Derivatives are financial instruments whose values depend on the value of other underlying financial instruments or objects. The main types of derivatives are:

- futures,

- forwards,

- options and

- swaps.

The original intended use of derivatives was to manage risk (hedge); however, now they are often traded as investments whether hedged, un-hedged or as component of a spread trading strategy. The diverse range of potential underlying assets and pay-off alternatives leads to a wide range of derivatives contracts available to be traded in the market.

Derivatives can be based on different types of assets such as:

- commodities,

- equities (stocks),

- residential mortgages,

- commercial real estate loans,

- bonds,

- interest rates,

- exchange rates, or

- indices such as a stock market index, consumer price index (CPI) — see inflation derivatives — or even an index of weather conditions, or other derivatives).

The largest component of the derivatives complex remains interest rate products which the U.S. Office of the Comptroller of the Currency tells us constitute more than 82 % of all outstanding bank held notionals. Interest rate derivatives have a great effect on interest rates as will be discussed later.

Origin of Derivatives

Derivatives have their roots in the agri-complex. From an historical context, it was agricultural commodities futures (mainly grain) that first gained traction as viable financial instruments. The genesis of these products dates back to the founding of the Chicago Board of Trade (CBT) in the mid-eighteen hundreds.

Back in the eighteen hundreds large scale farming enterprises were difficult (risky) to “bank”. The risk was embodied by the known costs associated with planting seed, fertilizing and subsequent growth and harvest – versus the often volatile, unpredictable final selling price of a perishable commodity. Futures removed…this “unknown” from the banking/farming relationship and transferred it to speculators for a nominal fee or cost.

From 1850 – 59, American agricultural exports were $189 million/year (81% of total exports). With agriculture occupying such a huge percentage of exports and GDP it was only natural that business of this scale (potential fees and profits) would and did attract the attention of the money changers. The advent of futures and forward contracts in the agri-complex was productive: giving a higher degree of predictability to farm income making the business of farming more bankable. Making farm income more predictable enabled the growth of corporate agri-businesses which brought with it economies of scale, the freeing-up of human capital which enabled / translated into mass migration [urbanization] of farmers into cities in part assisting with the rise of the human capital pool essential for the industrialization of America.

Early Growth – the Commodity Futures

In the beginning, as with users in the agri-complex – there were identifiable end users (farmers) for these products. Over time, futures and forwards were developed to meet demand in other…commodities like coal, crude oil, lumber, cattle and others. Similar commodity futures markets for these products and trade volumes were driven primarily by end users and it’s important to distinguish that for the entire 1800s and virtually all of the 1900s – the growth in derivatives was primarily tied to the commodity trade.

Commodities Law Dictates that Futures Only Aid In Price Discovery

Price Discovery is a method of determining the price for a specific commodity or security through basic supply and demand factors related to the market.

According to William J. Rainer, former Chairman of the Commodities Futures Trading Commission [CFTC] back in 1999, Section 3 of the Commodities Exchange Act espouses three basic purposes for the regulatory structure currently administered by the CFTC:

- to protect the price discovery function;

- to prevent the manipulation of commodities through corners, squeezes and similar schemes; and

- to assure an effective vehicle for risk transference.

Implicit throughout [the above purposes] is the need to provide suitable customer protection from abusive trade practices and fraud.

The Rise of Financial Engineering: The Genesis of OTC Interest Rate Derivatives

President Nixon took America and the world off the gold standard in August, 1971. What ensued was a dramatic increase in the price of crude oil which led to burgeoning balances of petro dollars (Euro-dollars) as deposits in the treasuries of banks involved in international trade and a subsequent bolstering of their treasury operations to deal with the influx of ‘inflated dollars’.

Interest Rate Derivatives were developed around 1980. Their basis was the four 3-month IMM (International Money Market) Eurodollar Futures Contracts (December, March, June, September) on the Chicago Mercantile Exchange (CME). These futures contracts are derivatives of 3 month Libor (London Interbank Offered Rate) for Eurodollar Time Deposits. The 3 month Libor rate is ‘set’ daily by a group of banks selected by the British Bankers Association and represents where these ‘reference banks’ are willing to ‘loan’ their mostly recycled Euro Dollars (petro-dollar) to their most credit-worthy customers.

These derivatives/futures gave banks the ability to ‘hedge’ or book profits on sizable amounts of predictable future cash flows. Up until 1980, this bank treasury trading business remained largely a cash trade.

