The US banks have lost about 6% this month, underperforming the S&P 500. This week, bank executives issued various warnings about issues such as credit quality and capital markets, which provided insights into the current state of the banking sector.

Could this be an entry point into the banking sector?

US Banks Extend Fall as Investors Assess Sobering Forecasts

U.S. banking stocks declined this week after bank executives cautioned of lower recoveries from investment banking and the potential impact of interest rate cuts that are expected next week.

Their comments sparked worries about the state of the overall banking industry. When interest rates were higher, banks earned more income from loans because they could charge higher interest rates. However, as the Federal Reserve eases monetary policy by lowering interest rates, the increase in banks’ loan income will not be as large as previously expected.

Their comments also come at an interesting time for the economy as investors are trying to resolve bearish and bullish factors – with rate cuts, comes a compression of net interest income (NII), but lower rates could help increase investment and consumer spending. NII is the difference between what a bank earns on loans and what it pays out on deposits.

These recent comments have drawn more attention than the Federal Reserve’s decision to soften its plan to increase the capital requirements for large banks. Initially, the Fed proposed a significant increase in capital requirements to 19%, but after facing pushback from politicians and the banking industry, they decided to scale back the proposal to only 9%.

The growing pessimism about the US banking sector was also intensified by the news that Warren Buffett’s investment company, Berkshire Hathaway (NYSE: BRK.A), reduced its investment in Bank of America by approximately 25 million shares (US$5.4 billion).

Executive Comments on Growth and Revenue

Daniel Pinto, President and Chief Operating Officer of JPMorgan, said analysts’ estimates for its NII in 2025 were “overly optimistic”. He also expects the trading revenue to either remain the same (flat) or increase by up to 2%.

Dan Simkowitz, President of Morgan Stanley, mentioned that initial public offerings (IPOs) and mergers & acquisitions (M&A) activities will be lower than usual for the rest of the year. These activities are important indicators of economic and business growth, so a decrease could suggest a more cautious or uncertain economic environment.

David Solomon, CEO of Goldman Sachs, anticipates a 10% decrease in trading revenue due to slow market conditions in August.

Mark Mason, CFO of Citigroup, forecasted a 4% decline in markets revenue.

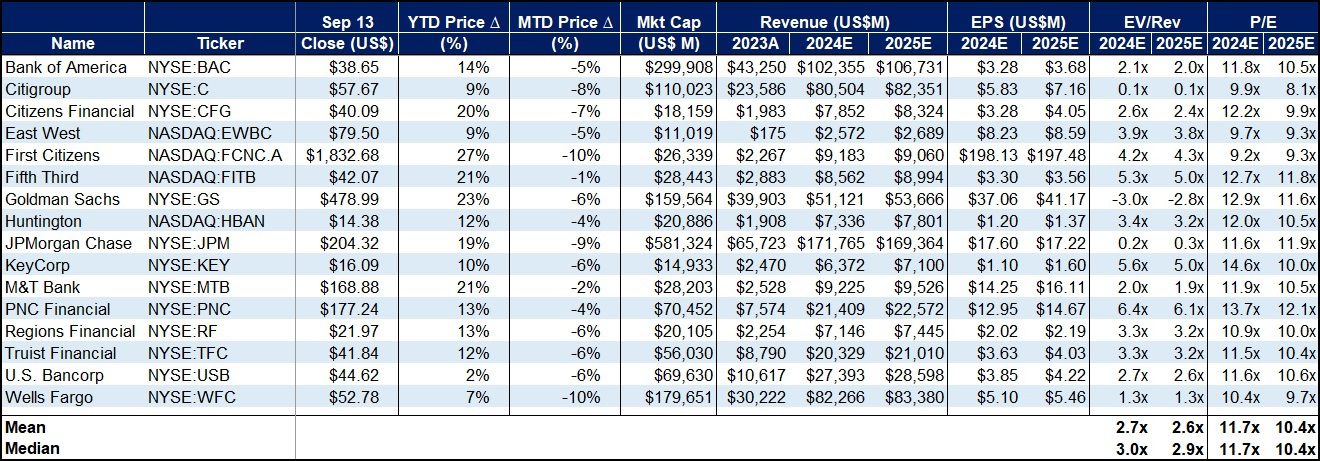

FIGURE 1: US Banking Market Data

Stock Market Reaction – Up for the Year but Down in September

With the S&P 500 up 19% year-to-date, the U.S. bank stocks performance has been mixed, but overall has only averaged 14%.

Citizens Financial (NYSE: CFG), First Citizens (NASDAQ: FCNC.A), Fifth Third (NASDAQ: FITB), Goldman Sachs (NYSE: GS), and M&T Bank (NYSE: MTB) have all registered +20% stock price gains in 2024, while Citigroup (NYSE: C), U.S. Bancorp (NYSE: USB), and Wells Fargo (NYSE: WFC) are all below 9% gains for the year.

In September, with the S&P 500 remaining flat, the banking sector has seen declines across the board, dropping 6% on average.

For example, First Citizens fell by 10%, JPMorgan Chase dropped by 9%, and Wells Fargo declined by 10%, suggesting that the banking sector faced pressures in September compared to the broader market.

EPS Analysis – Trading at Low P/E Multiples

The current S&P 500’s price-to-earnings (P/E) is over 29x and trading at a relatively high valuation compared to historical averages. Over the past five years, the S&P 500’s average P/E ratio ranged between 18x and 22x, currently placing the index in what many analysts might consider “expensive” territory.

With U.S. bank stocks currently trading at an average P/E ratio of 11.7x in 2024 and 10.4x in 2025, these valuations are significantly lower compared to both the current S&P 500 P/E (29x) and the 5-year historical average (20x).

Lower P/E ratios often indicate that a sector is considered undervalued, which could present a buying opportunity for investors anticipating a further recovery in the banking sector.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money