While many investors want to believe that U.S. treasuries are a safe haven, I will use this article to debunk that myth with plain hard evidence…[to support my contention that] holding U.S. bonds is the worst investment going forward. Words: 500

I will use this article to debunk that myth with plain hard evidence…[to support my contention that] holding U.S. bonds is the worst investment going forward. Words: 500

So says Katchum (http://katchum.blogspot.ca) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Katchum goes on to say, in part:

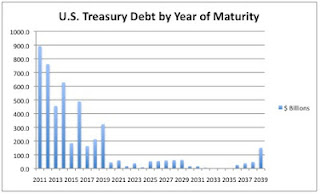

U.S. Treasury Debt by Year of Maturity

A look at the debt maturity graph below (chart 1) tells us that most of the U.S. debt is short term debt payable within 5 years. The scary part is that it is such a huge amount (approx. 2.5 trillion U.S. dollars)….Even more scary is that the U.S. treasury is not transparent about its debt maturity report. Chart 1 was published in February 2010 and hasn’t been updated since then. Also, Ben Bernanke is allegedly trying to make us believe that most of the debt is long term, which it is not (source: Ben Bernanke at Fed meeting on 7 June 2012).

Fed Holdings of U.S. Treasurys by Years of Maturity

At end of June 2011, foreign holdings of short term debt (less than 1 year) was 881 billion dollars amounting to 87% of the total (the Fed holding the balance)….This is the most crucial and important debt…[because] interest rates…rise….when a country is in a default…[that is,] short-term debt securities have higher yields than long-term debt securities….[Because of that fact] Marc Faber…[is of the opinion] that one day foreigners invested in U.S. debt will not be paid back. They are holding all the short term debt, while the Fed is holding the long term debt.

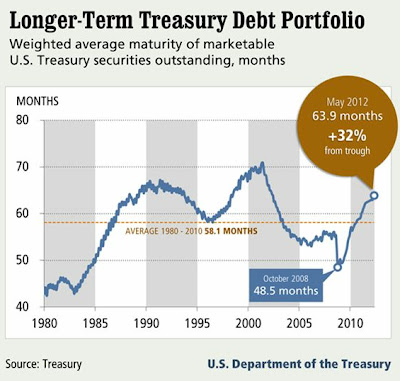

Average Maturity Date of Treasury Debt

Let us now take a look at the average maturity date of the debt portfolio (Chart 3). It tells us that the U.S. was in real trouble during the financial crisis of 2008, where debt maturity hit an all time low of 4 years. Imminent default was looming in that period. Today, the average debt maturity has risen to a high of 5 years [63.9 months to be exact], but it is still very low compared to other countries.

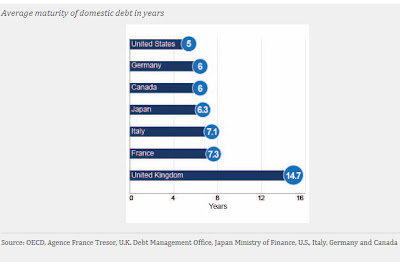

Comparison of Average Maturity of Debt in Years by Country

The United states has one of the lowest average debt maturities of the countries in the Organization of Economic Cooperation and Development (OECD) (Chart 4). Even Greece has a higher maturity of 8 years according to the Debt Management Office. Low maturity increases the risk of default, because there is less time to roll over the debt.

Take Note: If you like what this site has to offer go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE! An easy “unsubscribe” feature is provided should you decide to cancel at any time.

Conclusion

When you add to the above facts that treasury yields are at a 30 year low today you’ve got all the evidence of a bond bubble in the United States. It is difficult to know exactly when the bond market will collapse, but…[it will so] just stay out of it.

*http://katchum.blogspot.ca/2012/06/analysis-of-us-treasury-maturities.html (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Bonds Are NOT a Safe Place to Be – Here’s Why

For those who think bonds are a safe place to be, you might want to reconsider. In addition to rising sovereign risk (yes, for the U.S. as well as other countries), there is interest rate risk….[should you not] hold it to maturity. If interest rates rise, then the value of your bond falls (Bonds can produce capital gains/losses, just like stocks.) and the possibility of interest rates rising is pretty good. Words: 530

Martin Armstrong provides a remarkable explanation of what is going on right now with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say. Words: 822

The broad stock market may extend its rebound as the U.S Treasury Bond and the U.S. Dollar Index take a pause but the weakening Chinese stock market is slowing down the price advance on gold, silver and their mining stocks. Below is my detailed technical analysis of these market trends complete with charts. Words: 875

4. The Lessons Learned from 2008 Will Maximize Returns and Protect Your Assets This Time Round

My 3 favorite barometers for gauging investor sentiment in order to predict market outlook…are SPY as a proxy for U.S. stock markets…GLD as a proxy for commodities and TLT as a proxy for U.S. bonds, and when these 3 markets make big moves, it´s time to pay attention to what they´re saying. [Let’s review] how these 3 markets reacted during the crisis of 2009-2009 and then compare them to current market conditions. [Doing so] can give you an edge to be better positioned for the rest of this year. Words: 972

5. With Options So Limited Where Should We Invest?

The fear factor among investors is high with investors unsure just where to put their money. Let’s review the options and come to a conclusion as to where best to invest our cash at this point in time. Words: 402

6. This New ‘Peak Fear’ Indicator Gives You an Investment Edge

We are at a major crossroads in the equity and bond markets. We could see a major ‘risk-on’ rally in the S&P 500 BUT if no equity rally ensues, and U.S. Treasury note yields keep falling, then something terrible is about to strike at the heart of the global capital markets…. [As such, it is imperative that you keep a close eye on this new ‘Peak Price’ indicator. Let me explain.] Words: 450

7. Insights into the Bond Market and How to Trade Them

Although the stock market is the first place in which many people think to invest, the U.S. Treasury bond markets arguably have the greatest impact on the economy and are watched the world over. Unfortunately, just because they are influential, doesn’t make them any easier to understand, and they can be downright bewildering to the uninitiated. [This article provides you with an excellent understanding of what bonds are, the advantages of owning them and how to go about trading them.] Words: 1325

8. Gold Bullion, Stocks or Bonds: Which Have More Long-term Investment Risk?

In proclaiming buy-and-hold investing to be dead, the pseudo-experts masquerading as financial advisors have abandoned the fundamental principle of investing: buying undervalued assets – and then giving those assets the time necessary to mature. Instead, these charlatans have forced their clients to become short-term gamblers. Worse still, they are now consistently steering their clients toward the worst possible asset-classes, stocks and bonds, rather than the best ones [simply because they do not] understand the fundamental conceptual difference between risk and volatility. In a market populated by panicked lemmings, we cannot avoid volatility. However, we can and must reduce risk – which begins by building an allocation of history’s true safe haven asset, precious metals. [Let me explain more about what risk and volatility are and are not.] Words: 1080

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money