The derivative market has blown a galactic bubble…and since there is literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915 literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915 |

So say excerpts from an article/infographic* posted on www.demonocracy.info which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), presents below for your enlightenment. This paragraph must be included in any article reposting to avoid copyright infringement.The article/infographic goes on to say, in part:Pick something of value, make bets on the future value of “something”, add a contract & you have a derivative. Banks make massive profits on derivatives, but when the bubble bursts chances are the taxpayer will end up with the bill. A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. For example: So say excerpts from an article/infographic* posted on www.demonocracy.info which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), presents below for your enlightenment. This paragraph must be included in any article reposting to avoid copyright infringement.The article/infographic goes on to say, in part:Pick something of value, make bets on the future value of “something”, add a contract & you have a derivative. Banks make massive profits on derivatives, but when the bubble bursts chances are the taxpayer will end up with the bill. A derivative is a legal bet (contract) that derives its value from another asset, such as the future or current value of oil, government bonds or anything else. For example:

- A derivative buys you the option (but not obligation) to buy oil in 6 months for today’s price/any agreed price, hoping that oil will cost more in future.

- Derivative can also be used as insurance, betting that a loan will or won’t default before a given date.

- Bottom line, derivatives are a big betting system, like a Casino, but instead of betting on cards and roulette, you bet on future values and performance of practically anything that holds value.

The system is not regulated whatsoever, and you can buy a derivative on an existing derivative. Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk.

The world derivatives market amounted to $707 trillion as of a year ago of which the 9 largest banks in the USA accounts for $230 Trillion which, in and of itself, is 3-times that of the entire world economy! The source of the derivative data comes from ZeroHedge. |

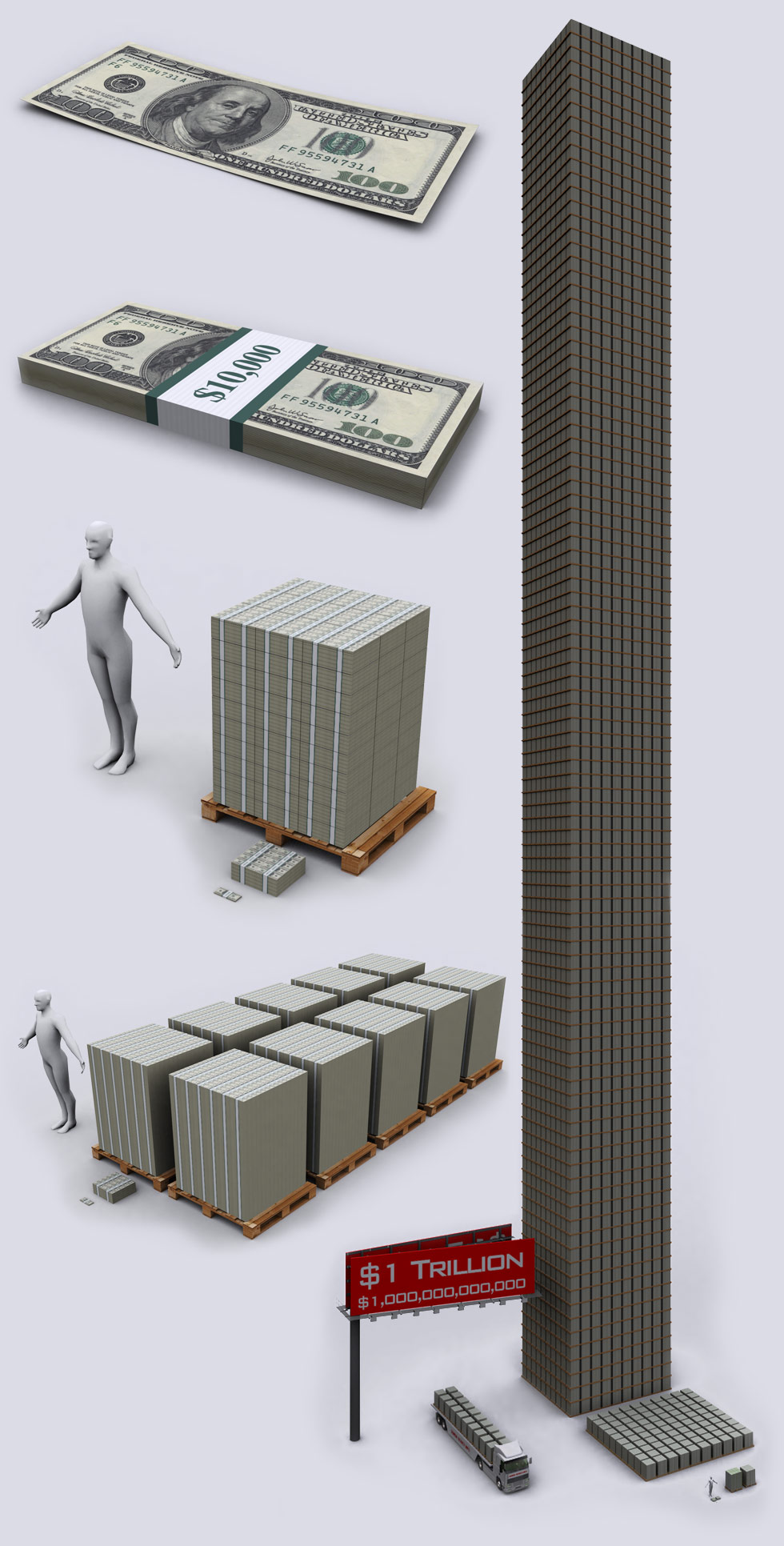

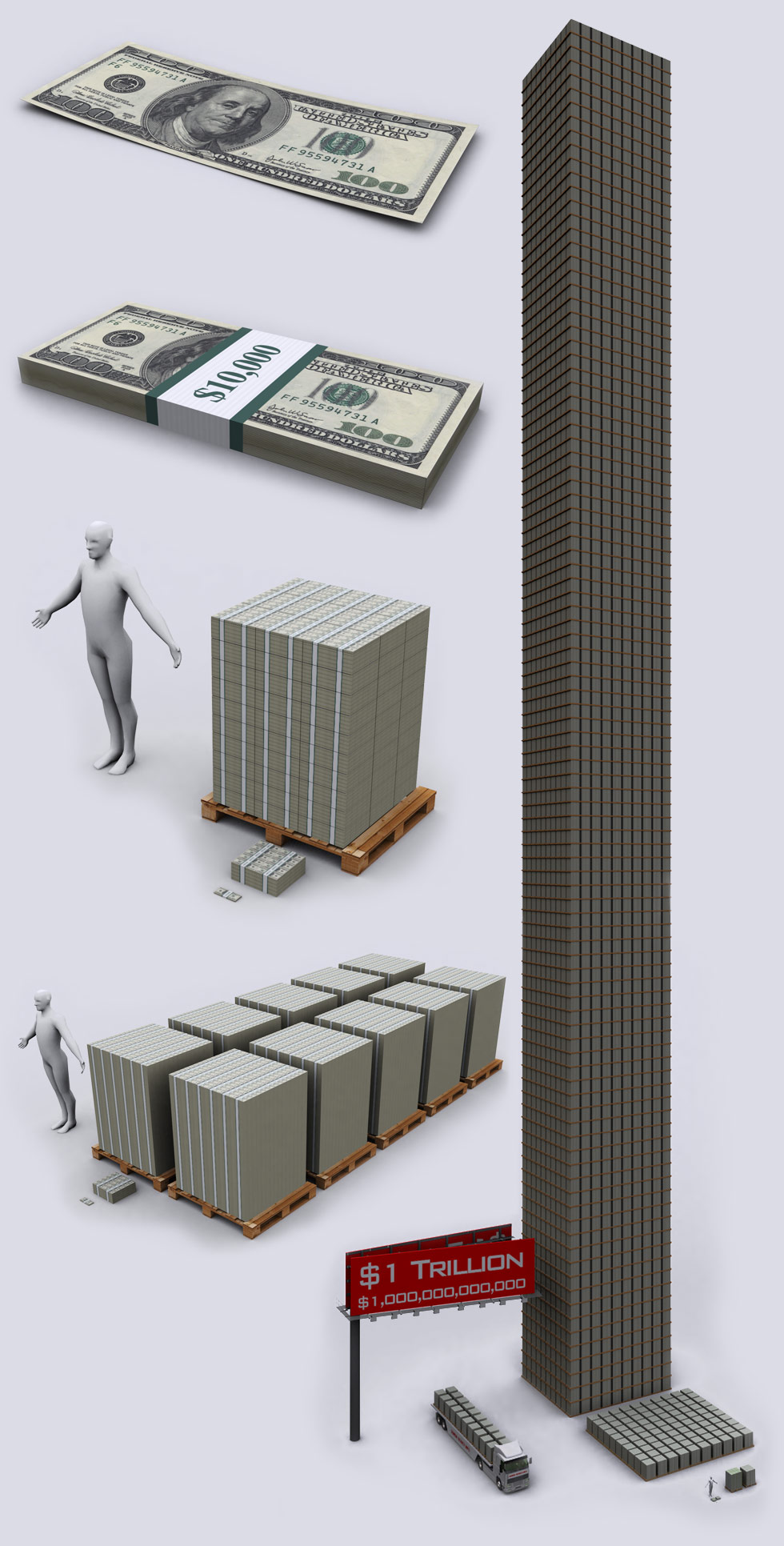

| 100 Million Dollars |

$100,000,000 – Plenty to go around for everyone. Fits nicely on an ISO / Military

standard sized pallet. $1 Million is the square bundle of cash on the floor in the graphic below. |

| 1 Billion Dollars |

| $1,000,000,000 – The 10 pallets of $100 bills below shows what a billion dollars looks like. The transport truck depicted below has a cargo of $2 billion. |

| 1 Trillion Dollars |

| $1,000,000,000,000 – When they throw around the word “Trillion” like it is nothing, this is the reality of $1 trillion dollars. The square of pallets in the bottom right hand corner of the graphic below is $10 billion dollars. 100x that and you have the tower of $1 trillion that is 465 feet tall (142 meters). |

| Bank of New York Mellon |

- BNY has a derivative exposure of $1.375 Trillion dollars.

