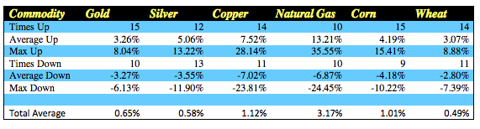

Have you been wondering how commodities will fare in November? [Below is a chart of] how select commodities performed in the past 25 Novembers (since 1986). Words: 489

the past 25 Novembers (since 1986). Words: 489

So says David Ristau (http://www.theoxengroup.com/) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Ristau goes on to say, in part:

A lot of that will depend on the dollar movement. It appears that the dollar may be ready to weaken further on Euro bailout plans for November, and that may give the dollar some ceiling. Historically, November has been good for some commodities and bad for others. [Take a look at the table below.]

*http://www.theoxengroup.com/

Related Articles:

1. Gold to Bounce Back to $2,250 – $3,000; Silver to $52 – $62; HUI to mid-900s by Year End

A tsunami doesn’t start with a bang, but with a whimper. The first sign is a little hump in the water way out in the distance that is barely notable. Anyone who catches a glimpse of it simply continues to expect the day to be the same as the last many days – calm and beautiful waters along the shore. This is the point where we are, today in the Precious Metals sector. Many have seen the little roll of water out in the distance as Gold edged up in the first move of a more parabolic slope, yet most investors are mired in the same expectations of yesterday – a return for Gold to correct down into a lower base. Our analysis based on the fractal relationship to 1979 shows, however, that the mid 900s are a realistic target for the HUI by the end of the year or early in 2012; that $52 to $56 should be achievable for silver, with $58 to $62 as real possibilities; and that Gold should go the $2250 level followed by $2500 with the potential for $3,000, or a bit higher, now on the radar screen. Let me explain why that is the case. Words: 2130

2. Aden Sisters: Buy Gold NOW as it Corrects on its Way to $2,000

When you just consider the downgrade of U.S. debt, the jobs problem, the housing situation, the European bank concerns and their debt crisis, the negative outlook for the global economy, not to mention that the Fed will likely seek new measures to help the economy, we just don’t see gold coming down any time soon, other than having a normal downward correction [as currently is the case. Let us show you why.] Words: 1102

3. Chris Vermeulen: Gold to Rebound to $1,775 by Year-end

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money