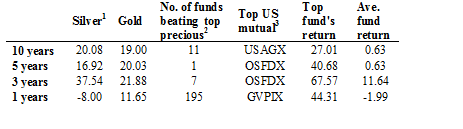

Out of the 7,500 separate [mutual] funds available, and with 22,000 shares classes to choose from, only 1 fund – just ONE fund – actually managed to achieve a greater percentage return than gold bullion since the alarm bells rang out at the turn of 2007! [That being said, are you still one of the 99% of investors who, for whatever reason (are you foolishly listening to the “advice” provided by your stock broker/securities salesman going under the guise of a financial “advisor”), is still without any physical gold or silver?] Words: 395 from, only 1 fund – just ONE fund – actually managed to achieve a greater percentage return than gold bullion since the alarm bells rang out at the turn of 2007! [That being said, are you still one of the 99% of investors who, for whatever reason (are you foolishly listening to the “advice” provided by your stock broker/securities salesman going under the guise of a financial “advisor”), is still without any physical gold or silver?] Words: 395 |

|||||

|

So says Adrian Ash (www.BullionVault.com)in edited excerpts from his original article*.

Related Articles: 1. Before Buying a Gold-related ETF Check Out These Alternatives There are many legitimate reasons to trade in gold and its derivatives. Gold has been proven time and time again to be an excellent “safe haven” investment, a holding that will appreciate in value during times of economic uncertainty. As such, gold may offer some valuable hedging and diversification benefits for a long-term portfolio. A number of exchange-traded products offering exposure to gold prices but not all gold ETFs are created equal. Here’s a quick rundown of factors to consider when making an investment in a gold ETF. Words: 1268 2. Surprise! A Close Look at GLD Reveals What it IS and is NOT The most common misunderstandings regarding the primary gold ETF, SPDR Gold Trust (NYSE:GLD) is that it buys and sells gold. That is not the case. It is just a paper asset. It is not a way to buy gold and have someone else store your holdings for you. It is just an innovative way to “own gold.” [Below I outline more of just what GLD is and is not:] Words: 1470 3. All Gold & Silver ETFs Are NOT the Same: a Lease vs. Own Comparison I have always been leery of the two big exchange traded funds, SLV and GLD, because they lease the gold and silver that they sell you. I much prefer the ETFs SGOL, CEF, PSVL and PHYS which actually own the gold and silver they sell you and store it for you segregated vaults. Words: 717 4. All Gold and Silver ETFs are NOT Created Equal! Here’s the Best Whole oceans of ink have been spilled detailing the good and not-so-good points of the closed-end fund CEF (Central Fund of Canada) and the twin ETF’s GLD (SPDR Gold Trust) and SLV (iShares Silver Trust) funds. My goal here is to distill the salient points down to the fewest words possible to help make your due diligence task somewhat less…well…tasking. [Let’s go!] Words: 650 5. Richard Russell: PLEASE MOVE INTO GOLD! For a decade I have been urging my subscribers to move into gold – either physical bullion or otherwise [Richard Russell: Get Prepared – A Gold Tsunami is Coming] . Now I am at it again: PLEASE MOVE INTO GOLD. [Here’s why you should.] Words: 720 6. How To Avoid Getting Ripped Off When Buying Gold If you’re trying to invest in precious metals, then stick to bullion coins or bars. Don’t be distracted by numismatics, rare coins, collector’s items, or fancy packaging or grading schemes…Even though I have long warned of the dangers of the industry, it is hard for retail investors not to be led astray by high-pressure salesmen [but] reading this guide is a step in the right direction. Words: 1000 |

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money