- Considered a too-big-to-fail bank.

- It is currently facing (among others) lawsuits fraud and contract breach suits by a Los Angeles pension fund and New York pension funds, where BNY Mellon allegedly overcharged the funds on many millions of dollars and concealed it.

|

| State Street Financial |

- State Street has a derivative exposure of $1.390 Trillion dollars.

- A too-big-to-fail bank.

- It has been charged by California Attorney General (among others) lawsuits for massive fraud on California’s CalPERS and CalSTRS pension funds – similar to BNY (above).

|

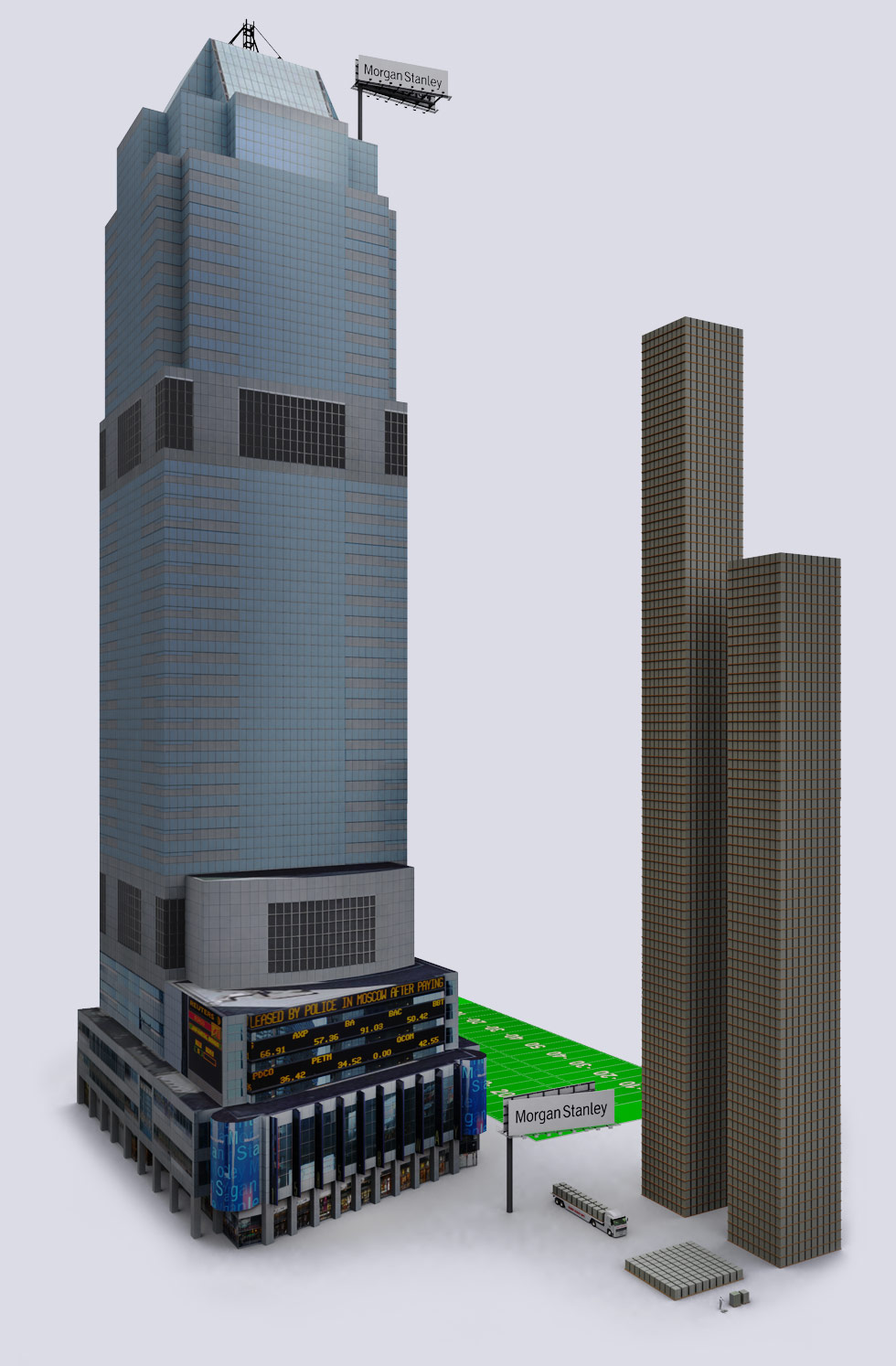

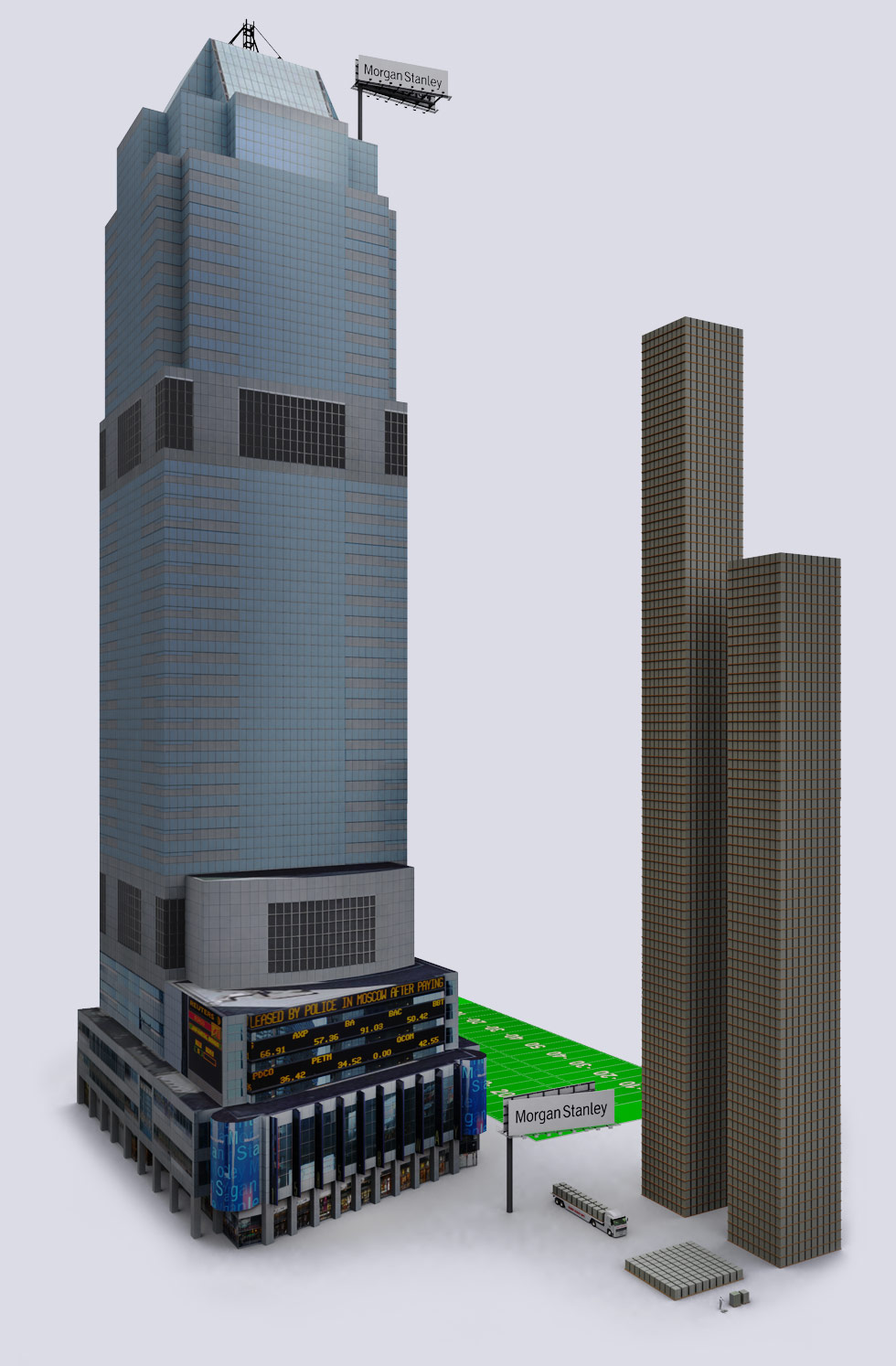

| Morgan Stanley |

- Morgan Stanley has a derivative exposure of $1.722 Trilion dollars.