The Toronto – Chicago Nexus

In 1980, Canada revised its Bank Act. In the ensuing few months Canada went from having 5 domestic banks to having roughly 65 foreign banks – dubbed “schedule B” banks. To protect their home turf, the existing domestic banking industry successfully lobbied Canadian politicos to limit the amount of capital [these] new “schedule B” banks could have to initially 5 million, and in a couple of instances,10 million Canadian dollars. This placed growth restrictions on the new foreign bank entrants [as these] capital ceilings implied severe balance sheet restrictions [as they] were substantially limited in participating in main stream bank treasury operations, such as lending long and borrowing short in the inter-bank market, because these activities bloated balance sheets. [As such, they]…needed to find a profitable raison d’etre or their parent banks would shut them down.

Competition Breeds Innovation

To differentiate themselves from the rest of the crowd back in the early 1980’s, institutions like Citibank-Toronto, Chemical Bank-Toronto and Chase-Toronto went on a hiring binge of Ph. D mathematician types and immersed themselves in ‘financial engineering’ utilizing then emerging exchange traded futures (cited above). These financial engineers conjured into existence two Over-the-Counter (OTC) products:

- Future Rate Agreements (FRAs) and

- Interest Rate Swaps (IRS).

Trade in these products did not entail the exchange of principal sums between counterparties but only interest-rate differentials on principal amounts (referred to as notional underlying amounts). The beauty of this “new trade” was that:

- it was fee based,

- for accounting purposes, it was “off balance sheet” and

- it circumvented capital ceiling restrictions.

From a customer standpoint these products were marketed to corporate customers as a means to achieve cheaper, more flexible funding or alternatives for funding in terms (years) they otherwise would not be able to access….

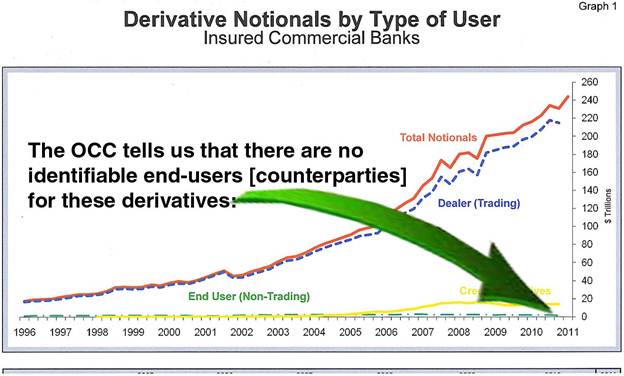

Citibank-Toronto was the first to engineer a financial model to successfully book accounting profits from FRAs and interest rate swaps and in the beginning these trades were enormously profitable, so much so that Citibank-Toronto very quickly became the world’s biggest OTC interest rate derivatives house and was, in fact, the clearing house for OTC interest rate derivatives for Citibank worldwide. This business absolutely mushroomed [as can be seen in the graph below]!

Source: U.S. Comptroller of the Currency Source: U.S. Comptroller of the Currency

Tracking the evolution of the aggregate derivatives held by U.S. banks, it is apparent that trade in end-user products has been absolutely overwhelmed by volumes in dealer trades – all in a “supposed market” which [as of June 30, 2011] is 96% constituted by 5 players (J.P. Morgan [23.5%], BofA [22.5%], Citi [16.5%], Goldman [16.5%] and Morgan Stanley [17%]) – as the U.S. Comptroller of the Currency tells us in the executive summary of their Quarterly Derivatives Report.

At this rate of concentration, the derivatives complex appears a lot more like an “old boys club” than it does “a market”. Therefore, the derivative market rapidly evolved during the late 1990’s to the early 2000’s from a previously end-user-based to a dominantly dealer-based or trading market. The parabolic rise of these dealer traded volumes parallels the rise of market rigging or the movement toward a centrally planned economy.

From Humble Beginnings, How and Why We Got Here

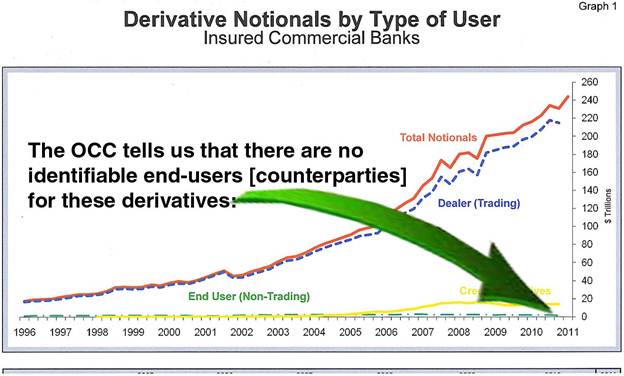

The graph of outstanding notional amounts above depicts a serious growth curve. To explain why, let’s take a look at the same graph with some added highlights explaining “what” is growing so quickly:

Source: U.S. Comptroller of the Currency Source: U.S. Comptroller of the Currency

How Derivatives Morphed into a Tool of Abusive, Manipulative Economic Tyranny

Through the late 1980’s and early 1990’s the Fed and U.S. Treasury – with a little bit of help from academia – realized that interest rate swaps could be utilized to CONTROL fixed income (bond) markets and hence – controllers could arbitrarily determine the cost of capital. As such, it’s no coincidence that institutions like Citibank-Toronto had their ‘U.S. Dollar derivatives books’ repatriated back to New York in this time frame.

