Households with credit card debt carry $16,000 at an average rate of 15% and, given that some households have little credit card debt, you can imagine how high the debt is for others.. Imagine, $16,000, but that is actually down by 17% as the grand American household deleveraging continues. [Be that as it may, credit card debt is still excessive with all ages and all income groups. Here are the facts.] Words: 760

that some households have little credit card debt, you can imagine how high the debt is for others.. Imagine, $16,000, but that is actually down by 17% as the grand American household deleveraging continues. [Be that as it may, credit card debt is still excessive with all ages and all income groups. Here are the facts.] Words: 760

So says an article* posted on www.mybudget360.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited further below for length and clarity – see Editor’s Note at the bottom of the page. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

The article goes on to say, in part:

A credit card essentially allows you to spend money you do not have today on the promise you will pay it off tomorrow. We constantly hear how great it is to have credit cards to build credit as long as you pay off your balance each month but the data tells us something very different from this ideal utopia vision of credit card debt. 176 million credit cardholders exist in the United States and the unpayed balances owing have become a big financial albatross for many American families.

Credit Card Debt Down 17% but Still Excessive

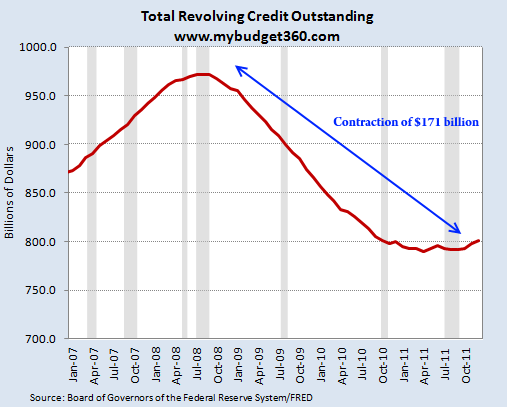

The apex of revolving debt in the U.S. was hit in 2008 when the recession was raging at a full pace. Over $970 billion in credit card debt was hit at this point:

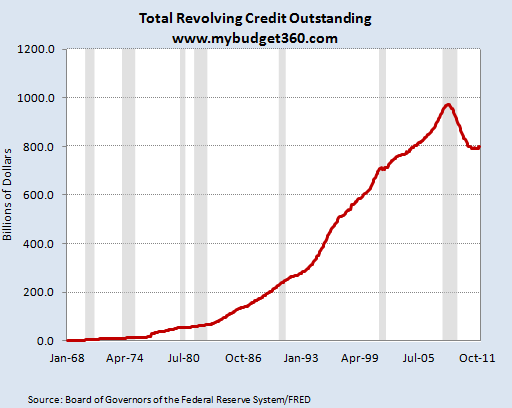

Keep in mind that this $970+ billion in credit card debt was being carried over from previous months. In other words, people that do not pay off their credit card debt balance in full. This deleveraging in credit card debt is truly a once in a generation type event:

Going back to data from 1968 there wasn’t one year where year-over-year credit card debt fell in the United States so to see a 17 percent contraction in revolving credit is a monumental event…

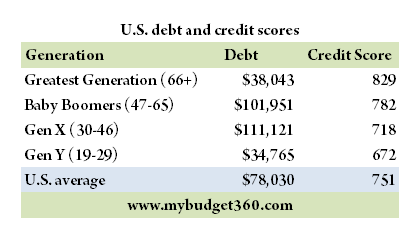

Average Credit Card Debt is $78,030 per Household

The above figures are even more startling when you realize that the per capita income is $25,000. Even using the median household income of $50,000 we realize that many households are significantly leveraged for years, even decades to come. Why else would credit card debt contract so severely after nearly half a century of unimpeded growth? You also need to examine the younger household debt and how much of it is now being replaced by student loan debt. The college debt bubble will burst at some point as student loan debt surges to roughly $1 trillion in 2012.

High Interest Rates Are High

Part of it has to also do with the high interest rates charged by credit card institutions:

Average Househood Has 3 Credit Cards

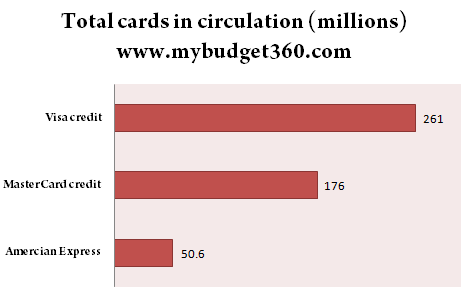

If you really want to see the addiction to credit card debt just look at the actual number of credit cards floating out in the economy:

There are more credit cards out in the economy than households since the average number of credit cards per household is over 3…Banks are immensely profitable since they can borrow from the Federal Reserve at virtually zero percent, pay you virtually zero percent on your savings deposits, and then charge you 15 percent on money loaned out to you. Now that is a racket we should all be fortunate to be a part of.

Bankruptcies are Widespread

While a…[large amount] of credit card debt is being paid off, a large amount is being paid off by bankruptcy. This isn’t exactly the kind of deleveraging that is healthy. When people look at the mortgage debt stalling out they fail to examine the fact that a giant portion of this was because of forced deleveraging via the 5,000,000 or so completed foreclosures since the recession hit. Nothing can clear mortgage debt faster than simply not paying your mortgage and giving the house back to the bank.

Who in the world is currently reading this article along with you? Click here

[Many people assume that bankruptcies only occur] in very poor areas of the country [but a] look at Orange County, California… [clearly shows] that too much debt is also an issue with supposedly wealthy counties:Source: OC Register

Orange County bankruptcies are up 600 percent from 2006. The drop from 2005 to 2006 was largely due to people rushing to file before new rules came into place in 2005 that made bankruptcy even tougher. Even with that said, Orange County is now seeing a peak in bankruptcies near the 2010 highs.

Conclusion

Credit card debt and other forms of debt can impact all parts of the country. The great deleveraging of the American household continues well into 2012.

*http://www.mybudget360.com/

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on FACEBOOK | and/or TWITTER .

Related Articles:

1. Move Over Visa, Mastercard and PayPal! Here Comes a Better Alternative – Dwolla

Imagine that you could pay for a service online without accruing a mountain of fees. Imagine being a retailer and having the ability to take your customer’s money – and keep all of it. Sounds impossible, doesn’t it? Well, now it’s not. Introducing Dwolla [- a better alternative to credit cards and Pay Pal for everyone involved, except the banks. Let me explain.] Words: 615

2. 75% of Americans are in Deep _ _ _t!

Rising education and medical costs, on-going credit card interest payments, well used personal lines of credit and large mortgage debt and home equity loans – most a penchant for living beyond their means – is keeping 75% of American households in some degree of debt. Take a look and then pass it on to your friends, neighbors and co-workers.

3. 2 Ways to Reduce Your Debts Using the “Snowball” Method

What is the best way to reduce debt? The most-efficient means is probably the snowball method. There are two main variations of the snowball method, but you must consider your personality to determine which of the two is right for you. [Let me explain.] Words: 1251

4. In Debt? Here are 10 Ways Out

When people talk about getting their personal finances in order, they usually try to find relatively pain-free and low-cost ways to reduce debt and increase savings but this is a long-term approach which some people just cannot “afford”. [For them] …it may be worthwhile to consider taking the hard way out of debt. [Let me explain.] Words: 1370

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money