- A too-big-to-fail bank.

- It recently settled a lawsuit for over-paying its employees while accepting the taxpayer funded bailout.

- Vice Chairman of Morgan Stanley had a license plate that said “2BG2FAIL” on his Porsche Cayenne Turbo.

- All this while $250 million of bailout money ended up in the hands of Waterfall TALF Opportunity, run by the Morgan Stanley’s owners’ wives– Marry a banker for a $250M tax-payer cash injection.

- The bank also got a SECRET $2.041 Trillion bailout from the Federal Reserve during the crisis, beyond the taxpayer bailout.

|

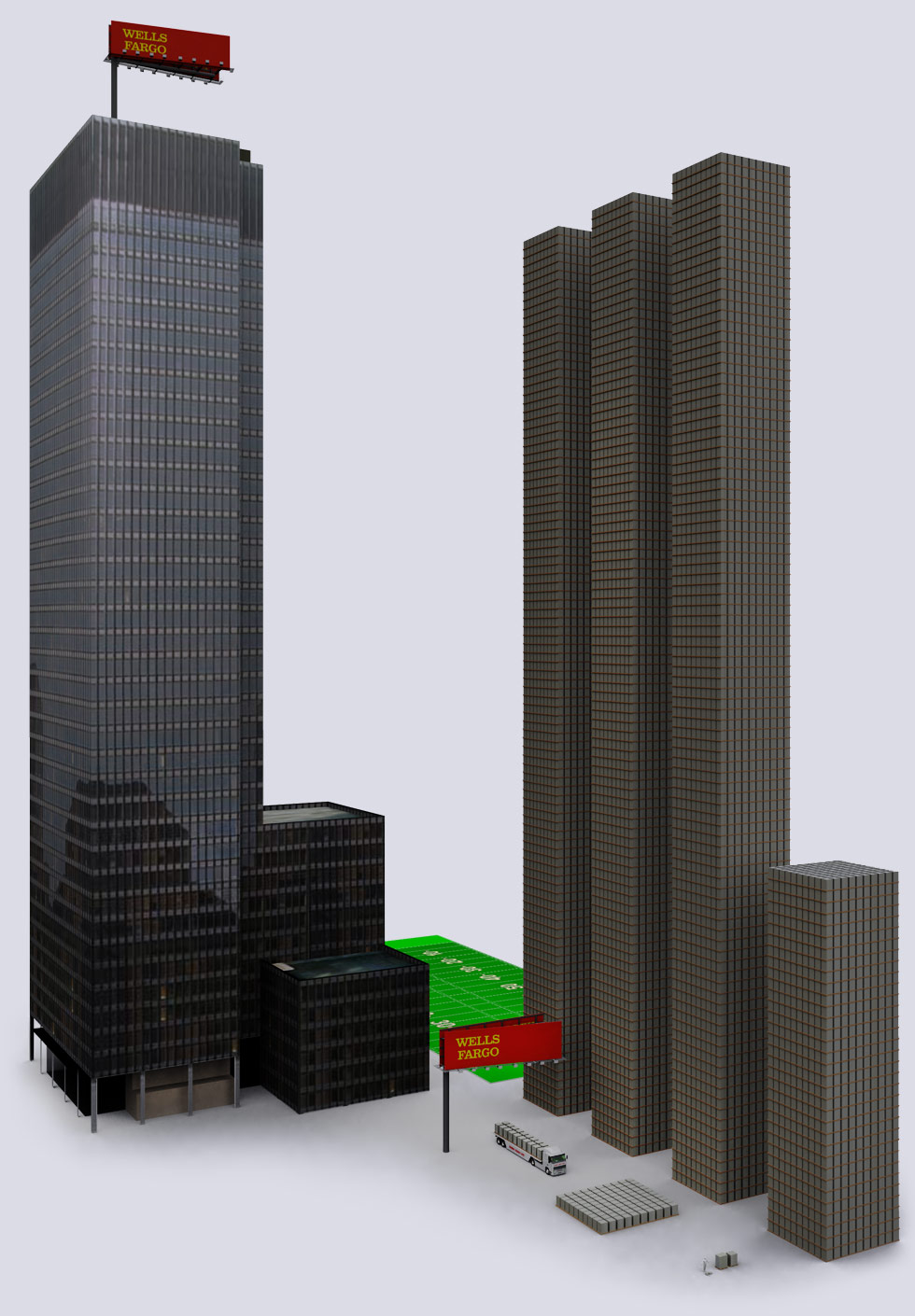

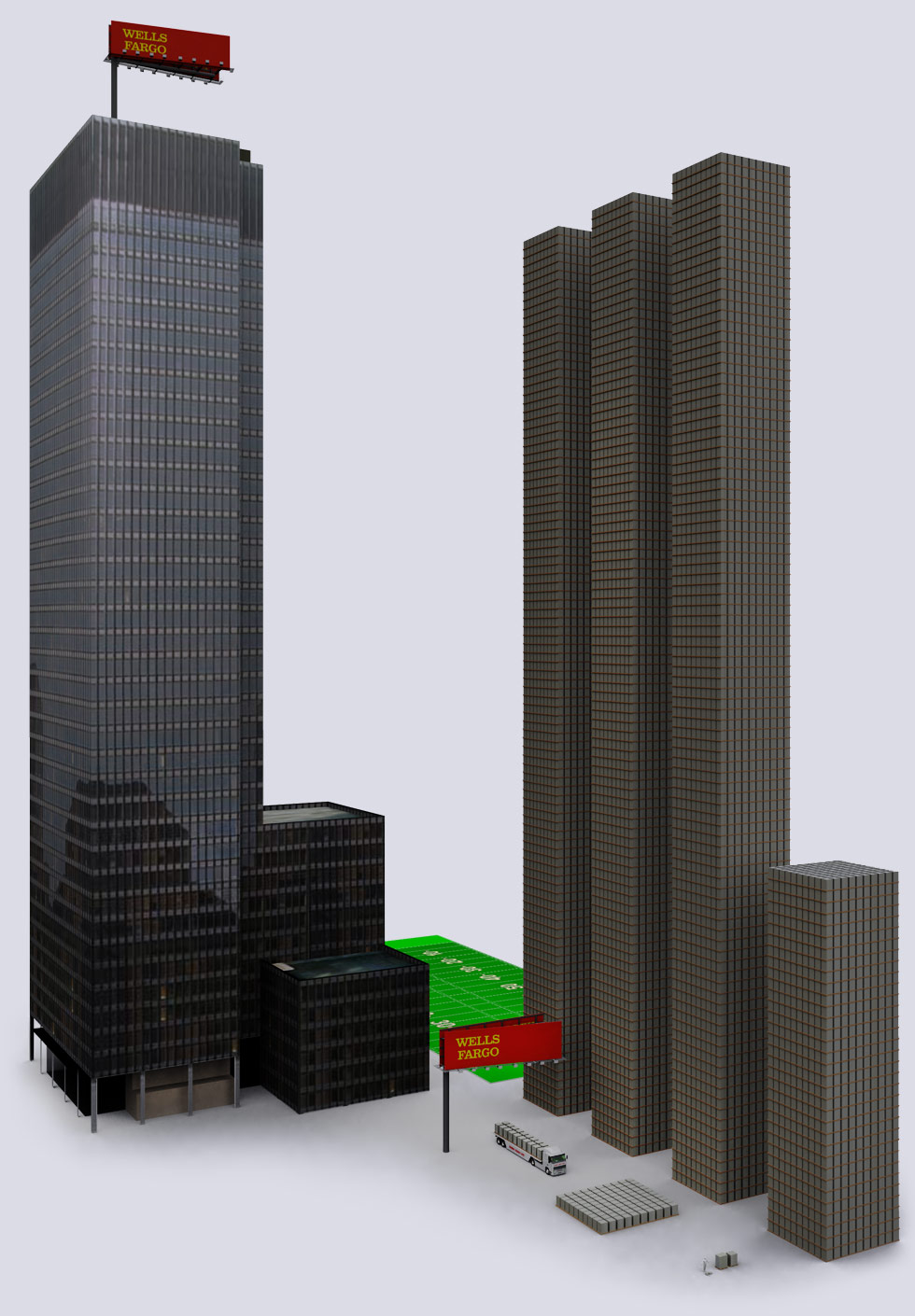

| Wells Fargo |

- Wells Fargo has a derivative exposure of $3.332 Trillion dollars.

- A too-big-to-fail bank.

