This week, Microsoft (NASDAQ: MSFT) announced a $60 billion share buyback and an increase in its dividend by 10%, to $0.83 per share from $0.75.

This follows after announcements from technology companies such as Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOGL), and Meta (NASDAQ: META).

In May, Apple announced plans to repurchase $110 billion in stock, one the largest buybacks in U.S. history, even after acquiring over $392 billion worth of stock in the past five years.

Google continues to buy back shares and, according to its financial statements, has acquired over $171 billion worth of stock in the past three years.

According to its financial statement, Meta bought $20 billion in stock in 2023 and $30.9 billion remained “available and authorized for repurchases.” In January, the company authorized an additional $50 billion of potential stock purchases and has already repurchased $21.3 billion as of June 30.

With some companies, such as Chevron (NYSE: CVX) and Phillips 66 (NYSE: PSX), investors can get both stock dividends and the benefits from share buybacks. Chevron is currently paying a 4.5% dividend and plans to buy back $4.0 to $4.75 billion of its shares in the third quarter. Phillips 66 has a 3.5% dividend yield and repurchased $2 billion of shares during the first six months of 2024 and still has $4.9 billion of room in its current plan.

What is a Stock Buyback?

A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the stock market. This action reduces the total number of shares available. This strategy is one of the ways companies can utilize their extra cash. Other options include paying dividends, settling debts, or reinvesting in their operations.

Usually, companies will announce a buyback plan that outlines how much money they intend to spend or how many shares they aim to repurchase. However, these plans can change depending on the company’s priorities or shifts in the market, meaning that not all announced buybacks are completed.

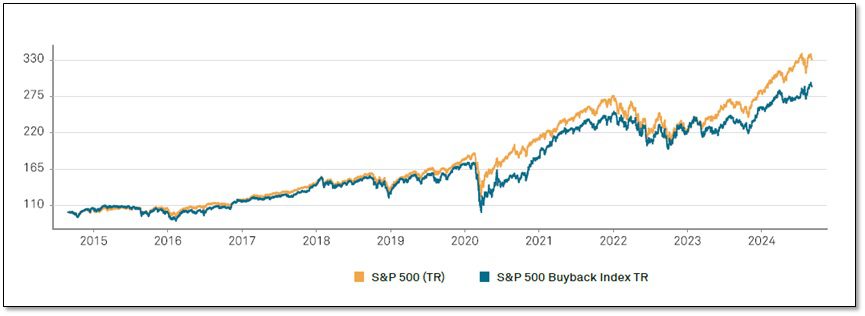

FIGURE 1: Historical Performance S&P 500 vs. S&P 500 Buyback Index

Why Buybacks Matter for Investors

Buybacks are significant to investors because they can boost earnings per share (EPS) by reducing the number of shares in circulation. Furthermore, buybacks can be a more tax-efficient way of repaying money to shareholders than dividends, which are taxed when paid out.

Even minor decreases in the number of shares can accumulate over time, potentially enhancing the returns for investors who keep their stocks. However, it’s crucial to understand that not all buybacks are beneficial; if a company repurchases shares at an inappropriate time or pays excessively, it could negatively impact shareholder value.

Moreover, buybacks might hide stock options given to executives or limit capital available for important growth initiatives or research and development.

Investors need to carefully evaluate whether a company’s buyback strategy fits with its long-term goals. Looking at a company’s history with buybacks can provide insights into how effectively they have been used. It’s wise for investors to be cautious and consider companies that have a proven track record of successful buybacks, as not all companies manage this strategy well.

For more about stock buybacks, read Lorimer Wilson’s article on the Stock Buybacks.

Research on Buybacks

In a 2019 article, J.P. Morgan discussed how U.S. and European companies that bought back over 5% of their shares outperformed the overall market by more than 4% over the last 20 and 25 years, respectively. Similar results were found in Japan over the past 13 years.

Academic research in 2024 found that stock returns during the period following the buyback announcement are positive, which could indicate that the company’s stock is undervalued. In addition, the research found that returns are higher for firms with low growth opportunities and high free cash flow.

In examining the stock price performance for one, two, and three years following the buyback announcement, low growth-high free cash flow companies tended to outperform their benchmark portfolios during these periods.

However, the S&P 500 Buyback Index that is designed to measure the performance of the top 100 stocks with the highest buyback ratios in the S&P 500, tracks below the S&P 500 over the 1-year, 3-year, 5-year, and 10-year periods (see Figure 1) .

U.S. Taxes Stock Buybacks

Facing a backlash from the general public and politicians because they prioritized returning cash to shareholders rather than investing back into the business, the Inflation Reduction Act (“IRA”) introduced a 1% excise tax on buybacks that started in 2023.

U.S. public companies now incur a 1% tax on the value of shares repurchased, leading to millions in extra costs for companies, but new tax revenue for the U.S. government.

Final Thoughts

Investors tend to like things simple and look for strategies to get alpha returns and searching for companies with generous buyback programs is one such system.

However, companies need to execute buybacks effectively to enhance shareholder value while still investing in business.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money