Constructing a portfolio for the retirement years requires one to focus on portfolio risk or uncertainty while not neglecting return. If the portfolio asset allocation plan is too conservative, the return will not meet lifestyle expectations. Inflation is again on the rise and this needs to be taken into consideration when putting together a retirement oriented portfolio. Below is a combination of index ETFs that project respectable returns while holding down portfolio volatility. Words: 455

So says Lowell Herr (http://itawealthmanagement.com) in an article* posted on SeekingAlpha.com.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Herr goes on to say:

Several goals were established before building the following portfolio.:

- The 6 to 12 month projected return must exceed that expected for the S&P 500 over the same period.

- The projected return/uncertainty ratio should be greater than 0.60.

- The projected standard deviation (uncertainty) must be less than 15%.

- Portfolio diversification is expected to be greater than 40% as measured by the Diversification Metric (DM).

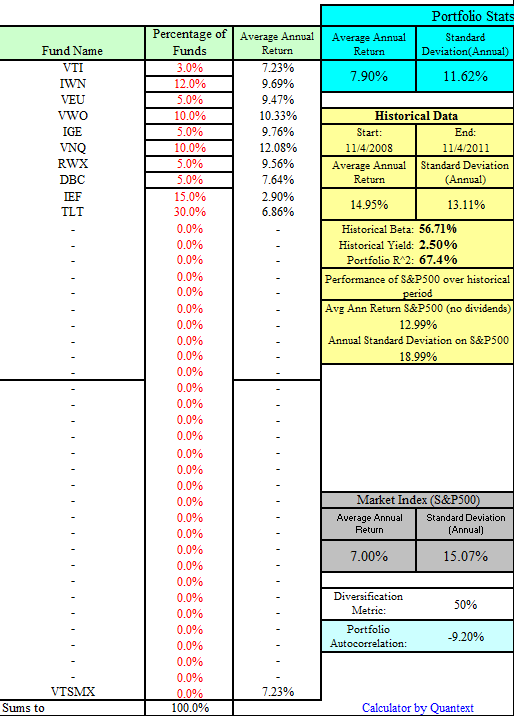

The following portfolio meets all the above goals. As a reference, the proposed or expected return for the S&P 500 was set to 7.0% for the next year. The following portfolio shows a projected return of nearly 1.0% point higher. The Return/Uncertainty ratio is 0.68 and the DM is a very high 50%. Take note of the average annual return over the last three years. Granted, the market was only about three months away from the low of the last bear market and we have had a nice recovery. All that is reflected in the performance results of this asset allocation plan.

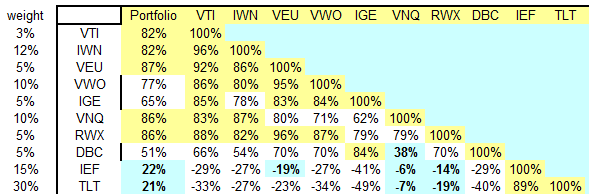

The following table shows the correlation matrix for the retirement portfolio. The high percentages selected for IEF and TLT create the diversification required. These two ETFs are largely responsible for the Diversification Metric moving to 50%. They also help drive the Portfolio Autocorrelation into negative territory.

Disclaimer: Always be skeptical of results where data extrapolation is involved. The portfolio is sufficiently conservative that an investor is not likely to experience severe damage when the next bear market strikes. As a balance, there are sufficient equities to counter inflation. There is a global component (VEU and VWO), although it is not over done. Domestic and international REITs (VNQ and RWX) bolster portfolio yield. There is a lot riding on the TLT ETF as it controls nearly one-third of the portfolio.

*http://seekingalpha.com/article/305624-10-etfs-for-building-a-better-retirement-portfolio?source=feed

Related Articles:

1. 65% Proof! Why Index Funds Increase Your Investment Returns Dramatically

The average annual equity return for individual investors has been 60-65% less ( 6-7 percentage points less), over a 20 year period, than the performance of the indices that everyone assumes reflect investor returns! In spite of such a dramatic under-performance that fact is being ignored because it is not useful to academics or investment companies – but I would think it is of interest to YOU! Words: 729

2. These 17 ETFs Have Higher Yields Than 10 Year Treasuries!

We are in a “new normal” environment with a future of low returns and high volatility. The Fed is pledging to keep short-term interest rates near zero through mid-2013. [Nevertheless,] in this low-yield world, there are still plenty of large ETFs offering yields higher than the 10Year Treasuries. [Let me explain in detail below.] Words: 723

3. Protect Yourself From Inflation With Gold or Precious Metals Funds

Investing in some form of precious metals is the preferable way to protect oneself from rising inflation/decrease in the value of the U.S. dollar and here are 10 ETFs and ETNs and 5 mutual funds to do just that. Words: 879

4. Market -Timing Pays BIG Dividends for Income Investors – Here’s Why

Many income investors have been taught to believe that “market-timing” is anathema to their investment objectives and/or that it can’t be done successfully… I will argue that this piece of conventional wisdom is false – dangerously false. In a three-part series of essays, I will argue that market-timing needs to be incorporated as a fundamental component of income investing. I will demonstrate why market-timing is important, when it should be applied and how it should be implemented. [Read on!] Words: 1956

5. Now’s the Time to Buy These 5 “sleep-well-at-night” Dividend Growth Stocks – Here’s Why

The past month has been marked with volatility and steep sell-off in stocks on a global scale. The unprecedented downgrade of US government debt from S&P, the high unemployment and the slowdown in the U.S. economy all caused investors to be bearish on equities. As stocks keep on falling however, companies keep on generating positive earnings surprises. Despite all the bearish news, I believe that now is the perfect time to start accumulating stocks, [particularly the following 5 “sleep-well-at-night” dividend growth stocks. Here’s why.] Words: 1362

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money