- WF has been charged for its role in allegedly pursuing illegal foreclosures and deceptive loan servicing.

- Wells Fargo was just slapped with a $85 million fine by Federal Reserve for putting good credit borrowers into bad-credit rating (high rate) loans.

- In March 2010, Wachovia (owned by Wells Fargo) paid $110 million fine for allowing transactions connected to drug smuggling and a $50 million fine for failing to monitor cash used to ship 22 tons of cocaine.

- It also failed to monitor $378.4 billion (that’s $378400 millions dollars) worth of transactions to Mexican “casas de cambio” (think WesternUnion, anonymous cash transfer) usually linked to drug cartels.

- Beyond that, WF lets its’ VIP employees live in foreclosed mansions.

- WF knows how to cash your legit check, then claim “fraud” and close your account.

- WF also re-orders your transactions to create more overdraft fees.

- Wells Fargo’s Wachovia also got a SECRET $159 billion bailout from the Federal Reserve.

- Wells Fargo paid NO taxes in 2008-2010 and had a tax rate of NEGATIVE 1.4% while making $49 billion in profit during the same time.

|

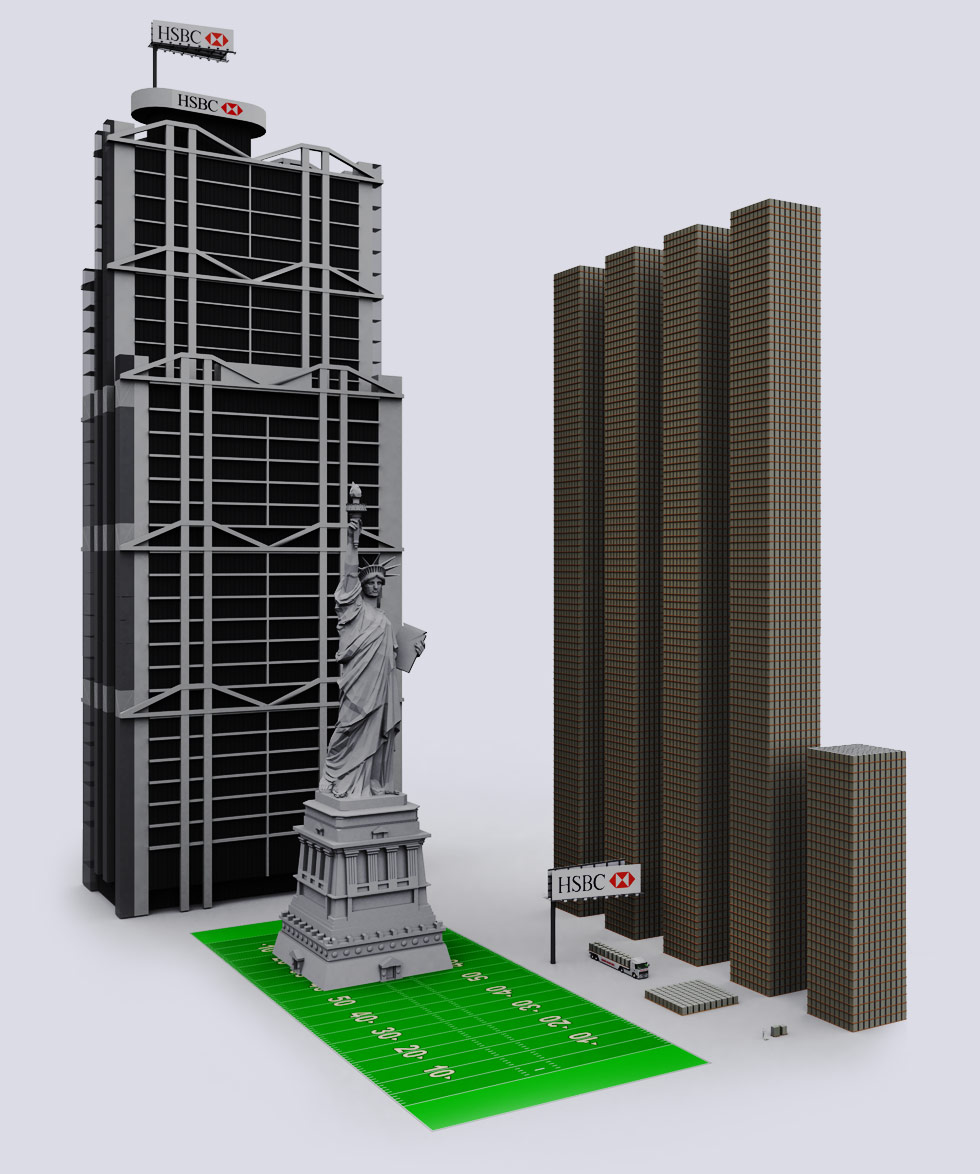

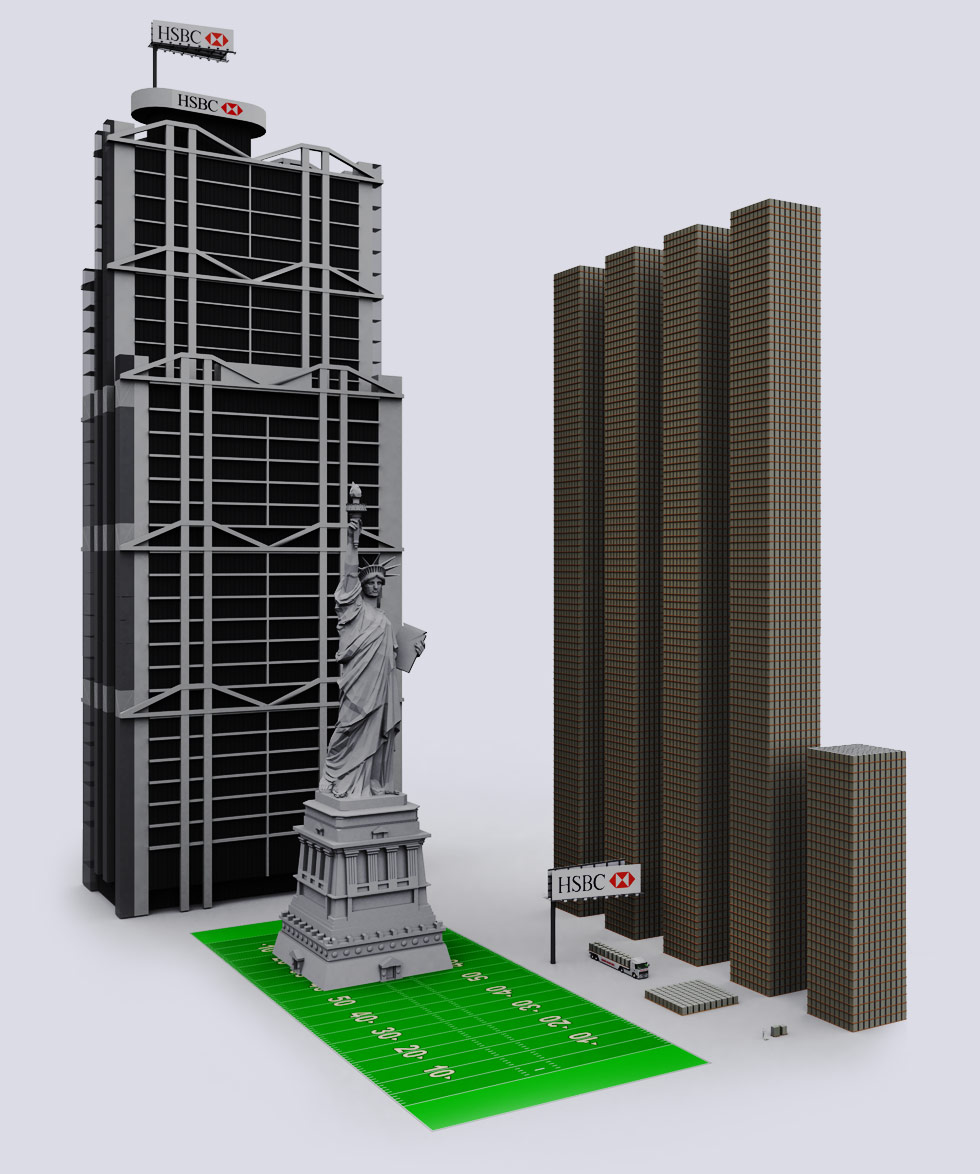

| HSBC |

- HSBC has a derivative exposure of $4.321 Trilion dollars.

- HSBC is a Hong Kong based bank and its original name is The Hongkong and Shanghai Banking Corporation Limited.

- You will find HSBC working a lot with JP Morgan Chase.

- Both HSBC and JP Morgan Chase have strong interest in gold & precious metals.

- HSBC and JP Morgan Chase are often involved together in financial scandals.

- Lately HSBC has been sued for allegedly funneling more than $8.9 billion to the largest ponzi-scheme in history – Bernie Maddof’s investment business.

