The cryptocurrency realm, already characterized by its unpredictable nature, has once again been thrust into the spotlight as Bitcoin, the pioneering cryptocurrency, recently experienced a rapid price drop.

Bitcoin’s Sudden Plunge

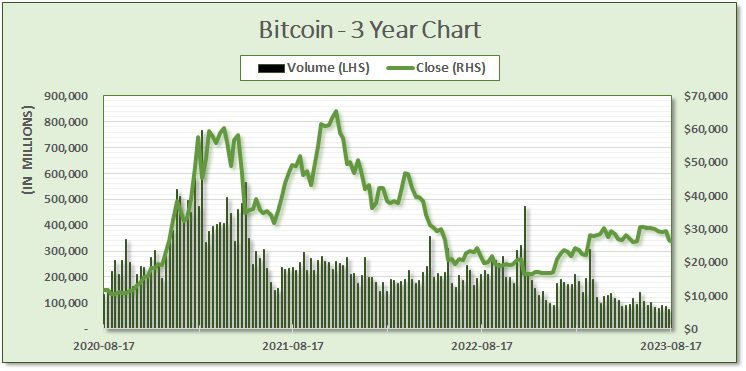

Bitcoin’s relatively stable trajectory was shattered as it experienced a significant price drop. This decline marked one of the most substantial one-day dips since November 2022.

The cryptocurrency, which had shown remarkable resilience, plunged by 7.2% in a single day. While Bitcoin has become synonymous with volatility, this particular drop holds unique significance due to the events that accompanied it.

Bitcoin’s Steep Descent to a Two-Month Low

The price plummet persisted, pushing Bitcoin to a two-month low of $26,172 during an intense period of Asian trading. This level, last seen on June 16, signals a stark departure from the cryptocurrency’s recent stability.

However, this drop was far from a solitary event, as the broader market sentiment was also undergoing profound shifts.

Global Market Ripples

Cryptocurrency-related stocks, including Coinbase (Nasdaq: COIN), Marathon Digital (Nasdaq: MARA), and Riot Platforms (Nasdaq: RIOT), experienced a retreat in their value, and affected other cryptocurrencies, such as Ether, Cardano, and Solana, which also dropped 2% to 5%.

The cryptocurrency market’s turmoil seems to be in lock step with the global financial markets. Wall Street’s key indices experienced downward trends, and Asian shares braced for their third consecutive week of losses.

This broader market tumult can be attributed to concerns over China’s economic trajectory and apprehensions about sustained higher U.S. interest rates. However, the interconnectedness between the cryptocurrency market and traditional financial markets became more evident than ever.

Was SpaceX the X-Factor Catalyst?

While initial theories pointed to Elon Musk’s SpaceX and its Bitcoin write-down or liquidation as the prime catalyst, a nuanced understanding reveals a more intricate narrative.

While the Wall Street Journal’s report spotlighted SpaceX’s Bitcoin holdings, attributing the entire market tumble solely to this event overlooks the broader context. A confluence of factors, including macroeconomic uncertainties, regulatory concerns, and retail investor sentiment, contributed to the sudden downturn.

Crypto’s Outlook

Bitcoin’s recent plunge serves as a stark reminder of the multifaceted nature of the cryptocurrency market. The recent events underscore the volatile nature of the cryptocurrency landscape and the dynamic interplay between various market influencers.

Regulatory developments, economic news, and high-profile figures like Elon Musk have a cumulative impact on market sentiment. It is evident that the cryptocurrency market is not an isolated entity but is intertwined with global financial dynamics.

About the Writer:

Chris Thompson, CFA, MBA, P.Eng, is the President and Director of Equity Research at eResearch. He is a Professional Engineer and CFA Charterholder with an MBA in Investment Management and over 14 years of experience in the Capital Markets covering industries including mining, software development, FinTech, telecommunications, and technology.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money