Over the past five years, the volatility in the financial markets has been driven by economic events, changing interest rates, and shifting market sentiment.

Gold, often regarded as a haven during uncertain times, has seen its price fluctuate considerably.

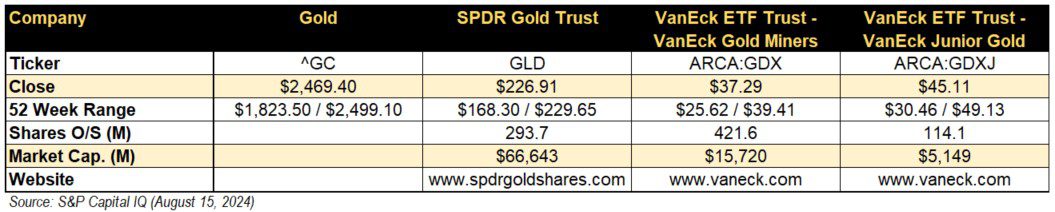

Besides physical gold, ETFs like the SPDR Gold Trust (NYSE: GLD), VanEck Gold Miners ETF (ARCA: GDX), and VanEck Junior Gold Miners ETF (ARCA: GDXJ) offer investors exposure to gold and gold mining companies.

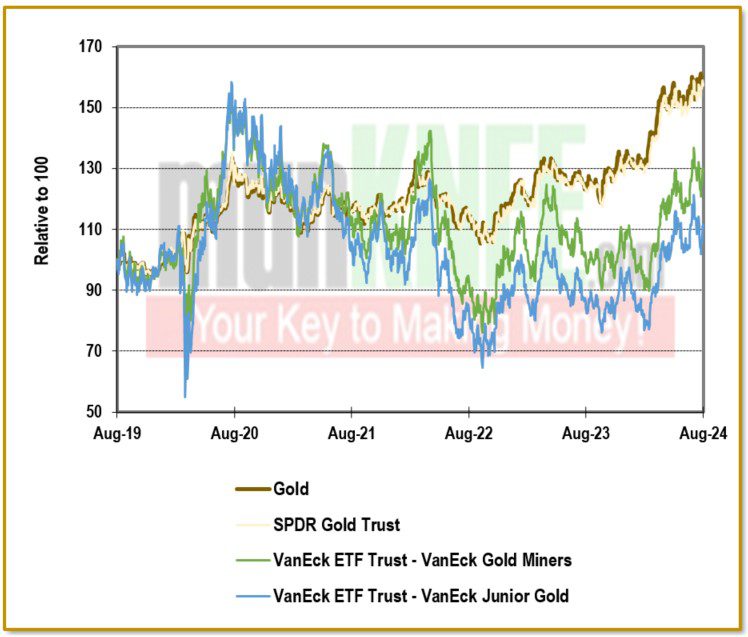

Comparing the actual and relative gains, the performance of these assets over the past five years has fluctuated widely, influenced by market and economic factors.

Gold’s Performance

The gold price has shown significant volatility over the past five years, with global economic uncertainty, geopolitical tensions, and the COVID-19 pandemic driving demand for safe-haven assets.

In August 2019, gold was trading at approximately $1,542 per ounce. The onset of the pandemic in early 2020 saw gold surge to an all-time high of over $2,000 per ounce by August 2020, as investors flocked to safety amid market fears.

However, as the global economy began to recover, and central banks, particularly the U.S. Federal Reserve, signaled the tightening of monetary policy, gold prices faced downward pressure.

Today, gold closed at $2,469 per ounce, representing a total gain of approximately 60% over the five years, reflecting gold’s role as a store of value during periods of economic stress.

Performance of Gold ETFs

The SPDR Gold Trust (GLD) is one of the most popular ETFs for investors seeking direct exposure to gold prices. Over the same period, GLD’s performance closely mirrored that of physical gold, with an overall gain of about 58%. In Figure 2, the two lines are almost indistinguishable.

The ETF’s price fluctuations aligned with gold’s movements, peaking during the height of the pandemic and then gradually declining as interest rates rose and economic conditions stabilized. The slight underperformance relative to gold itself can be attributed to the costs associated with the fund’s fees, which slightly erode returns over time.

The VanEck Gold Miners ETF (GDX), which tracks the performance of gold mining companies, offers a different kind of exposure. Mining stocks are generally more volatile than gold itself because they are influenced not only by gold prices but also by the operational performance of the companies, including production costs, exploration success, and geopolitical risks.

Over the past five years, GDX’s performance saw more pronounced highs and lows compared to GLD, with a cumulative gain of only 30%.

While this represents a decent return, it is half the increase seen in the price of gold. This underperformance can be explained by the additional risks that mining companies face, such as rising operational costs, geopolitical instability in key mining regions, and the impact of rising interest rates, which increase the cost of capital for these companies.

FIGURE 1: Market Data Table – Gold and Gold ETFs

Junior Miners and Volatility

The VanEck Junior Gold Miners ETF (GDXJ) focuses on smaller, more speculative mining companies. These companies typically have higher growth potential but also higher risk.

During periods of rising gold prices, junior miners can see outsized gains as their smaller size and higher leverage to gold prices make them more responsive to market movements. However, this also means that during periods of declining gold prices, junior miners can underperform significantly.

As such, GDXJ is often more volatile than both GDX and GLD. Over the past five years, GDXJ recorded a gain of less than 12%. This modest increase compared to gold, GDX, and GLD highlights the higher risks associated with junior miners, which are more sensitive to operational challenges and financing difficulties.

Impact of Economic Events and Interest Rates

The past five years have been marked by several key economic events that have influenced the performance of gold and gold-related ETFs. The COVID-19 pandemic led to unprecedented economic disruption, driving demand for gold as a safe-haven asset. Central banks around the world responded with massive monetary stimulus, which supported gold prices and, by extension, the performance of GLD, GDX, and GDXJ.

However, as the global economy began to recover and inflationary pressures emerged, central banks, particularly the Federal Reserve, started to tighten monetary policy. Rising interest rates are typically negative for gold because they increase the opportunity cost of holding non-yielding assets like gold. This led to a cooling of gold prices and, consequently, the performance of gold-related ETFs.

GDX and GDXJ were particularly affected by rising interest rates, as higher rates increase the cost of capital for mining companies and can negatively impact their profitability.

Additionally, the broader stock market volatility influenced the performance of these ETFs. During periods of market stress, mining stocks can experience sharp declines, even if gold prices remain stable, due to broader market sell-offs.

No Certainty for Gold Investors

The past five years have been a period of significant volatility and change in the global economy, impacting the performance of gold and gold-related ETFs.

Gold itself increased by over 60%, reinforcing its role as a reliable store of value during turbulent times. The SPDR Gold Trust (GLD) closely followed gold’s performance, albeit with slightly lower returns due to fund-related expenses.

However, the VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ) significantly underperformed relative to gold, with the latter barely making gains over the five years.

This analysis underscores the importance of understanding the distinct risks and factors that influence different types of gold-related investments.

While physical gold and ETFs like GLD provide more stable returns, gold miners, particularly junior miners, carry additional risks that can significantly impact their performance. Investors must weigh these factors carefully when considering exposure to the gold market.

FIGURE 2: Comparison Chart (5-Year)- Gold vs Gold ETFs

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money