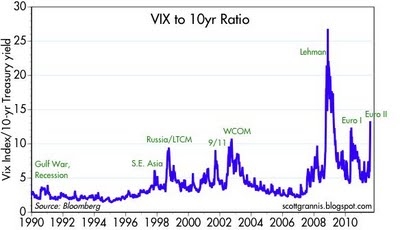

The plunge in global markets this week qualifies as a genuine panic according to the VIX index of implied equity volatility divided by the yield on 10-year Treasuries which measures how pessimistic the market is, and how much actual deterioration in the fundamentals there has been… [So,] are we finally on the cusp of “the end of the world as we know it”? Words: 437

So says Scott Grannis (www.CalafiaBeachPundit.com) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Grannis goes on to say:

The higher the Vix, the higher the degree of market uncertainty and fear; the lower the yield on Treasuries, the weaker the economy is perceived to be. So a higher ratio is bad, and a lower ratio is good. This is almost as bad as the first European sovereign debt scare which struck in April of last year.

The Vix is currently over 32, and the 10-yr yield has dropped to 2.42%, which is only a few bps higher than the lows it hit last October when the market thought we were in a double-dip recession.

Who in the world is currently reading this article along with you? Click here to find out.

However, as this next chart shows, the Vix is still substantially below its previous peaks, so the driving factor behind the increase in the Vix/10-yr ratio is the very low level of 10-yr yields, which decline like this only when driven by fears of an imminent recession.

The above suggests that the market is very concerned about the onset of a global economic slump, triggered by PIIGS defaults which cause such great stress among European banks that contagion effects ripple throughout the world.

Are we finally on the cusp of “the end of the world as we know it?” I doubt it. We’ve survived worse situations.

*http://scottgrannis.blogspot.com/2011/08/this-qualifies-as-genuine-panic.html

Related Articles:

- This Pattern Suggests Stock Market Crash Coming in the Fall https://munknee.com/2011/08/this-pattern-suggests-stock-market-crash-coming-in-the-fall/

- The S&P 500 is Highly Vulnerable – Here’s Why https://munknee.com/2011/08/the-sp-500-is-highly-vulnerable-heres-why/

- Market Crash Will Hit By Christmas 2011! Here’s Why https://munknee.com/2011/07/the-sp-500-is-worth-only-910-get-out-or-lose-big/

- S&P 500 Likely To Top Out at 1400 – 1500 & Then Topple to 400! Here’s Why https://munknee.com/2011/02/uncanny-relationship-with-nikkei-1929-crash-suggests-sp-500-about-to-top-out-and-then-tumble/

- Stock Market is Due for a 15-20% Correction – Here’s Why https://munknee.com/2011/06/stock-market-is-due-for-a-15-20-correction-heres-why/

- A Violent Correction Is Coming For the S&P 500! Here’s Why https://munknee.com/2011/06/a-violent-correction-is-coming-for-the-sp-500-heres-why/

- Why a Major Stock Market Correction is Imminent https://munknee.com/2011/05/why-and-how-best-to-play-a-major-stock-market-correction-is-imminent/

- S&P 500 is 45% Overvalued According to Reversion to Mean Analysis! https://munknee.com/2011/01/these-2-historical-charts-show-how-high-then-how-low-the-sp-500-might-go/

- How Mean Will the S&P 500′s Future Regression to Trend Be? https://munknee.com/2011/01/how-mean-will-the-sp-500s-future-regression-to-trend-be/

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money