Donald Trump has outlined a series of cryptocurrency policy proposals aimed at positioning the United States as a global leader in the digital asset space.

Central to these proposals is his commitment to retain 100% of all Bitcoin currently held or acquired by the U.S. government. This would establish what he refers to as a “strategic Bitcoin stockpile,” positioning Bitcoin as a national financial reserve.

Trump’s policy also includes the formation of a presidential advisory council dedicated to cryptocurrency. This council would be tasked with advising on regulatory frameworks and ensuring that the U.S. remains competitive in the rapidly evolving digital currency landscape.

Trump’s shift towards a pro-cryptocurrency stance represents a significant departure from his earlier skepticism. Initially, Trump was a vocal critic of digital assets, labeling Bitcoin a “scam” and expressing concerns about its volatility and potential for facilitating illegal activities.

However, in recent years, Trump has embraced the potential of cryptocurrency, recognizing its growing influence and appeal among investors and tech entrepreneurs. His proposals indicate a strategic move to align with the burgeoning crypto industry, which has seen significant growth and mainstream adoption.

Political Strategy and Fundraising Tied to Cryptocurrency

Trump’s embrace of cryptocurrency is also closely tied to his broader political strategy, particularly in terms of fundraising.

By positioning himself as a pro-crypto candidate, Trump has attracted substantial financial backing from key figures in Silicon Valley and the tech industry. Notable supporters include billionaire investor Peter Thiel and the Winklevoss twins, both of whom have significant stakes in the cryptocurrency market.

The financial support from these tech leaders is not incidental; it reflects a calculated effort by Trump’s campaign to tap into the growing economic power of the cryptocurrency industry.

The selection of JD Vance as Trump’s vice-presidential running mate further underscores this strategy. Vance, who has deep ties to Silicon Valley, has been instrumental in securing substantial financial support from the tech community.

In June of this year, Vance helped organize a $12 million fundraiser for Trump, attended by prominent venture capitalists and tech entrepreneurs. This influx of capital from the crypto and tech sectors is a clear indicator of the industry’s belief that a Trump presidency would result in a more favorable regulatory environment for digital assets.

Intersection of Cryptocurrency with Gold and Silver Investing

The rise of cryptocurrencies, particularly Bitcoin, has introduced a shift in the investment landscape, challenging traditional asset classes such as gold and silver. Both gold and silver have long been considered safe-haven assets, valued for their stability and ability to hedge against inflation and economic uncertainty.

However, the emergence of digital currencies has sparked debates about their impact on precious metals markets.

On one hand, cryptocurrencies and precious metals share certain attributes; both are seen as alternatives to fiat currencies and are considered hedges against inflation. However, their inherent differences—cryptocurrencies being digital and decentralized, while gold and silver are tangible commodities—result in distinct market behaviors.

The introduction of gold-backed cryptocurrencies further complicates this relationship, as these digital assets aim to combine the stability of gold with the convenience of blockchain technology.

Gold-backed cryptocurrencies peg their value to physical gold, offering less volatility compared to traditional cryptocurrencies like Bitcoin. This innovative approach has attracted investors seeking a digital representation of gold, but it also introduces risks related to the physical storage and management of the underlying assets.

Impact of Trump’s Cryptocurrency Policies on Gold and Silver Markets

Trump’s cryptocurrency policies, particularly his proposal to establish a strategic Bitcoin stockpile, could have significant implications for the gold and silver markets.

By positioning Bitcoin as a national reserve asset, Trump’s strategy could alter the traditional role of gold and silver as primary stores of value. If Bitcoin is increasingly seen as a legitimate reserve asset, it could potentially divert investment flows away from gold and silver, particularly among investors seeking higher returns and those willing to embrace the volatility associated with digital currencies.

However, the relationship between cryptocurrencies and precious metals is not straightforward. While cryptocurrencies offer high potential returns, they are also highly volatile and lack the intrinsic value that gold and silver possess.

Gold and silver have been used as stores of value for centuries, providing a level of stability that cryptocurrencies have yet to achieve. During periods of economic uncertainty, investors might still flock to gold and silver due to their historical stability and physical tangibility. Conversely, in a bullish market for digital assets, the allure of rapid growth in cryptocurrency valuations could overshadow the traditionally more stable returns from precious metals.

The market capitalization of cryptocurrencies, although growing, remains relatively small compared to that of gold and silver. This suggests that while cryptocurrencies may impact the investment appeal of precious metals, they are unlikely to completely overshadow gold and silver in the near term. Instead, the rise of cryptocurrencies could lead to a more diversified investment landscape, where digital assets and precious metals coexist as complementary components of an investment portfolio.