- HSBC (along w/ JP Morgan Chase) has been sued for alleged conspiracy suppressing the price of silver and gold, partially through precious metal DERIVATIVES and making billions of dollars on it.

- State of Hawaii is suing HSBC (and other banks) for deceptive credit card lending practices.

- DZ Bank in Germany is suing HSBC (and JP Morgan) for deceptive (lying) practices when selling home-loan-backed securities.

- HSBC is also under investigation for laundering billions of dollars.

|

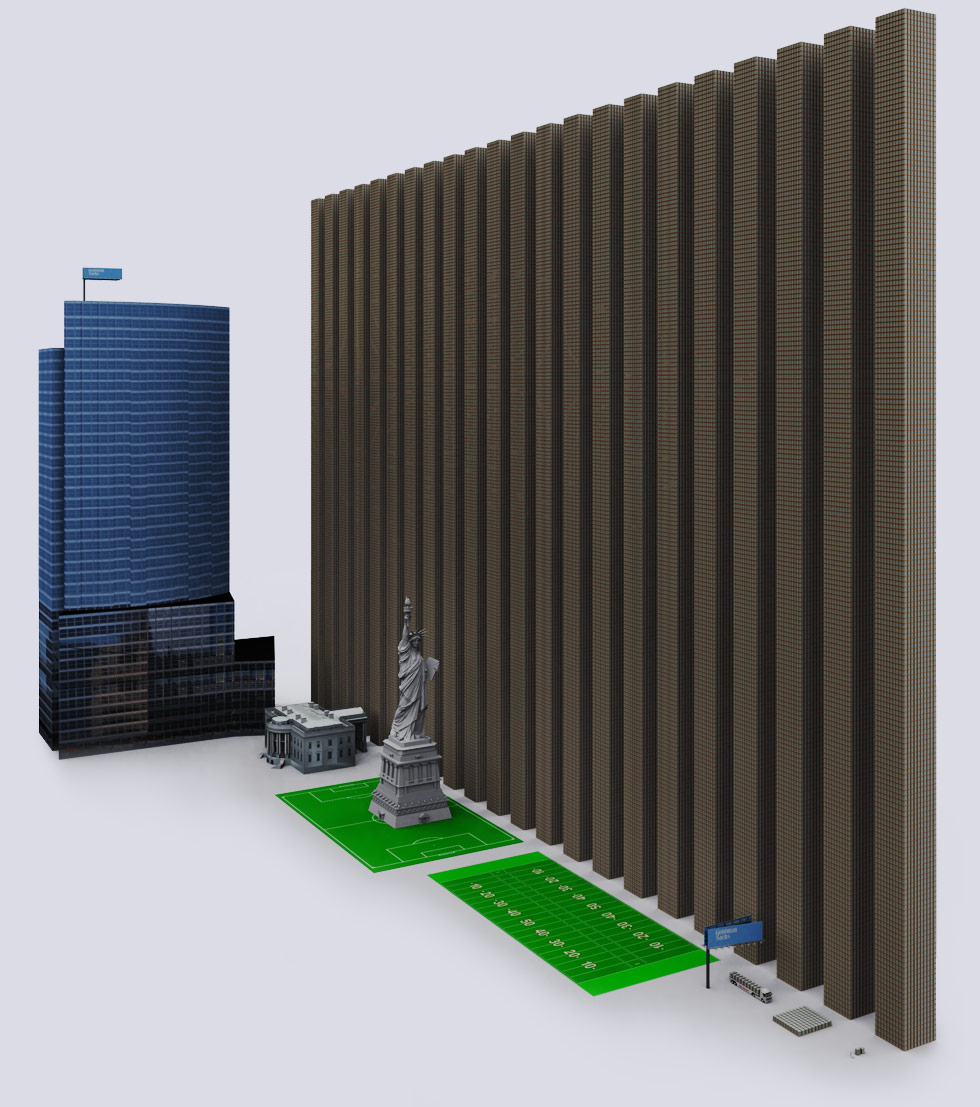

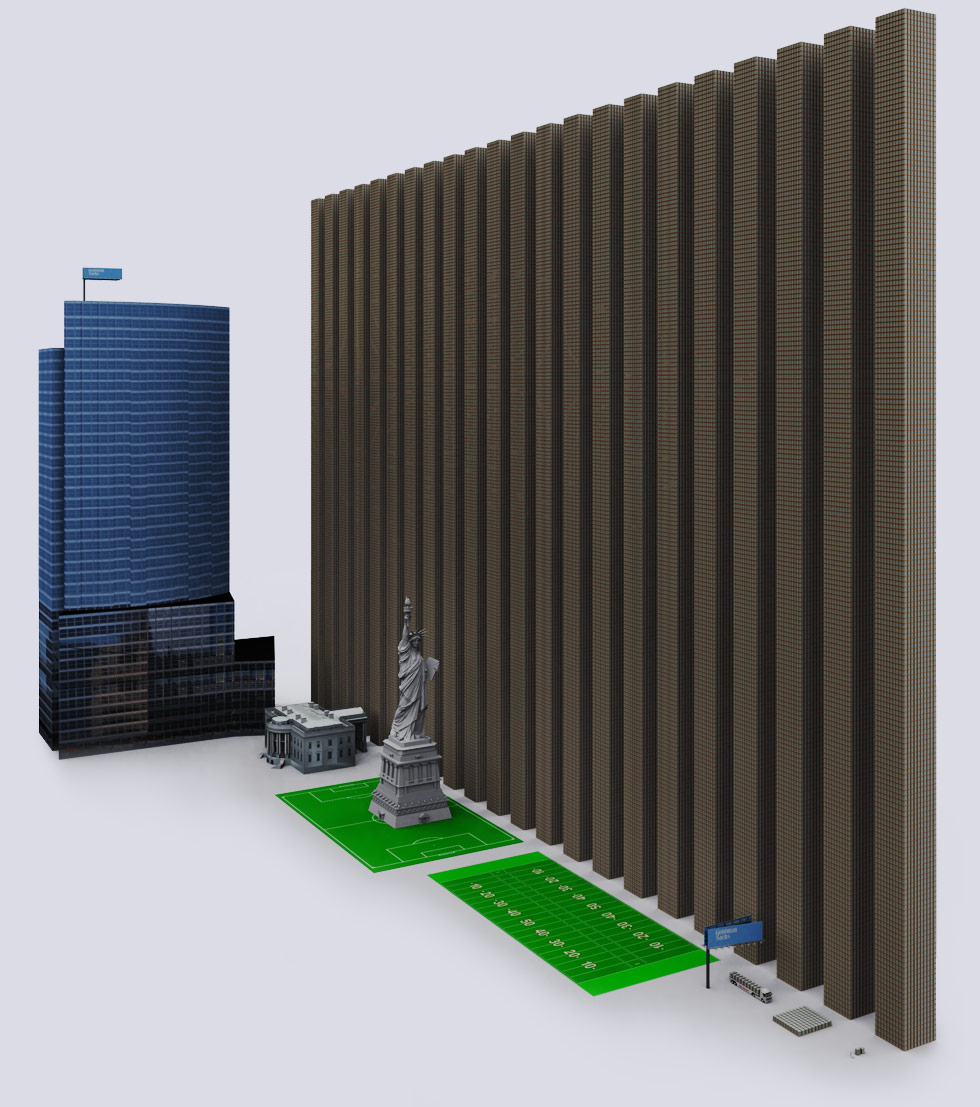

| Goldman Sachs |

- Goldman Sachs has a derivative exposure of $44.192 Trillion dollars.

- The $1 Trillion pillars towers are double-stacked @ 930 feet (248 m).

- The White House is standing next to the Statue of Liberty. Goldman Sachs has an advantage over other banks because it has awesome connections in US Government. A lot of former Goldman employees hold high-level US Government positions (chart). Mitt Romney’s top donor is Goldman Sachs, and one of Obama’s best donors.

- Ex-CEO of Goldman Sachs, Hank Paulson became the Secretary of Treasury under Bush and during the 2008 financial crisis authored the TARP bill demanding $700 billion bail-out.

- In UK, Goldman Sachs escaped £10 million bill on a failed tax avoidance scheme with help of good connections.

- The bank is the largest player in the food commodities market, earned $955m from food speculation in 2009″ – That’s your $$$.

- Goldman Sachs employees are arming themselves with guns in case there is a populist uprising against the bank.

- Goldman Sachs calls their investors “muppets”. and use clients to make money for themselves, disregarding the clients.

- The bank was fined $22 million for sharing valuable nonpublic information with top clients (Think insider trading with best clients).

- Goldman Sachs was part-owner of America’s leading website for prostitution ads until the ownership stake was exposed.

- Goldman Sachs helped Greece conceal its debt with secret loans, while simultaneously taking advantage of Greece.

- Goldman Sachs got a $814 billion SECRET bailout from the Federal Reserve during the 2008 crisis.