Historically, the Federal Reserve/U.S. Treasury only had control of the very short end of the interest rate curve – specifically the Fed Funds rate (the rate at which banks and investment dealers borrow and lend to each other on an overnight basis). With the advent and proliferation of interest rate derivatives, [however, and] specifically Interest Rate Swaps, the Fed/Treasury gained effective control of the “long end” of the interest rate curve. Thus the Fed/Treasury has been practicing an undeclared form of financial repression for a very long time.

In free market economies the laws of usury dictate that the interest rate mechanism serves as the arbiter as to where scarce (finite) capital is allocated. Historically, it was a group of industry professionals known as the bond vigilantes who enforced this discipline – primarily on spend-thrift governments – by making them pay more, through elevated interest rates when they demonstrated poor stewardship of national finances.

Before the neutering of ursury, [what I now refer to as “neusury”,] when the bond vigilantes “sold” interest rates went up. To illustrate this point look no further than Bill Gross (the closest thing there is to a bond vigilante today) who heads the world’s largest bond fund PIMCO, who dumped all the US Treasury bond exposure in its flagship Total Return Fund given his belief at the time that Treasurys were over-valued.

[Pimco’s actions, however, did not cause] a major sell off in bonds [resulting in] higher rates…[because] the Fed/U.S. Treasury and their ‘captive’ investment banking vassals pre-determined the outcome through the Interest Rate Swap complex to show folks like Bill Gross who’s really in charge (the cascade in 10 year yields depicted above just happens to coincide with the first half of 2011 when, according to the Office of the Comptroller of the Currency, Morgan Stanley just happened to grow their swap book from 27.2 Trillion to 35.2 Trillion in notional for a cool increase of 8 Trillion in six months at one investment bank)…overwhelming the bond vigilantes rendering them either impotent, extinct or perhaps just plain-old confused and afraid…

The incapacitation or extinction of the bond vigilantes has enabled the U.S. government to spend like drunken sailors, prosecute wars and misallocate resources on a grand scale – all the while lowering and/or keeping interest rates at or near zero percent. This arbitrary, gross mispricing of capital helped to spawn further abuses like the real estate and equity bubbles – the development of which produced new sub-sets of equity derivatives and cdo’s which also enabled the macro-management of these markets. Economics 101 tells us that capital is scarce and finite but, by arbitrarily rigging interest rates too low, capital markets created the false impression of abundance and loose lending practices resulted.

How the Long End of the Interest Rate Curve is Controlled

Control over the long end of the interest rate curve works as follows: The U.S. Treasury’s Exchange Stabilization Fund (ESF), a secretive arm of the U.S. Treasury unaccountable to Congress, began entering the “free market” – deals brokered by the N.Y. Fed – as a receiver of “all in” fixed rates – in terms from 3 to 10 years in duration. Interest rate swaps trade at a spread – expressed in basis points – over the yield of the 3, 5, 7 and 10 year government bond yield. Banks are virtually all spread players. When trades occur between spread players – one side of the trade sells the other side of the trade the proscribed amount of U.S. Government bonds. This creates superfluous settlement demand for bonds. When the U.S. Treasury’s Exchange Stabilization Fund intervenes in this market,[however,] they are not spread players.

When the ESF trades with “spread players” (Morgan, Citi, BofA, Goldman, Morgan Stanley) the banks are forced to purchase cash – physical U.S. Government bonds in the proscribed terms (3-10 years) – almost dollar-for-notional-dollar as hedges for each trade they do with the ESF because the ESF does not supply them. This is why, instead of the hollow, contrived, official excuses offered by the Fed [and] despite record, off-the-charts, government bond issuance, a remarkably large percentage of U.S. Government bond trades fail to settle.

The ESF participates in these trades taking “naked interest rate risk” – meaning they do not provide their counterparties with the requisite amount of bonds to hedge their trades – thus forcing them into the “free market” to purchase them. This generates unbelievable “stealth” settlement demand for U.S. Government securities. This is how/why U.S. Government bonds and hence the Dollar can be made to appear “bid-unlimited” – even when economic fundamentals are screaming otherwise.

