Sooner or later I think everyone will have an epiphany about money that pushes them to buy gold – even if it’s at levels that would seem expensive today. When that time comes, we won’t be focused on the price of gold but on the absolute need to acquire a more lasting asset. If I’m right, the plus $1,700/ozt. price today is not too high a price to pay. [Let me explain further.] Words: 874

So says Jeff Clark (www.caseyresearch.com) in edited excerpts from an article* which Lorimer Wilson, editor of www.munKNEE.com (It’s all about Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Clark goes on to say:

Imagine the condition of our world if gold reached $5,000 a troy ounce – and kept soaring. We would likely be in a mania if that happened – but what kind of mania would it be? There would be some greed, to be sure, but I think…a deeper reason would be at play and it’s the same reason that will drive you to keep buying gold [even] at $2,000 an ounce: you’ll have to.

There are 101 reasons to own gold right now. You might buy because of the debt turmoil you see around the globe. You may think it wise, like the Chinese and others, to keep some of your savings in gold. Negative real interest rates may draw you to gold. You might buy because of the mere fact that demand is overwhelming supply or that you fear inflation or deflation, but most of these factors are missing one critical element: They are not yet personal.

Most reading this have not had to flee their country, been the victim of hyperinflation, or watched helplessly as their currency went poof! Longtime investors have made money on their gold investments, to be sure, but most of us bought the yellow metal as an investment and not because of a do-or-die situation.

It’s doom and gloom to say this, but I think it’s possible and perhaps even probable that at some point we’ll all feel forced to buy gold, almost irrespective of price, due to a sudden and rapid depreciation of the U.S. dollar.

How do we get to that point? Simple: You go to buy something and realize you’ve just been priced out of the market, not because the item is too expensive, but because you suddenly realize the money in your hand no longer has purchasing power. Your reaction to that event is predictable: you feel cornered, maybe even scared, and the urgency to seek an alternative takes over.

This is obviously an inflation scenario, but it’s not exactly a stretch to get there from where we are today. Here’s why.

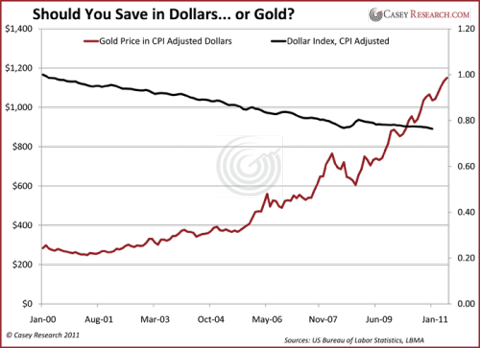

The above chart tracks the dollar and gold adjusted by the CPI from 2000 to present. It catches many people off guard, once they realize its implications. Look what’s happened to the greenback in the past 11+ years:

Since the Y2K scare, the U.S. dollar has lost an incredible 25% of its purchasing power. Even adding the measly interest one would earn in a traditional savings account doesn’t make up for this loss. This isn’t a picture of the dollar since the creation of the Fed or since Nixon took us off the gold standard. This is what’s happening right now – a gross devaluation of your dollar-based savings. Gold, on the other hand, has not only preserved but increased our purchasing power.

Now, imagine this scenario on fast forward. Instead of a 25% loss in 11 years, what if it occurs in, say, two years? That’s what can happen in a highly inflationary environment. At some point, given the baked-in consequences for our currency and the unwillingness of politicians to effectively deal with the problem, you one day instinctively realize, as you hand money to a cashier to buy milk and she asks for more, that it is a depreciating asset and no longer a stable form of exchange.

In other words, you won’t buy gold at $2,000 a troy ounce because you think it’s going to $6,000; you’ll buy gold because you fear the dollar will continue losing its ability to meet basic monetary requirements and you’ll need a substitute, something that will retain its value.

Regardless of whether the downward trend with the dollar continues at the same pace or speeds up, one thing is clear: it will continue. You must portion some of your savings in gold.

*http://www.caseyresearch.com/articles/when-buying-gold-becomes-life-or-death-question

Related Articles:

- Update: These 90 Analysts Believe Gold Will Go to $5,000/ozt. – or More! https://munknee.com/2011/06/update-these-90-analysts-believe-gold-will-go-to-5000ozt-or-more/

- Gold Will Drop to $1390 By Year-end and $1000 by 2013! Here’s Why https://munknee.com/2011/07/gold-will-drop-to-1390-by-year-end-and-1000-by-2013-heres-why/

- The Future Price of Gold and the 2% Factor https://munknee.com/2011/06/the-future-price-of-gold-and-the-2-factor/

- Richard Russell: Get Prepared – A Gold Tsunami is Coming https://munknee.com/2011/05/richard-russell-get-prepared-a-gold-tsunami-is-coming/

- Gold to Repeat? https://munknee.com/2011/07/gold-to-repeat/

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

If a ounce of gold is too expensive to purchase as today’s price of $1885 then buy it in smaller increments. I’m not sweating buying the ounce when i can buy 1/4 of ounce of gold. Why? It’s easier to buy things with smaller increments like 10th ounce of gold or 1/4 ounce. Finding change for 1 ounce of gold will be hard IF gold is at $5000 ounce!