What’s the best time to buy gold on a seasonality basis? November! Over the past 40 years (basically since gold became legal for private ownership in the U.S.) November and December accounted for almost HALF of the year’s gains for gold…If this year is anything at all like the previous 40, we’ll see about 44% of the year’s gains in November and December. That’s huge. This tendency for gold to rise in November and December isn’t just some bizarre cherry-picked technical chart: it’s a solid fundamental trend of supply and demand functions. [That being said: Don’t delay a day. NOW is the BEST time to purchase some gold.] Words: 700

for private ownership in the U.S.) November and December accounted for almost HALF of the year’s gains for gold…If this year is anything at all like the previous 40, we’ll see about 44% of the year’s gains in November and December. That’s huge. This tendency for gold to rise in November and December isn’t just some bizarre cherry-picked technical chart: it’s a solid fundamental trend of supply and demand functions. [That being said: Don’t delay a day. NOW is the BEST time to purchase some gold.] Words: 700

So says Kevin McElroy (www.wyattresearch.com) which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

McElroy goes on to say, in part:

You can see this seasonality for yourself in this chart:

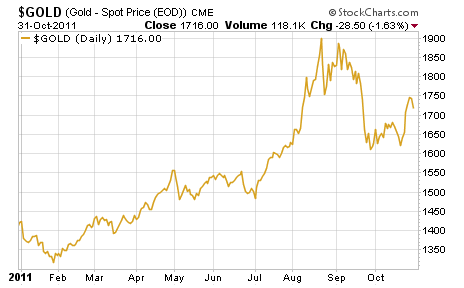

The above chart doesn’t include data from 2011, but you can see for yourself in this year-to-date chart that 2011 doesn’t differ all that much from the seasonal trends:

We have the characteristic spike in May, followed by a substantial correction in September-October and if this year is anything at all like the previous 40, we’ll see about 44% of the year’s gains in November and December. That’s huge.

The question is: why are November and December so good for gold?

It has a lot to do with Asian gold buying, specifically, the Indian wedding season, which lasts from the end of September through December. That sustained buying from one of the biggest and fastest growing economies for three months on end tends to have a crescendo effect on gold prices into the New Year. Despite what you might think, higher priced gold has NOT resulted in less consumption in India. In fact, it’s resulted in MORE consumption. Over the past 10 years, Indian gold consumption rose an average of 13% per year – even as gold rose faster in price. As such, this tendency for gold to rise in November and December isn’t just some bizarre cherry-picked technical chart: it’s a solid fundamental trend of supply and demand functions.

So now that we know we have 40 years of a fundamental trend on our side – what should we do? My suggestion would be to buy gold now.

…I feel extremely strongly about taking delivery of your gold and NOT buying the ETF…I own gold for the safety and reliability of having real money close at hand. Buying the ETF version of gold completely undermines those factors. Most gold ETFs won’t ever let you take delivery….[and] if you can’t touch it, you don’t own it.

Unless you’re a trader who’s looking for a 2-month play on gold, I would suggest taking delivery and keeping your gold close at hand. The world’s currency crises are nowhere close to being solved, and the world’s growth economies (like India) are consuming more gold all the time.

In conclusion: I hope you’ll buy gold now for the first time, or add to your position.

*http://www.wyattresearch.com/article/the-best-60-days-to-own-gold-begin-now/25024

Related Articles:

1. Not Available to Americans: New Gold Investment Vehicle Introduced By Royal Canadian Mint

The Royal Canadian Mint has announced that it is making an initial public offering of exchange-traded receipts (ETRs) under the mint’s new Canadian Gold Reserves program. Unlike other gold investment products currently available which only enable the purchaser to own a unit or share in an entity that owns the gold, the ETRs will enable the purchaser to actually own the physical gold bullion which will be held in the custody of the mint at its facilities in Ottawa, Ontario. Unfortunately, the ETRs have not, and will not, be registered under the U.S. Securities Act of 1933 and, as such, may not be offered or sold in the U.S. Words: 745

2. Situation is Ultra-bullish for Gold & Silver Bullion and Stocks! What are You Waiting For?

The technical situation is ultra-bullish for both gold and gold stocks. Sentiment indicators…continue to show [that] the dollar is poised for a serious decline and the MACD on the gold chart is giving one of the most powerful buy signals in the history of the bull market. The GDX should reach $75 a share by year-end and gold should push to new highs in the $2000 area by January of 2012 [while silver] could possibly be the best investment opportunity available to investors for many years to come! [Let me explain and back up my comments with an array of charts.] Words: 781

