According to all sorts of financial media, the end of the fiscal world as we know it is about to occur. All rational individuals surely would come to the same conclusion, right? Wrong! For the past 3 years, the “world has been ending” according to nearly every publication. The market however, simply does not agree with this prognosis. Throughout the past 3 years, despite the negative headlines, the markets have rallied over 50% in wave after wave of briefly interrupted momentum. Given this continuous counter-intuitive bullish onslaught, and according to the volatility smile and the current positioning of money in the options market, I believe it is entirely possible for the S&P 500 to end the year…up 15% from its current price. [Let me explain.] Words: 829

it is about to occur. All rational individuals surely would come to the same conclusion, right? Wrong! For the past 3 years, the “world has been ending” according to nearly every publication. The market however, simply does not agree with this prognosis. Throughout the past 3 years, despite the negative headlines, the markets have rallied over 50% in wave after wave of briefly interrupted momentum. Given this continuous counter-intuitive bullish onslaught, and according to the volatility smile and the current positioning of money in the options market, I believe it is entirely possible for the S&P 500 to end the year…up 15% from its current price. [Let me explain.] Words: 829

So say edited excerpts from the original article* as posted by “Moody Cap” on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

Implied volatility is a method of gauging market sentiment by examining the relative value investors are assigning to option contracts. One of the primary ways that investors value options is using the Black-Scholes equation. The equation takes 5 simple inputs – current price, strike price, risk-free rate, volatility, and time until expiration – and gives the investor a value on a per share basis that an investor should be willing to pay to own a specific option.

The largest driver of the value that the Black-Scholes equation provides is volatility. This makes intuitive sense in that if you are going to have the right to buy or sell something in the future, the primary thing which you are concerned with is if prices are actually going to move so that your option pays out at the end of its life.

Using the Black-Scholes equation, you can do something truly amazing and that is to use the price that the market is giving for a specific option and back out what the implied volatility (or the volatility which would justify that price) is. By doing iterative calculations across several different options both above and below the current price, the analyst is left with a shape that concisely describes the beliefs of the market about the future. This curve is known as the “volatility smile”, and it is a key component in understanding where investors expect prices and risks to lie in the future.

Take Note:

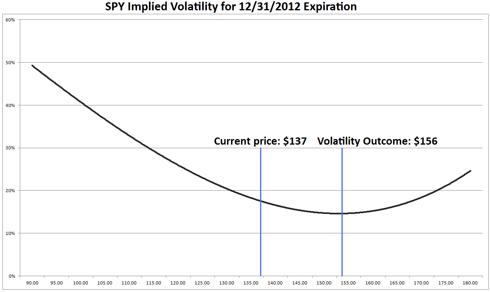

Below is the volatility smile for the S&P 500 ETF (SPY). This chart shows the implied volatility for options on the SPY expiring on December 31st of 2012. This chart gives us key insight into how the market expects the future to behave.

The shape of the volatility smile, or curve, has two main drivers. On the downside, we have many insurance policies – individuals want to be hedged if prices fall below the current price, and they are willing to pay for this protection. The upside shape is driven largely by sellers of options in the form of covered calls. Individuals own the security and want to earn income from selling options above the current market price, which causes option prices to be lower.

[There are a several things to pay attention to when looking at the volatility smile, namely:]- the side of the smile that is below the current price is relatively higher while the other side is relatively lower. This means that people are willing to pay more for options that protect their downside below the current price. Essentially, the market is giving a signal that if you are long and wish to purchase insurance, you are going to have to pay more for it than if you were short and wished to purchase insurance.

- the side of the smile above the current price…shows that individuals do not value options as much above the current price. In other words, the market doesn’t value upside insurance as much as insurance to protect their downside risk.

- the midpoint, or the point at which options possess the least implied volatility in the future shows where the collective market believes that future volatility will be fairly priced.

According to the volatility smile and the current positioning of money in the options market, the most fairly priced future will be around $156 on December 31st, 2012. This has powerful implications in that this means that given the current positioning of investors, the SPY should end the year around this point or up 15% from its current price….

This strongly contrarian claim is not only supported from a fundamental pricing standpoint but also from a technical standpoint. I prefer to frame my trades fundamentally but execute technically, so I always try and keep an eye on what the price action of the market is saying. In the chart below, it is reasonable that this implied level of $156 is favored by the market as a potential area where price could travel in the near future. The technical trend is solidly upward, and the $156 target is very close to the pre-crisis highs.

Conclusion

It is entirely possible that we will hit decade highs by the end of the year as implied volatility analysis seems to dictate.

*http://seekingalpha.com/article/738131-the-s-p-500-could-make-decade-highs-by-year-end (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Thank You, Thank You: How 17 Equations Made the World What it Is Today

“Equations definitely CAN be dull, and they CAN seem complicated…but you CAN appreciate the beauty and importance of equations without knowing how to solve them…..[My] intention was to locate them in their cultural and human context, and pull back the veil on their hidden effects on history. Equations are a vital part of our culture. The stories behind them — the people who discovered/invented them and the periods in which they lived — are fascinating” and some are particularly relevant to anybody affected by the current financial crisis. [Let’s take a look.] Words: 2072

2. Options Are a Gold Bull’s Better Play Than Owning High Beta Miners – Here’s Why

Whilst it is true, more often than not, that mining stocks move in the same direction as gold [and historically outperform that of the physical metal based on their better beta statistics] there are periods where this relationship does not hold. That is one of the reasons we currently have no interest in trading or investing in mining stocks. Why form a bullish view on gold and buy mining stocks based on this view, only to see gold rise and mining stocks fall? [Instead,]… our preferred strategy to optimize and maximize potential profits… is using options that are directed based on the price of gold with no other factors influencing their performance. [Let us explain why.] Words: 1235

3. What Are Warrants, Options & LEAPS?

Investors are always looking for ways to maximize their gains and warrants, options and LEAPS are a good way to do just that. These investment vehicles are very similar to each other except for issue of time. [Let me explain.] Words: 752

4. Options: The Best Way to Optimize Leverage of Your Gold Investments

In our quest for the best gold investment vehicle – one that exerts direct undiluted correlated returns to the gold price with added leverage that is quantifiable to a reasonable accuracy – we think that options are the best choice. Words: 690

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money