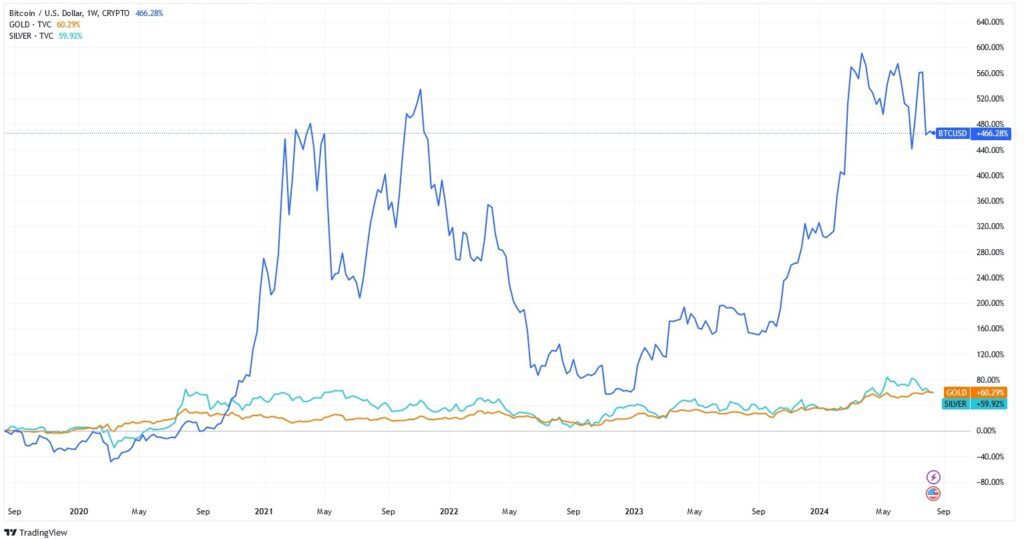

FIGURE 1: 5-Year Chart – Bitcoin (up 466.3%), Gold (up 60.3%), and Silver (up 59.9%)

Regulatory Challenges and the Future of Cryptocurrency and Precious Metals

One of the key aspects of Trump’s cryptocurrency strategy is his criticism of the current regulatory framework.

Trump has promised to replace SEC Chairman Gary Gensler, who has been a vocal advocate for applying traditional financial regulations to digital assets. This move could lead to a more lenient regulatory environment for cryptocurrencies, potentially spurring innovation and growth in the sector.

However, it also raises concerns about reduced oversight, which could increase the risks of fraud and market manipulation within the cryptocurrency industry.

For gold and silver markets, the regulatory environment will also play a crucial role in determining their future relationship with cryptocurrencies. A more crypto-friendly regulatory landscape could lead to increased adoption of gold-backed cryptocurrencies, further integrating precious metals with digital assets. However, this integration will depend on the effectiveness of regulatory frameworks in ensuring the security and transparency of these asset-backed digital tokens.

Public and Industry Reaction to Trump’s Cryptocurrency Strategy

The reaction to Donald Trump’s cryptocurrency proposals has been mixed, reflecting the diverse perspectives within the crypto community and the general public.

On one hand, many in the cryptocurrency industry have expressed strong support for Trump’s pro-crypto agenda, particularly his promises to retain government-held Bitcoin and to support domestic mining operations.

This support is often driven by the belief that Trump’s policies could lead to a more favorable regulatory environment, which would benefit investors and entrepreneurs in the sector.

However, there are also voices of caution and skepticism. Some industry participants are wary of the potential consequences of Trump’s proposals, particularly the creation of a government-held Bitcoin reserve.

Concerns have been raised about the concentration of Bitcoin in the hands of the government, which could lead to increased market volatility if these reserves were ever sold. Additionally, while Trump’s promises of deregulation are appealing to some, others worry that a lack of oversight could exacerbate existing issues within the cryptocurrency market, such as fraud and consumer protection.

In contrast, investors in gold and silver may view Trump’s cryptocurrency policies with a degree of caution, recognizing the potential for these policies to impact the traditional roles of precious metals in investment portfolios. The mixed reactions underscore the complexities of integrating cryptocurrency into the broader financial system and the challenges that lie ahead for policymakers.

Final Thoughts

Donald Trump’s cryptocurrency strategy, with its emphasis on retaining government-held Bitcoin and fostering a crypto-friendly regulatory environment, represents a significant shift in the U.S. approach to digital assets.

While this strategy has the potential to impact gold and silver markets, particularly by diverting investment flows towards cryptocurrencies, the relationship between these asset classes is complex and multifaceted.

As the financial landscape continues to evolve, the interplay between cryptocurrencies and precious metals will remain an area of keen interest for investors and policymakers alike.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money