The technical situation is ultra-bullish for both gold and gold stocks. Sentiment indicators…continue to show [that] the dollar is poised for a serious decline and the MACD on the gold chart is giving one of the most powerful buy signals in the history of the bull market. The GDX should reach $75 a share by year-end and gold should push to new highs in the $2000 area by January of 2012 [while silver] could possibly be the best investment opportunity available to investors for many years to come! [Let me explain and back up my comments with an array of charts.] Words: 781

3. Are You One of the 99% Still Undecided About Owning Gold or Silver? Here’s What You Need to Know

Don’t own any gold or silver yet? New to the precious metals? Regardless whether you are a novice or seasoned veteran, the following seven points provide essential background information you can use to help determine whether the precious metals are right for you. Words: 1311

4. Is Gold On Its Way to $3,000, $5,000, $10,000 or Even Higher? These Analysts Think So

143 analysts maintain that gold will eventually reach a parabolic peak price of at least $3,000/ozt. before the bubble bursts. Of those 143 a total of 103 see gold achieving a price of at least $5,000/ozt. and 20 predict that gold will reach a parabolic peak price of $10,000 per troy ounce or more. Take a look here at who is projecting what, by when and why. Words: 745

5. Gold Price Keeps Going Higher As U.S. Debt Keeps Increasing – Got Gold?

Will our National Debt be trillions higher than today in a few years? If you think the answer is yes, than buying physical gold today is a good idea. It’s that simple. Just look at the chart. Words: 140

Will our National Debt be trillions higher than today in a few years? If you think the answer is yes, than buying physical gold today is a good idea. It’s that simple. Just look at the chart. Words: 140

6. Peter Schiff on Gold: Don’t Look a Gift Horse in the Mouth!

Following the crowd has never been the reason to buy gold. After all, that same logic would have recommended buying a house in Phoenix five years ago. Since the fundamentals still point to gold’s long-term viability… why [are] investors responding by selling gold and buying dollars and euros? I was always told not to look a gift horse in the mouth… [so] take advantage of the dip. Words: 880

7. Aden Sisters: Buy Gold NOW as it Corrects on its Way to $2,000

When you just consider the downgrade of U.S. debt, the jobs problem, the housing situation, the European bank concerns and their debt crisis, the negative outlook for the global economy, not to mention that the Fed will likely seek new measures to help the economy, we just don’t see gold coming down any time soon, other than having a normal downward correction [as currently is the case. Let us show you why.] Words: 1102

8. Gold: Are You “The 99%” or “The 1%”?

34% of Americans say gold is the best long-term investment, but how many of that 34% actually own it in the form of coins and bullion? No one has that figure, but my guess would be less than 1% of the total population, and when global investment demand doubles or triples (or more) from current levels — a distinct possibility — and you paint a whole new picture for gold. You begin to understand why gold is not in a bubble at all but, in fact, is in a long-term secular bull market that is still amassing considerable potential energy. Words: 1092

9. Gold Bullion: What’s the Difference Between 1 Troy Ounce and 1 Regular Ounce?

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 963

You have no doubt read countless articles on the price of gold costing x dollars per “troy ounce” or perhaps just x dollars per “ounce” but the difference between the two measurements is significant. For that matter, what’s the difference between a 24 karat gold ring and an 18 karat gold ring? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 963

10. $1,800+ for Gold is Still Not Too Much to Pay – Here’s Why

Sooner or later I think everyone will have an epiphany about money that pushes them to buy gold – even if it’s at levels that would seem expensive today. When that time comes, we won’t be focused on the price of gold but on the absolute need to acquire a more lasting asset. If I’m right, the plus $1,700/ozt. price today is not too high a price to pay. [Let me explain further.] Words: 874

11. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

12. Price of Gold Will Explode Upward If – and When – We See….

For the past decade gold has been “catching up” to the amount of money (M2 and M3) in the system to make up for understatement of the gold price due to U.S. price fixing on its way to an inflation-adjusted value of approx. $2,300 – and that is just the beginning. If, and when, we see a release into the market of the trillions of U.S. dollars being stored on balance sheets of banks, companies, and other countries around the world then the price of gold should explode upward. Let me explain why that would be the case. Words: 850

13. Here’s the Definitive Article on Why Gold is Going Even Higher

[Whatever you] call it – a bubble, a frenzy or a mania – there seems to be a large number of voices in the marketplace who just are not fans of gold, whether prices are moving up, down or sideways [but] the reality is that gold doesn’t possess the traits necessary for a financial bubble to form. [In fact, the current worldwide economic and fiscal environment suggests that gold will go MUCH higher. Let me explain.] Words: 236814. Pension Funds: Why $5,000 Gold May Be Too Low!

