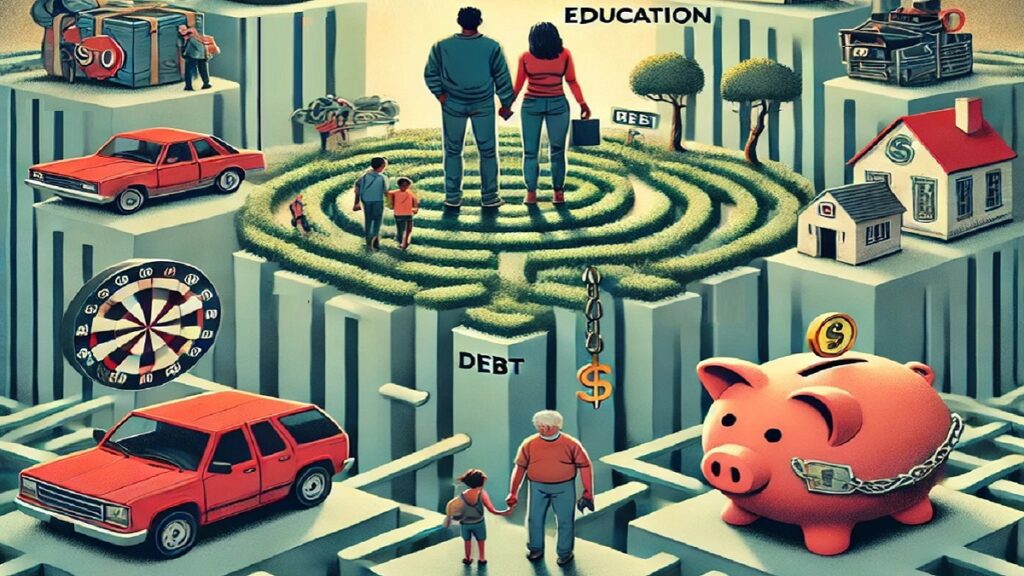

In North America, the dream of leisurely vacations, quality education, and a secure retirement is increasingly out of reach for many.

The economic landscape has shifted, making these aspirations more challenging to achieve. As costs rise and financial pressures mount, the middle-class lifestyle that once seemed attainable now feels distant for many families.

Vacation Struggles

Despite a strong desire to travel, many Americans are finding it difficult to save enough money for vacations.

The rising cost of travel, compounded by inflation, has made international travel particularly expensive.

As a result, there has been a noticeable shift towards domestic travel, which has seen a 9% increase as people seek more budget-friendly options.

However, even domestic travel requires careful planning and strategic budgeting, which adds stress to what should be a relaxing pursuit.

Challenges in Education Savings

Education savings are also under strain. The pandemic has exacerbated financial challenges, with many families unable to afford educational expenses due to the rising costs of education.

Public education funding is in dire need of reform, as recent economic downturns have highlighted the inadequacies and inequities in the system.

This has led to growing concern about the direction of public K-12 education, with many Americans feeling that it is on the wrong path, and questioning how to secure a better future for their children.

What Retirement Savings

Retirement savings present perhaps the most daunting challenge for American households.

Nearly half of American families have no retirement savings, forcing them to rely heavily on Social Security benefits.

The reasons for this are complex, including wages that have not kept pace with inflation, the resumption of student loan payments, and high levels of credit card debt.

Additionally, economic factors like inflation and rising interest rates have made it more difficult to save for retirement, creating a sense of uncertainty about the future.

The Interconnectedness of Financial Struggles

These issues are deeply interconnected, with the rising cost of living directly impacting the ability to save for vacations, education, and retirement.

The American middle-class lifestyle is now 30% more expensive than it was two decades ago, making it increasingly difficult for families to allocate funds for future needs.

This financial strain is not only challenging but also psychologically taxing, as the stress of planning and saving becomes an overwhelming burden for many.

Complex Problems – Complex Solutions

Addressing these financial challenges requires more than just practical tips for cheaper vacations, student bursaries, or better financial planning, it demands a deep understanding of the complex interplay between politics, societal behaviors, and the evolving concept of the “American Dream”.

Legislative gridlock and the polarization of American politics have made it difficult to implement comprehensive reforms that could address these issues at their core.

For example, funding for public education is often tied to local property taxes, leading to significant disparities in the quality of education available to students based on where they live.

Similarly, the debate over Social Security and retirement benefits is deeply political.

While expanding access to retirement savings options sounds straightforward, it runs into the reality of budget constraints and differing views on the role of government in providing for its citizens.

People’s behaviors and choices are also a crucial part of the equation.

The cultural emphasis on consumerism and immediate gratification (“Buy Now, Pay Later”) can often overshadow the importance of long-term financial planning.

Ultimately, addressing these challenges will require a collaborative effort that brings together policymakers, financial institutions, educators, and individuals.

Final Thoughts

The path forward requires both individual initiative and systemic change.

It’s a call to action for policymakers, financial institutions, and individuals to work together to create a more sustainable economic environment where the dreams of vacations, education, and a comfortable retirement are attainable for all.

The first step is acknowledging the challenges and committing to finding solutions that will benefit not just the current generation, but also those that follow.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money