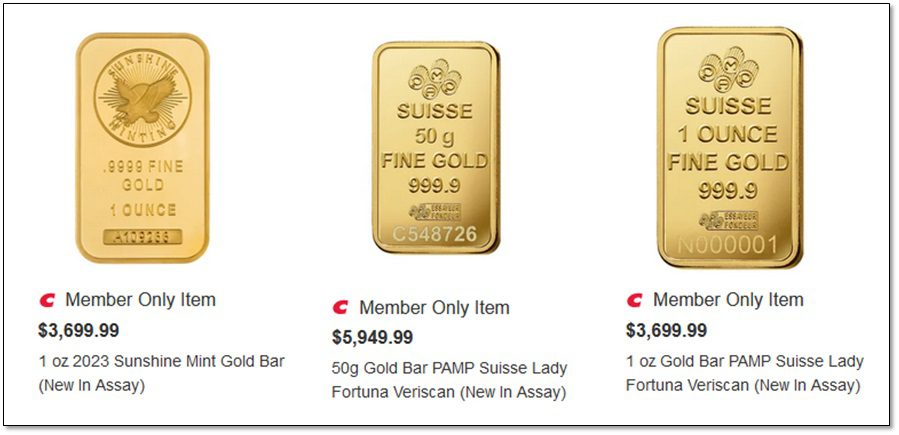

Costco Wholesale Corporation (NASDAQ: COST), known for offering everyday household goods at competitive prices, has also been highly successful in selling gold bullion. During its Fiscal Q4/2024 earnings call on September 26, 2024, Costco revealed that sales of gold bars and jewelry surged by double digits, reflecting a significant driver of its non-food sales growth. Gold bullion sales have become an integral part of Costco’s e-commerce business, contributing to a 18.9% growth in e-commerce comparable sales for the quarter.

As economic uncertainty continues and inflationary pressures drive interest in tangible assets, more consumers are turning to gold as a hedge. Costco has capitalized on this trend by offering gold bullion at competitive prices through its online platform, appealing to both investors and members seeking to diversify their assets. During the earnings call, executives noted that “continued strength in bullion was a meaningful tailwind to e-commerce comps,” underscoring the importance of gold in driving Costco’s broader digital growth strategy.

Gold Shining E-commerce Growth

That 18.9% growth in e-commerce? Gold sales were a huge part of it. Adjusting for foreign exchange, the growth hit 19.5%. High-ticket items like gold don’t just bring in casual shoppers; they attract serious buyers, reinforcing Costco’s image as more than just a big-box retailer.

Other luxury items such as high-end jewelry, toys, seasonal furnishings, and beauty products also saw significant gains as the whole non-food segment enjoyed double-digit growth, thanks in part to these items.

Costco’s Margins and Net Income: Trending Up

Costco didn’t just ride on high sales; they also posted solid profits. Net income for FQ4/2024 came in at $2.354 billion, or $5.29 per share, up from $2.16 billion (or $4.86 per share) a year ago. That’s a 9% year-over-year increase, with earnings per share also rising by 12.6% when you adjust for certain tax benefits and last year’s extra week in the quarter.

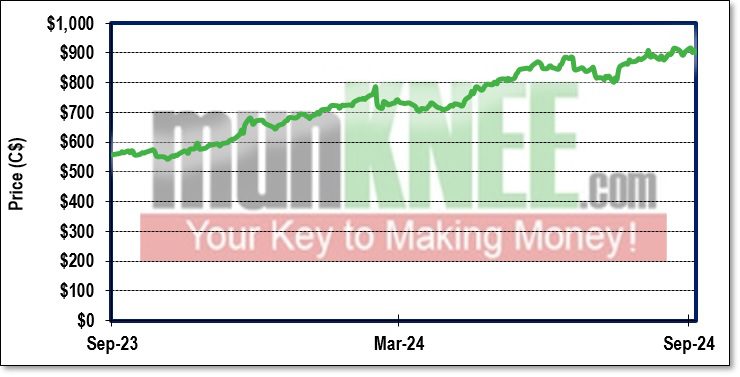

Unfortunately, Costco traded lower on Friday as revenue came in slightly below consensus estimates. Investors are also wary of its high Price-to-Earnings (P/E) multiple at 50x versus the current 30x average for the S&P 500 index and historical median P/E in the 15x to 20x range.

However, other financial metrics remained strong. Costco’s gross margin also improved during the quarter. The reported gross margin for FQ4/2024 was 11%, a 40-basis-point improvement over the 10.6% reported in the same quarter last year. Excluding the impact of gasoline deflation, the margin increased by 33 basis points. This improvement in margin was driven by factors such as strong sales in e-commerce and ancillary businesses, including gas and big-ticket items like appliances and furniture.

The strength in non-food categories, especially gold and jewelry, contributed significantly to Costco’s gross margin growth. E-commerce sales, which include gold bullion, have been highly profitable for the company, benefiting from improved fulfillment efficiency and better sell-through of products. Additionally, Costco’s Kirkland Signature products have continued to perform well, offering members significant value compared to national brands, further boosting margins.

FIGURE 1: Costco Gold Offerings in Canada

Membership Fees Rise, But Memberships Keep Growing

A key development during the quarter was Costco’s decision to increase membership fees, which went into effect on September 1, 2024. The impact of the membership fee increase, however, is expected to be minimal in the early part of F2025 due to deferred accounting, with most of the financial benefits anticipated in the second half of F2025 and into F2026. The increase has been in the works for a while but was delayed due to inflationary pressures and the overall economic situation.

Even with the hike, membership renewal rates didn’t miss a beat. In the U.S. and Canada, renewal rates held steady at 92.9%, while the global rate remained strong at 90.5%. About half of new sign-ups came from people under 40. That’s right, Costco is successfully attracting a younger demographic, which is lowering the average age of its member base. By the end of FQ4/2024, the company had 76.2 million paid household members, up 7.3% from last year and total cardholders jumped 7% to 136.8 million.

New Store Openings Drive Physical Presence

In addition to its strong financial performance, Costco continued its global expansion with the opening of 14 new warehouses during the quarter. Ten of these new stores were located in the U.S., with additional openings in international markets such as Japan, Korea, and China. Costco opened its first-ever warehouse in the state of Maine, bringing the company’s total U.S. store count to 600, and expanded its footprint in Spain with a fifth warehouse.

In F2025, Costco plans to open 29 new warehouses, with 12 slated for international markets. This global expansion reflects the company’s strategic focus on extending its physical presence in key international markets while maintaining a strong base in North America. With a growing number of stores and a diversified product range, including high-demand items like gold bullion, Costco is well-positioned to capitalize on both local and international growth opportunities.

What Does This Mean for Investors?

Costco’s success in FQ4/2024 underscores the strength of its diversified product offerings, including the surge in demand for gold bullion. The company’s ability to leverage its e-commerce platform, improve profitability, and expand its global footprint has allowed it to deliver strong financial results, with net income up 9% and margins improving year-over-year.

As Costco continues to execute its growth strategy, including membership fee increases and new store openings, it is well-positioned for sustained growth in the coming quarters. With a continued focus on providing value to its members, whether through everyday items or luxury goods like gold bullion, the company is poised to remain a leader in both physical and digital retail spaces.

FIGURE 2: Costco 1-Year Stock Chart

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money