The Federal Reserve has a dual mandate set by Congress of maximum employment and stable prices. During Chairman Bernanke’s most recent press conference he indicated that the Federal Reserve has done a better job of maintaining price stability while falling short of fostering maximum employment. [As such,] we believe the Federal Reserve will continue to increase the monetary base and weaken the dollar as long as unemployment remains elevated. While the economy (measured by real GDP) and the unemployment rate have not benefited from a substantial increase in the monetary base, the price of gold and silver have benefited from money printing. We believe this statement is quite important for monetary policy and for investors. [Let us explain further.] Words: 388

Chairman Bernanke’s most recent press conference he indicated that the Federal Reserve has done a better job of maintaining price stability while falling short of fostering maximum employment. [As such,] we believe the Federal Reserve will continue to increase the monetary base and weaken the dollar as long as unemployment remains elevated. While the economy (measured by real GDP) and the unemployment rate have not benefited from a substantial increase in the monetary base, the price of gold and silver have benefited from money printing. We believe this statement is quite important for monetary policy and for investors. [Let us explain further.] Words: 388

So says an article* by Parsimony Investment Research (http://www.parsimonyresearch.com/) posted on SeekingAlpha.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Who in the world is currently reading this article along with you? Click here

The article goes on to say, in part:

We believe the Bernanke and the Federal Reserve are more focused on reducing unemployment given the greater near-term social consequences of unemployment, particularly long-term unemployment as defined by U-6 and youth unemployment.

The U-6 unemployment rate is 16.2% and the youth unemployment is 18.1%.

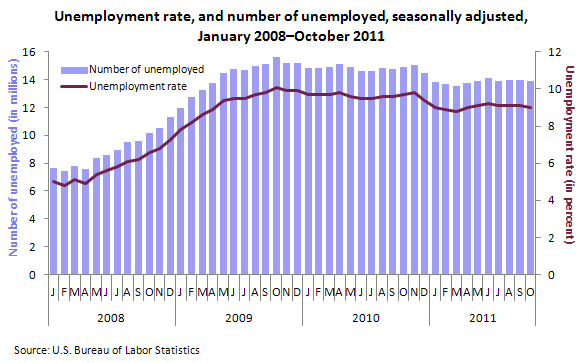

The chart below from the Bureau of Labor statistics shows that despite the easy monetary policy and the fiscal stimulus packages, there is an incremental 2 million people unemployed.

(Click charts to expand)

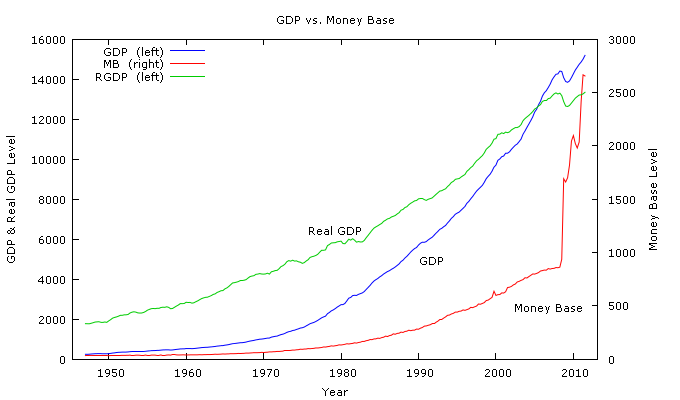

Between 2008 and 2011, the Federal Reserve has significantly expanded its balance sheet depicted by the monetary base (red line below) despite generating only a modest increase in real GDP (green line below).

Tactical Strategy

The physical markets for both gold and silver should determine the long-term price of the metal and we believe individual investors should continue to accumulate physical precious metals to diversify their wealth and help mitigate the loss of purchasing power from central bank intervention.

*http://seekingalpha.com/article/307282-federal-reserve-falling-short-on-its-dual-mandate-buy-precious-metals?ifp=0&source=email_macro_view

Related Articles:

1. There Are 2 Ways Out of Global Economic Mess – Hope for One of Them & Prepare for the Other

It all comes down to this: We have to match growth to debt. If we can’t create miracles from growth, we have to consider inflation to reduce the value of our debt. [Those are the] only two ways out of our current global economic mess – innovation and inflation. As the saying goes, we should hope for the best (more innovation) and prepare for the worst (higher inflation). [Let me explain why that is the case.] Words: 1195

2. Any Way You Look At It – Inflation Is On The Rise!

We can make some inferences about how inflation is impacting our personal expenses depending on our relative exposure to the individual components [and any way you look at it inflation is on the rise – so let’s take a look at the particulars.] Words: 769

3. Higher Lumber Costs Today = Higher Housing Costs Tomorrow = Higher Inflation in 2012/13

Housing makes up 42% of the Consumer Price Index (CPI) with the rest of it – food, energy, clothing, recreation, education, transportation, toys, cosmetics, etc. – making up the other 58%. [The current] softness of housing prices is artificially suppressing the growth of the CPI inflation rate [but with the coming increase in lumber costs that is about to change. Let me explain] Words: 772

4. Environment is Inflationary, NOT Deflationary – Here’s Why

While it is true that the average consumer isn’t (and won’t soon be) spending as much as he used to, it’s not because he’s waiting for bargains. No, it’s because he’s out of credit, he’s unemployed, his house, car, motorcycle, boat, and plasma television have all either been repossessed or foreclosed upon, and his wife just left him. He’s not exactly in the mood for shopping. He’s not waiting for bargains. He’s waiting for a miracle – and I don’t think they sell those at the mall. Words: 1582

5. Gold Price Keeps Going Higher As U.S. Debt Keeps Increasing – Got Gold?

Will our National Debt be trillions higher than today in a few years? If you think the answer is yes, than buying physical gold today is a good idea. It’s that simple. Just look at the chart. Words: 140

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money