- Goldman Sachs got $10 billion of the 2008 TARP bailout, and in the same year paid $10.9 billion in employee compensation and “benefits”, while paying a tax rate of 1%. That means an average of $327,000 to each Goldman Sach’s employee.

|

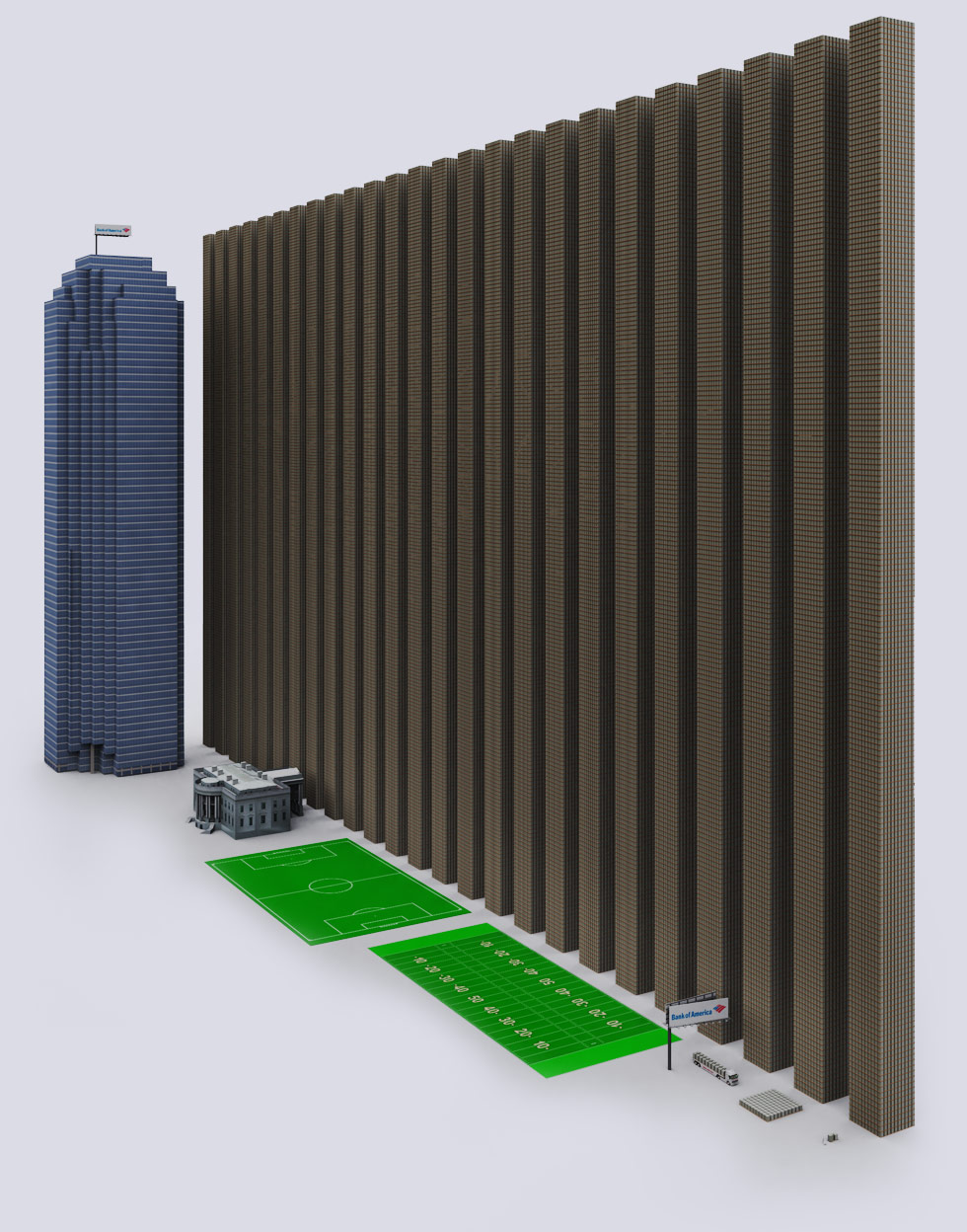

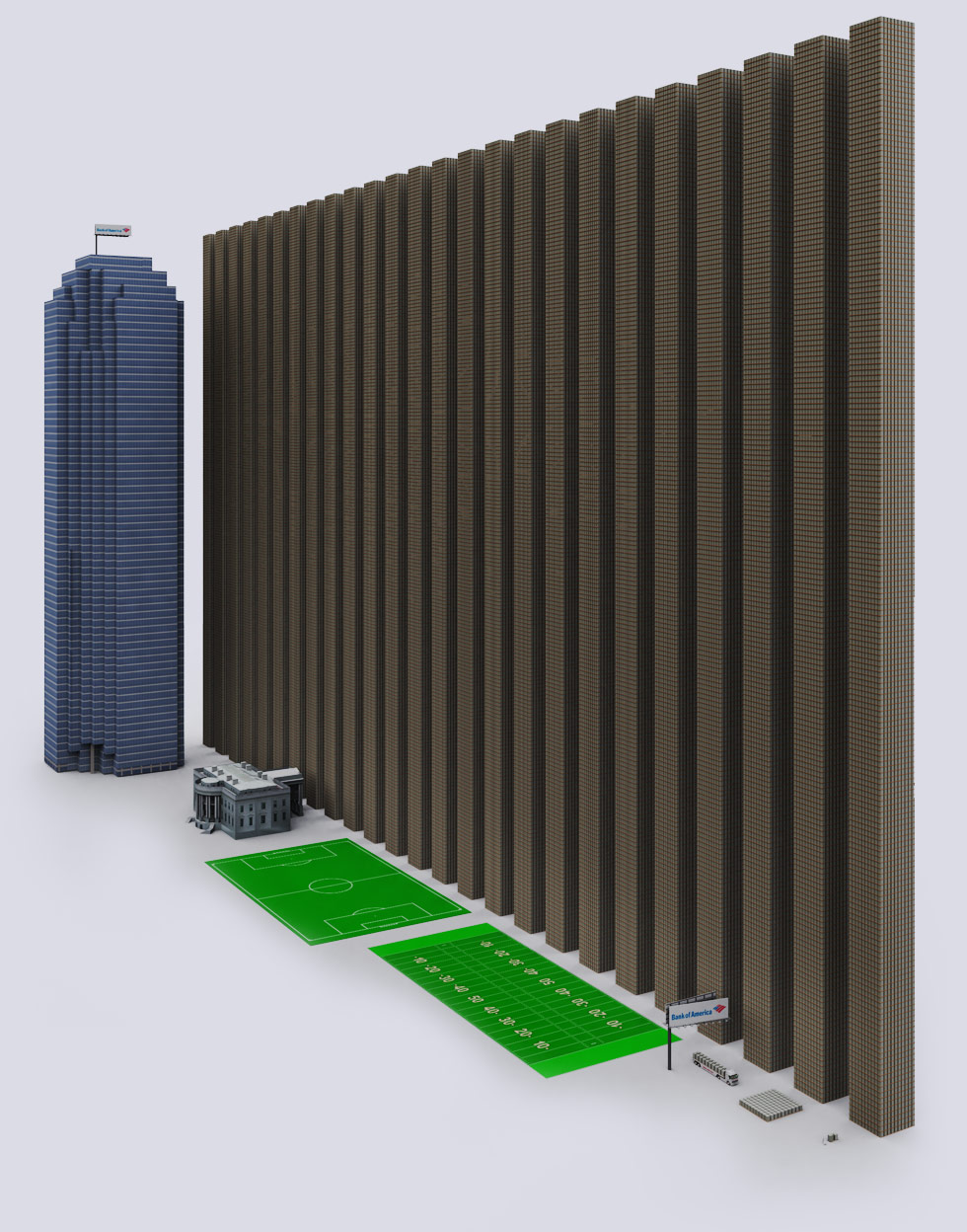

| Bank of America |

- Bank of America has a derivative exposure of $50.135 Trillion dollars.

- BofA is sticking the tax-payers with a MASSIVE bill, by moving derivatives to

accounts insured by the federal government @ total of $53.7 trillion as of 06/2011.

- During 2011-12 BofA has been in need of cash, so Warren Buffett gave BofA $5 billion.

- Same year BofA sold its stake in China Construction Bank to raise $1.8 billion in cash.

- Bank of America paid $22 million to settle charges of improperly foreclosing on active-duty troops.

- BofA recruited 3 cyber attack firms to attack WikiLeaks but the anonymous hacker group hacked the security firms first.

- BofA was sued for $31 billion in home-loan losses in 2011 and is involved in many lawsuits, too many to document.

