After months of speculation, the Federal Reserve finally handed Wall Street the rate cut it was waiting for, a 50 basis point slash that sent the markets soaring. Stocks, particularly in the tech sector, rallied on the news, and many believe the Fed’s move has increased the odds of a “soft landing.” But while the excitement is palpable, there’s still plenty of uncertainty lurking around the corner. Investors are keeping one eye on the potential risks that come with a slowing economy and a cooling labor market.

Fed’s 50 Basis Point Cut

On September 18, the Fed decided to cut interest rates by 50 basis points, the first reduction of its kind since March 2020. For a while, it wasn’t entirely clear whether we’d see a 25 or 50-basis point cut. But when the larger cut was announced, markets took off, with the Dow Jones, S&P 500, and NASDAQ all climbing. Some say this rate cut may signal the Fed’s readiness to do whatever it takes to support economic growth and steer clear of a labor market slump.

This move didn’t just boost equities. It also relieved a significant portion of market uncertainty, which had been hanging in the air for months. Pundits commented that the cut took away some of that uncertainty and also showed the Fed’s commitment to a more accommodating stance on policy. And markets? They like certainty.

The Hope for a Soft Landing

So, what exactly does this rate cut mean for the broader economy? Investors have been talking up the chances of a “soft landing,” where inflation cools off, and the economy slows just enough to avoid a full-blown recession. The term itself has almost become a mantra in recent months. Sure, the labor market is showing signs of weakening, but so far, no alarm bells are ringing.

Fed Chair Jerome Powell echoed this sentiment at the September policy meeting, saying that they were committed not to fall behind the curve. That determination has given markets reason to believe the Fed might be able to pull off balancing growth and inflation without going overboard. But it’s not all sunshine.

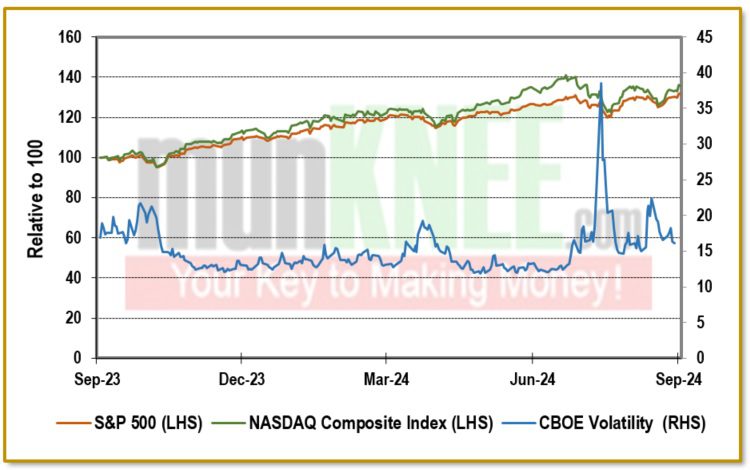

FIGURE 1: The Relative Change in the S&P 500 and NASDAQ Composite in Relation to the VIX

Hedging Against Risk

Despite the optimism, some investors aren’t ready to throw caution to the wind just yet. Defensive stocks saw a rally after the rate cut, showing that market players are still hedging against risk. After all, a lot could still go wrong. Take consumer spending or the labor market, for example. Both could slow down faster than expected, leading to a “growth scare.” If that happens, watch out—the markets could take a sharp turn south.

Powell is maintaining a positive outlook for now, stating he doesn’t see anything signaling an elevated risk of a downturn at the moment. A small uptick in inflation or a significant slowdown in consumer demand could flip the narrative, with investors quickly reversing course.

Inflation Worries Linger

Inflation remains a wildcard. While price increases have been tapering off, they’re still a bit faster than the Fed’s ideal target of 2%. There is also the risk of stagflation, which would be the worst possible outcome, rising prices with sluggish growth. Thankfully, both Powell and other experts don’t seem to think this is likely. But it’s one of those things that could shift the market’s mood almost overnight.

Stock Market Surge: How Long Will It Last?

The rate cut pushed stocks to new highs, but how sustainable is this rally? The Dow, S&P 500, and NASDAQ all closed the week up significantly, with the S&P 500 notching its 39th record high this year. But even though lower rates tend to buoy corporate earnings, there’s a sense that stocks are already priced high after a strong year.

Market volatility may still be a factor and while the Fed has signaled more rate cuts, the market is vulnerable if inflation doesn’t continue to cool and unemployment edges higher.

A Labor Market Slowdown on the Horizon?

Here’s where things get tricky: the labor market. It’s been showing signs of a slowdown, with unemployment creeping up from 3.7% to 4.2% this year. This has many wondering whether the economy is slowing down more than anticipated. If the jobs report disappoints again in the coming months, it could increase pressure on the Fed to act even more aggressively.

Looking Ahead: More Cuts on the Way?

So, what’s next? It seems traders are betting that the Fed will continue on this path, with expectations of another 50 basis points of cuts across the remaining meetings this year.

With the Fed’s next decision set for November, the market will be watching closely. Could we see another sharp cut before year-end? If Powell’s recent comments are anything to go by, we might. His emphasis that the Fed’s not falling behind is boosting confidence that more cuts could be on the way, especially if the data supports it.

But, as always, we’re left with one big question: How long can the rally last? The coming months will tell us a lot more.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money