The amount of demand for cash government bonds that can be conjured out-of-thin-air in the derivative interest rate swap complex, which might be best described as “high-frequency-trade” on steroids – measured in hundreds of Trillions in notional – literally overwhelms the cash bond settlement process. This:

- means bond yields are set arbitrarily – in accordance with Fed/Treasury policy – not in free markets,

- explains why there are no identifiable end-users for the dizzying growth in interest rate derivatives (swaps) – the trade is all attributable to the Treasury’s ‘invisible’ ESF – an institution that is not publicly accountable to anyone or anything,

- is why other nations can and do have, from time to time, failed bond auctions while America never has and never will be allowed to,

- is all done in stealth to facilitate and give an air of legitimacy to the U.S. Treasury’s ZIRP (zero interest rate policy) and this

- is the real reason why J.P. Morgan Chase and the rest of the magnificent 5 now sport OTC derivatives books of 50 – 80 TRILLION in notional.

[For those so interested]…the detailed, documented, inner workings of the Treasury’s Exchange Stabilization Fund and their unique relationship with the N.Y. Fed trading desk is best explained by forensic financial researcher Eric deCarbonnel, here.

How We Know the ESF is the Other Side of These Trades

Morgan Stanley (MS) supplies us with the “smoking gun”. MS grew their derivatives book by 14 Trillion in notional in the first 6 months of 2011 – virtually all in product swaps that requires 2-way/mutual credit lines…The global banking system, in aggregate, does not have sufficient credit lines to allow Morgan Stanley to conduct this level of trading activity in these credit dependent products as reported with legitimate banking counterparties. The notion that this obscene amount of trade represents legitimate business with banking counterparties that was bilaterally “netted” is preposterous and a non-starter. Ergo, the other side of the bulk, if not all, of this trade is necessarily the ESF which is being done in the name of “national security” and/or the perpetuation of ZIRP and global U.S. Dollar hegemony…

Complete Capture of the Derivatives Complex and Defiling of Fiat Capital

Rather than let the “fiat” U.S. Dollar fail, as all irredeemable fiat currencies are designed to do. [those] in charge of the Anglo/American banking edifice have bought time through the capture of the derivatives price control grid by blatantly commandeering the unlimited resources of the U.S. Treasury’s ESF along with the printing presses of the Federal Reserve. This is done to make historic alternative currencies, like precious metal, appear unworthy. This has further endangered the financial wellbeing of all who have acted prudently and financially responsible.

Physical Precious Metal: The Achilles Heel of Fraud

As the interest rate swap mechanism is used to corral interest rates – so are gold futures contracts on exchanges like COMEX and the London Bullion Market Association [LBMA] used to suppress the price of the U.S. Dollar’s number one competing currency alternative – gold.

The reality is that metals exchanges, like those identified above, have sold as much as 100 times, or in some case much more, paper ounces or promises of gold in the form of receipts than they have physical bullion available for delivery in their vaults.

There is plenty of documented proof available…that conduits for procurement of physical precious metal like national mints have been choked or suspended for prolonged periods of time over the past few years for investment grade physical gold and silver bullion coins. These shortages have always been characterized by, or in, the…financial press as being the result of issues specific to the retail trade (like not enough gold or silver “blanks” available from which bullion coins are stamped). These reported bottlenecks, however, fly in the face of anecdotal reports by the likes of major industry players such as Sprott Asset Management principal, Eric Sprott, who has reported that institutional amounts of silver bullion received were virtually all smelted after they were bought and paid for which is inconsistent with the waterfall declines [sewering] of paper-silver-prices on highly conflicted and suspect exchanges like COMEX and also inconsistent with the notion that physical silver bullion shortages are strictly a retail phenomenon. The derivatives that trade on exchanges, supposed[ly] to reflect or aide in price discovery, are increasingly being used as tools of price manipulation.

Regaining control and the reinstatement of integrity to our capital markets requires market participants to continue saying “NO” to paper promises and yes to physical bullion…

Conclusion

All is not well in America – not by a long shot. America has been taken over through subterfuge in a financial, fascist coup and the perpetrators have installed a police state. America is no longer a nation of laws. Any additional regulation of the financial services industry would be fruitless. There already exists “laws on the books” – to prevent the blatant, criminal price rigging / abuse that has already occurred. The abuse has been allowed to occur by derelict regulators who have vacated (or been bought) their fiduciary duties.

While America’s industrial potential has been largely “off-shored” – their Constitution and Bill of Rights are in tatters but their propensity to manufacture is there – it just manifests itself in different ways:

- Manufactured financial data

- Manufactured cost of capital [int. rates]

- Manufactured gold and precious metals prices

- Manufactured cost of energy

It’s all about control. Derivatives products – well intentioned when they were conceived – have been utilized to prop-up a failing fiat currency and undermine capital through the establishment of a phony, crony, price control grid. As such, derivatives have become very dangerous tools in the hands of a gaggle of miscreant sociopaths (who think, speak and act as if they are doing god’s work) that now occupy the U.S. Treasury/Fed and rule Wall Street.

Got physical gold yet? |

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money