You already know the basic reasons for owning gold — currency protection, inflation hedge, store of value, calamity insurance — many of which are becoming clichés even in mainstream articles. Throw in the supply and demand imbalance, and you’ve got the basic arguments for why one should hold gold for the foreseeable future. [T]here is another driver of the price, however, that escapes many gold watchers and certainly the mainstream media [a]nd I’m convinced that once this sleeping giant wakes, it could ignite the gold market like nothing we’ve ever seen. [Let me explain.] Words: 788

15. Don’t Delay! Here are 50 Ways to Invest in Gold

Beyond its role as a diversifying agent in a portfolio, perhaps the most enticing attribute that gold offers is the huge potential for price appreciation. Although prices were stuck in somewhat of a rut in the middle part of the last decade, financial turmoil, money printing, and widespread fears over inflation have pushed gold prices sharply higher in recent years to near all time highs… Given the continuation of easy money policies by the Fed and other central banks around the world, as well as the very real possibility of more turmoil in the financial space, it isn’t surprising that many investors are looking to cash in on this modern day gold rush. For these investors looking to make a play on this elusive metal, we explore below every nook and cranny of the investing world to offer 50 ways to play gold. Words: 2768

16. Tidal Wave of Global Gold Demand Developing

In the East…gold is not only celebrated, acquired, worn or displayed during holidays or special occasions; it is seen as an everyday symbol of wealth. Increases in demand from China and India have driven a 7.5 percent increase in demand for gold jewelry during the first half of the year despite a 25 percent increase in the price. [Overall,] gold buying in India jumped 38 percent during the second quarter alone…China’s gold purchases jumped 90 percent on a year-over-year basis through June. In addition, demand from central banks is growing dramatically. [Such activity is setting up a] perfect storm – a tidal wave of gold demand [which can only keep prices high and escalating. Let me be more explicit.] Words: 959

17. Gold to Bounce Back to $2,250 – $3,000; Silver to $52 – $62; HUI to mid-900s by Year End

A tsunami doesn’t start with a bang, but with a whimper. The first sign is a little hump in the water way out in the distance that is barely notable. Anyone who catches a glimpse of it simply continues to expect the day to be the same as the last many days – calm and beautiful waters along the shore. This is the point where we are, today in the Precious Metals sector. Many have seen the little roll of water out in the distance as Gold edged up in the first move of a more parabolic slope, yet most investors are mired in the same expectations of yesterday – a return for Gold to correct down into a lower base. Our analysis based on the fractal relationship to 1979 shows, however, that the mid 900s are a realistic target for the HUI by the end of the year or early in 2012; that $52 to $56 should be achievable for silver, with $58 to $62 as real possibilities; and that Gold should go the $2250 level followed by $2500 with the potential for $3,000, or a bit higher, now on the radar screen. Let me explain why that is the case. Words: 2130

18. Gold Stocks: Get Ready, Get Set, GO!

Both gold and silver continue to trade well below their inflation-adjusted highs in nominal terms, and the market is now beginning to acknowledge the profit potential that precious metals equities offer at today’s bullion prices. We believe the equities will offer more upside than the bullion over time. Many of the smaller names are well priced and have momentum behind them. The prospects for gold stocks look extremely bright [for very good reasons. Let us explain.] Words: 2250

19. The Five “M’s” for Picking Gold Mining Stocks

With gold miners, in general, so attractively valued relative to the gold bullion price, the question becomes which stocks are the most compelling and have the best leverage to robust precious metals prices…In order to find the diamonds in the rough, I use what I call “The Five M’s” for mining stocks… Market cap, Management, Money, Minerals and Mine life cycle. [Let me explain each .] Words: 1146

20. Major Performance Gap Between Gold Stocks and Gold Bullion! Here’s Why

One market trend that seems to be attracting more and more attention is the large performance gap between gold bullion and gold stocks. The price of gold bullion has increased roughly 28 percent in 2011, while the S&P/TSX Gold Index is down [about] 1 percent. [Let me convey why that is the case.] Words: 1001

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money