reason, I view the alternate inflation data as an interesting, but ultimately useless statistical series.

That said, I think that economist John Williams, the founder of Shadow Government Statistics, offers provocative analysis on a range of government statistics. While I do not share his hyper-inflationary expectations, at least not based on current economic conditions, I find his skeptical view of government data to be filled with thoughtful insights.

Take Note:

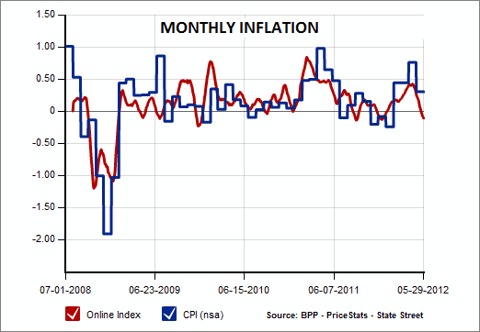

For independent evidence that the Consumer Price Index is a reasonably accurate representation of the prices we pay, see the MIT Billion Prices Project US Daily Index.

* http://seekingalpha.com/article/728341-a-long-term-look-at-inflation?source=email_macro_view&ifp=0 (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Real-time Inflation Data is Now Available – Finally

Inflation is a significant measurement for the economic health of countries around the world but rates are often reported weeks after data is collected. To address this problem, two professors at MIT Sloan School of Management have launched the Billion Prices Project which is the first website to publish daily price indexes and provide real-time inflation estimates around the world. Words: 825

2. Once Inflation Starts There Will Be NO Stopping It!

If inflation starts to head towards 5%, you can be sure it’s headed for 10% because they don’t have the ability to stop it now. The only antidote they have to the mess we are in, which is massively excessive debt reinforced by derivatives, is unlimited money printing. The idea that you can withdraw the punch bowl or sharply raise interest rates, it just doesn’t exist, unless you want to take a complete deflationary collapse.

3. James Turk Interviews Robert Prechter: Which Will It Be – Hyperinflation or Massive Deflation?

James Turk believes hyperinflation is ahead. Bob Prechter believes massive deflation is coming. An interesting discussion between the two takes place in this audio. Ultimately, both lead to Depression. Only the route taken differs, but that is important.

4. Major Inflation is Inescapable and the Forerunner of an Unavoidable Depression – Here’s Why

Whether our current economic crisis will end with massive inflation or in a deflationary spiral (ultimately, either one results in a Depression) is more than an academic one. It is the single most important variable for near and intermediate term investing success. It is also important in regard to taking actions which can prepare and protect you and your family. [Here is my assessment of what the future outcome will likely be and why.] Words: 1441

5. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

The developed economies of the world have opened the money spigots…[and this] massive money and credit creation is sitting in the banking system like dry tinder just waiting for a spark to set it ablaze. How quickly it happens is anyone’s guess, but once it does we are likely to be enveloped in a worldwide inflation unlike anything before ever witnessed. [Let me explain further.] Words: 625

6. High Inflation is Coming but Hyperinflation is Highly Unlikely – Why is That?

People get confused about the nature of mass inflation, hyperinflation, and what causes both. [Let me clarify the nature and causes of each.] Words: 930

7. A Hyperinflationary Great Depression Is Coming to America by 2014! Here’s Why

The U.S. economic and systemic-solvency crises of the last four years only have been precursors to the coming Great Collapse: a hyperinflationary great depression. Outside timing on the hyperinflation remains 2014, but there is strong risk of a currency catastrophe beginning to unfold in the months ahead…moving into a full blown hyperinflation [in a few] months to a year… depending on the developing global view of the dollar and reactions of the U.S. government and the Federal Reserve. [Let me go into more detail.] Words: 2726

8. Deflation is Starting to Show Up; Can Hyperinflation Be Far Behind?

A look at the status of the economy, and in particular money supply, shows that deflation is starting to show up. Below are 7 charts that support that view. Words: 370

9. Will the Current Whiff of Deflation Bring 2008 All Over Again?

You don’t need [actual] deflation—a reduction in the outstanding supply of money—to have markets react to a decrease in the rate of money supply growth…, anticipate the eventual deflation [and begin to price it into the market. Remember 2008?] Oil prices fell from $147 in July of 2008 to $33 per barrel by early 2009. The S&P 500 went into free-fall starting in September of 2008 and bottomed out in March of 2009—falling almost 50% in six months. This is what has already happened to the gold mining sector but, remember, central banks may be on a counterfeiting holiday right now but they have a history of taking very short vacations.

10. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

11. A Look at Inflation Specifics Over the Past 5 Months

Core CPI [continues to rise, remaining] above the Fed’s inflation target of 2%. [That being said,] how inflation is impacting our personal expenses depends on our relative exposure to the individual components. [Let’s take a look at the specifics.] Words: 291

12. Slicing & Dicing Consumer Price Index Data of the Past 11 Years

The Fed justified the previous round of quantitative easing “to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate”. In effect, the Fed has been trying to increase inflation at the macro level, but what does an increase in inflation mean at the micro level — specifically to your household? [Let’s take a look and see.] Words: 957

13. These Indicators Say Inflation to Go to 4% Soon – and 6% by 2014

In response to the financial crisis of 2008, the Fed injected unprecedented levels of liquidity into the banking system. While inflation has been modest to date, an analysis of similar periods in history shows that it typically takes more than two years for the impact on consumer prices to be seen. Consequently, we are now at a pivotal point in the current cycle as Fed stimulus began more than two years ago. [Let me explain further.] Words: 2755

14. The CPI, TIPS and Protecting Yourself From Inflation: What You Need to Know

Many investors are worried about inflation and, as a result, are considering buying inflation indexed bonds and other inflation protected investment vehicles. They may be setting themselves up for significant losses, however, because of the way the government is now calculating the CPI, and the further changes being proposed. In the opinion of this writer, the CPI calculation appears to be inaccurate and, as a result, such investments may not be appropriate inflation hedges. [Let me explain.] Words: 1533

15. Environment is Inflationary, NOT Deflationary – Here’s Why

While it is true that the average consumer isn’t (and won’t soon be) spending as much as he used to, it’s not because he’s waiting for bargains. No, it’s because he’s out of credit, he’s unemployed, his house, car, motorcycle, boat, and plasma television have all either been repossessed or foreclosed upon, and his wife just left him. He’s not exactly in the mood for shopping. He’s not waiting for bargains. He’s waiting for a miracle – and I don’t think they sell those at the mall. Words: 1582

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

I think even the 9.26% is way too low…

As the Government keeps redefining the criteria, these numbers are being “punked” to make them “acceptable” to the masses. I can’t locate the article but one I read recently said that if the COLA was calculated using the “old” method Social Security payments would be about doubled…