- BofA also received a SECRET $1.344 trillion dollar bailout from the Federal Reserve.

|

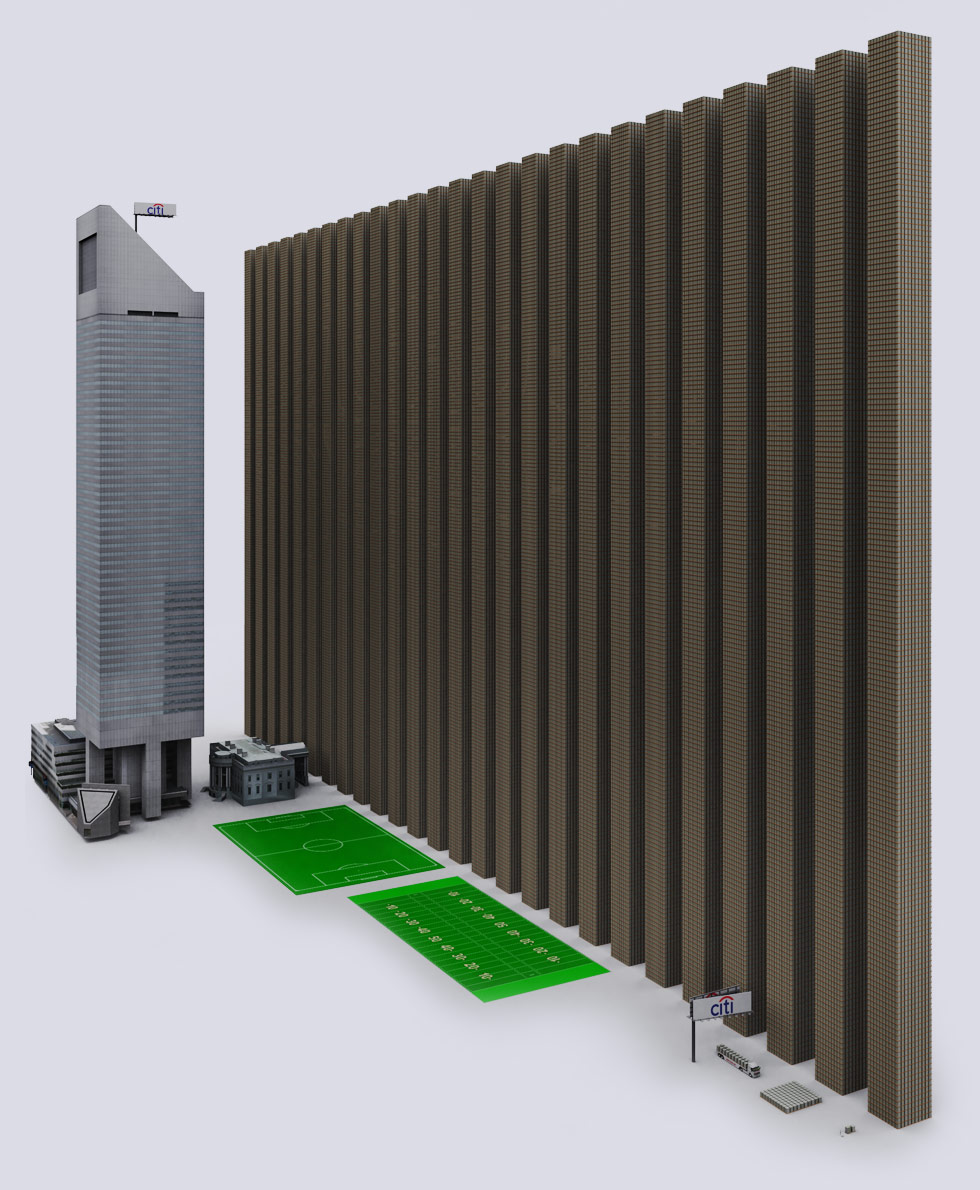

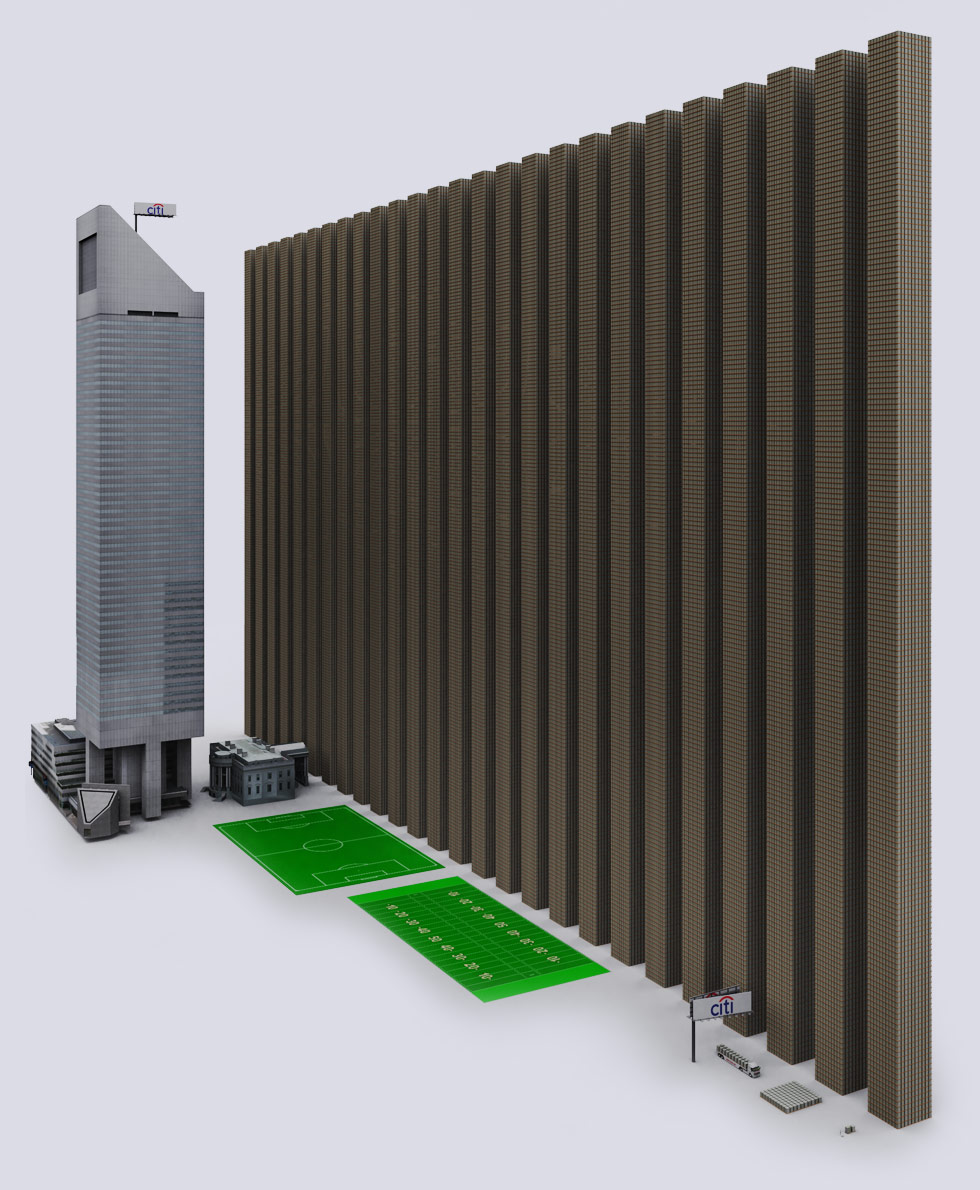

| Citibank |

- Citibank has a derivative exposure of $52.102 Trillion dollars.

- The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

- Citibank customers have been arrested for trying to close their accounts, while in Indonesia a man was interrogated to death in Citibank’s special “questioning room”.

- In 2011 Citibank paid a fine of $285 million for selling home-loan backed bonds to investors, while betting they would lose value (think derivatives/insurance). The man in charge of the unit at Citibank became Obama’s Chief of Staff. 2 weeks before getting hired by Obama he got $900,000 from Citibank for great performance. This was after Citigroup took out $45 billion in bailout money.

- Citibank knowingly passed over bad loans to the Federal Housing Administration to insure Citigroup also received a SECRET $2.513 trillion dollar bailout from the Federal Reserve.

|

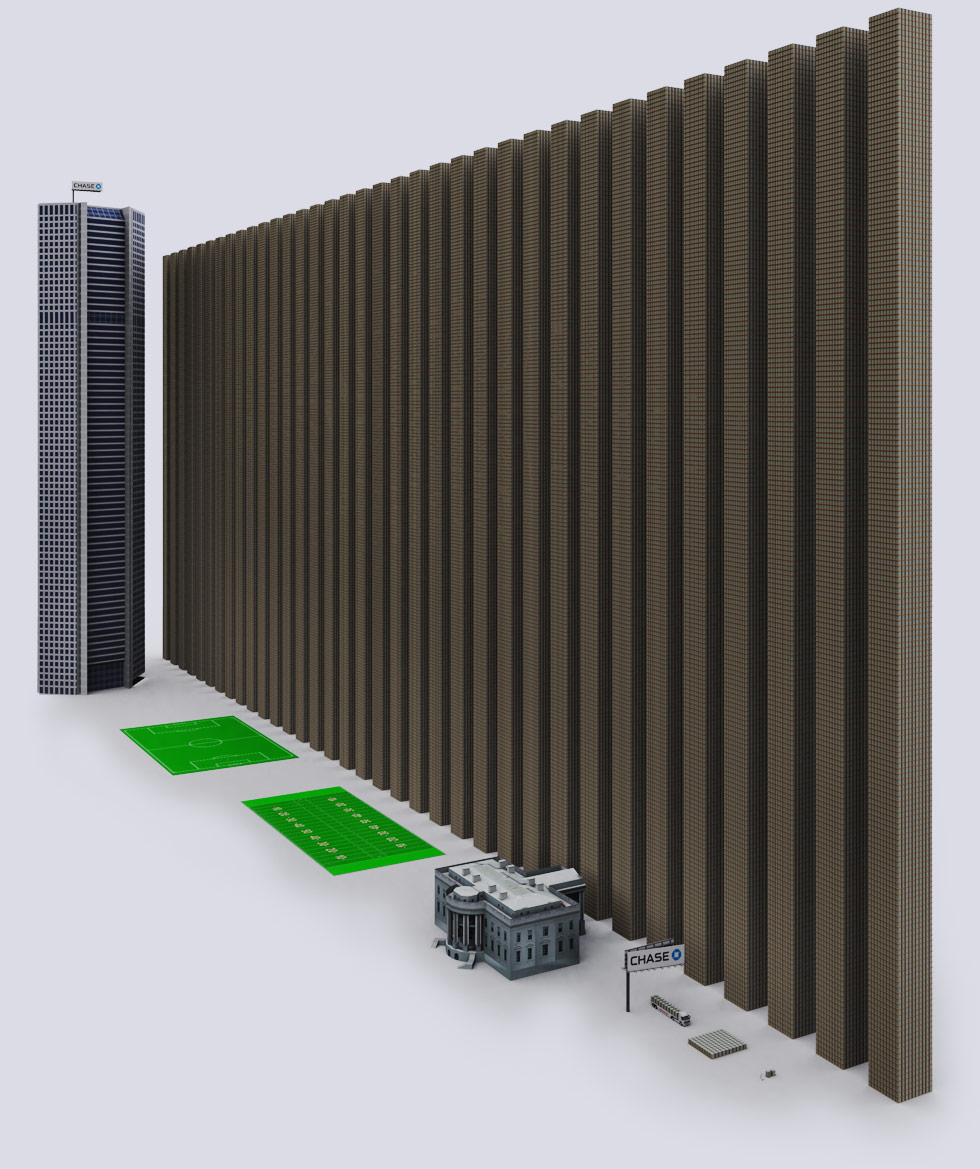

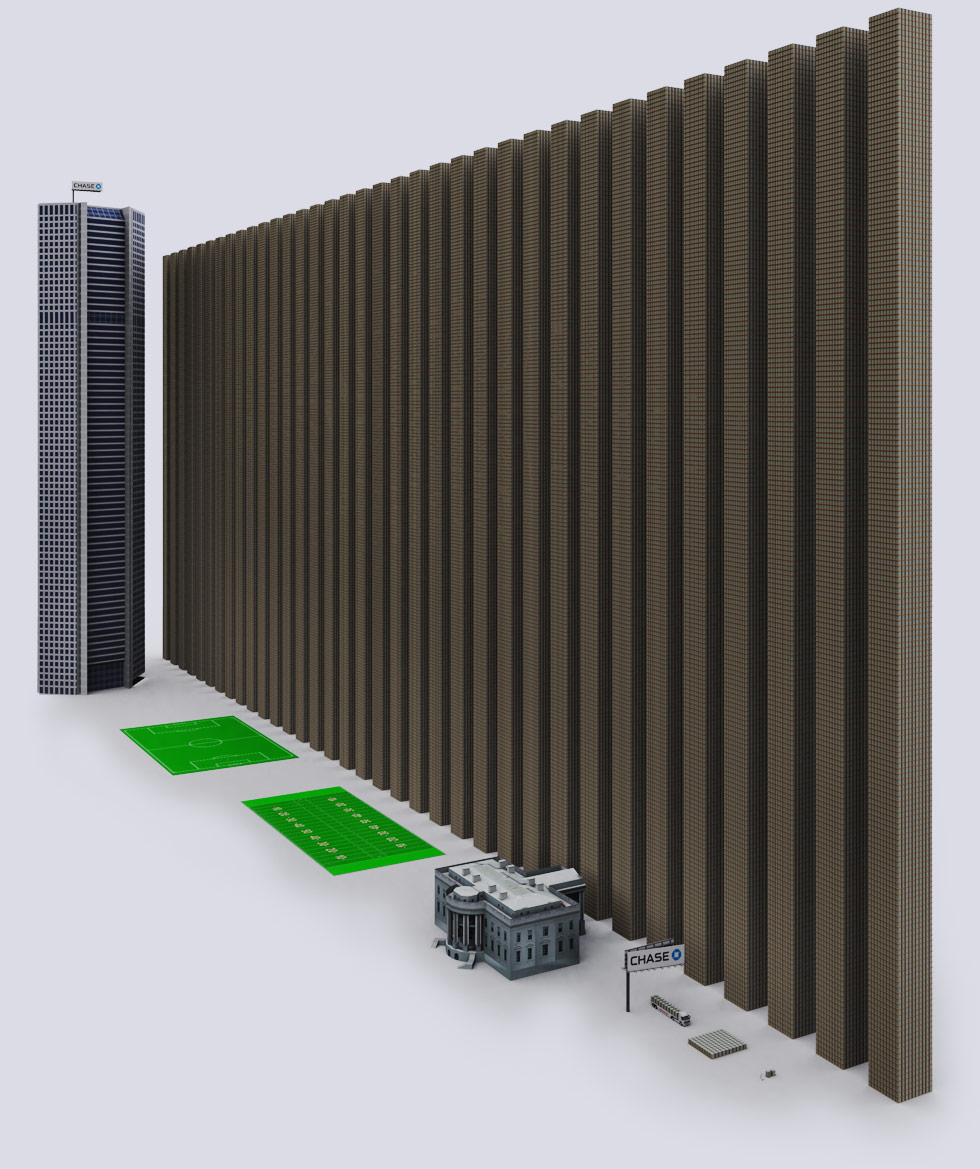

| JP Morgan Chase (JPM) |

- JP Morgan Chase has a derivative exposure of $70.151 Trillion dollars.

- $70 Trillion is roughly the size of the entire world’s economy.

- The $1 Trillion dollar towers are double-stacked @ 930 feet (248 m).

- JP Morgan is rumored to hold 50->80% of the copper market, and manipulated the market by massive purchases.

- JP Morgan (JPM) is also guilty of manipulating the silver market to make billions.

- In 2010 JP Morgan had 3 perfect trading quarters and only lost money on 8 days.

- Lawsuits on home foreclosures have been filed against JP Morgan.

- Aluminum price is manipulated by JP Morgan through large physical ownership of material and creating bottlenecks during transport.

- JP Morgan was among the banks involved in the seizure of $620 million in assets for alleged fraud linked to derivatives.

- JP Morgan got $25 billion taxpayer in bailout money. It has no intention of using the money to lend to customers, but instead will use it to drive out competition.

- The bank is also the largest owner of BP – the oil spill company. During the oil spill the bank said that the oil spill is good for the economy.

- JP Morgan Chase also received a SECRET $391 billion dollar bailout from the Federal Reserve.

- In 2012, JP Morgan (JPM) took a $2 billion loss on “Poorly Executed” Derivative Bets.

|

Conclusion

There is no government in the world that has this kind of money. This is roughly 3 times the entire world economy. The unregulated market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse. Keep an eye out in the news for “derivative crisis”, as the crisis is inevitable with current falling value of most real assets.

*http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

Related Articles:

1. Derivatives: Their Origin, Evolvement and Eventual Corruption (Got Gold!)

The term “derivative” has become a dirty, if not evil word. So much of what ails our global financial system has been laid-at-the-feet of this misunderstood, mischaracterized term – derivatives. The purpose of this paper is to outline the origin, growth and ultimately the corruption of the derivatives market – and explain how something originally designed to provide economic utility has morphed into a tool of abusive, manipulative economic tyranny. Words: 3355

2. Alf Field: Will Derivative Losses Be Black Swan Event Propelling Gold to $4,500?

To achieve the EW target of $4,500/ozt. on the next upward move [in gold that I laid out in my article Alf Field: Correction in Gold is OVER and on Way to $4,500+!] will require something to trigger substantial new buying of gold. What could that event be? By definition, it will be a surprise to all market participants, a “black swan” event. That doesn’t prevent us from making a guess [and] one likely area from which problems could emerge…[would be] derivatives. [Let me explain why that might well be the case.] Words: 591

literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915

literally no economist in the world who knows exactly how the derivative money flows or how the system works,…we really don’t know what will trigger the crash, or when it will happen, but considering the global financial crisis this system is in for tough times. [If, and when, it happens it] will be catastrophic for the world financial system. If you ever wanted a tool to help yourself or others visualize the staggering magnitude of US debt and derivatives, the infographic below is a good one to share. It visualizes who those 9 too-big-fail banks are, what their derivative exposures are, and what scandals they’ve been lately involved in. Words: 1915

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money