The increasing significance of artificial intelligence (AI) has led to a surge in investments and acquisitions by US-based, large tech companies, often referred to as “Big Tech.”

These “Big Tech” companies, including Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT), are using AI to stay ahead in the competitive technological landscape.

Big Tech’s Push Towards AI

Over the past decade, major tech companies have aggressively pursued AI-related acquisitions to strengthen their technological capabilities and maintain a competitive edge.

This trend has accelerated in recent years, with companies such as Alphabet, Amazon, Apple, and Microsoft leading the way.

Strategic acquisitions are not only about acquiring technologies but also about integrating AI into core business strategies and improving existing products.

For example, Apple has made more than 30 AI-related acquisitions in the last decade, significantly contributing to the development of features for its flagship products like Siri.

Similarly, Google’s acquisition of DeepMind in 2014 had a substantial impact on AI research and development, positioning the company as a leader in the field.

Microsoft’s Strategic Investment in OpenAI

One of the most significant AI investments in recent years is Microsoft’s multi-billion-dollar partnership with OpenAI.

Microsoft initially invested $1 billion in OpenAI in 2019, followed by additional investments in subsequent years, making it one of the largest strategic AI partnerships in the industry.

This collaboration has allowed Microsoft to integrate OpenAI’s advanced language models into its products, including Azure’s cloud services and the Office 365 suite.

The partnership emphasizes Microsoft’s commitment to leading the AI revolution, positioning itself as a central player in the development of generative AI technologies.

FIGURE 1: Market Data Summary

The Role of Mergers and Acquisitions in AI Strategy

Mergers and acquisitions have become a central strategy for Big Tech companies seeking to dominate the AI landscape.

These acquisitions often serve multiple purposes: acquiring cutting-edge technologies, attracting top talent, and eliminating potential competitors. Furthermore, these moves allow tech giants to expand into new markets and diversify their offerings.

A notable example is Nvidia’s (NASDAQ: NVDA) recent acquisition of Run, an AI infrastructure company. Run specializes in optimizing GPU compute resources for AI and deep learning workloads, and this acquisition is expected to enhance Nvidia’s ability to offer comprehensive AI solutions to its customers.

Similarly, AMD’s (NASDAQ: AMD) acquisition of Silo AI, the largest private AI lab in Europe, aims to accelerate the company’s AI ambitions by bringing in the necessary talent and resources to develop advanced AI solutions.

Strategic Collaborations in Generative AI

In addition to acquisitions, strategic collaborations have also played a crucial role in Big Tech’s AI strategy.

Amazon’s partnership with Anthropic, a leading AI research company, is a notable example. Amazon has invested $4 billion in Anthropic to deepen its collaboration on advancing generative AI technologies. This partnership aims to enhance Amazon Web Services (AWS) by integrating Anthropic’s AI models into Amazon Bedrock, AWS’s fully managed service.

This collaboration highlights the importance of generative AI in shaping the future of technology. Companies are increasingly focusing on generative AI as a key area for innovation, with applications ranging from improving user experiences to creating new business models.

Challenges in the AI Acquisition Landscape

Despite the aggressive pursuit of AI acquisitions, Big Tech companies face several challenges, particularly on the regulatory front. The regulatory climate in the United States and Europe has become stricter, with increased antitrust scrutiny.

This led to a decline in acquisitions by Big Tech, reaching an 18-quarter low in the second quarter of 2023.

However, despite these challenges, the race for AI dominance continues. Companies are exploring new ways to integrate AI into their operations while navigating the complex regulatory landscape.

The importance of AI strategy continues to grow, prompting these companies to continue their investments, albeit with greater caution and consideration of potential regulatory implications.

The Future of AI Investments

Looking ahead, the AI market is expected to continue its rapid growth, with projections suggesting it could reach $900 billion by 2026.

This growth is fueled by massive investments from technology providers and venture capitalists. AI and machine learning companies raised $22.7 billion from venture capitalists during the first quarter of 2023.

As AI continues to evolve, we can expect to see more acquisitions and strategic collaborations in this field. Companies that successfully integrate AI into their operations and products will likely maintain a competitive advantage, shaping the future of technology and influencing global economic trends.

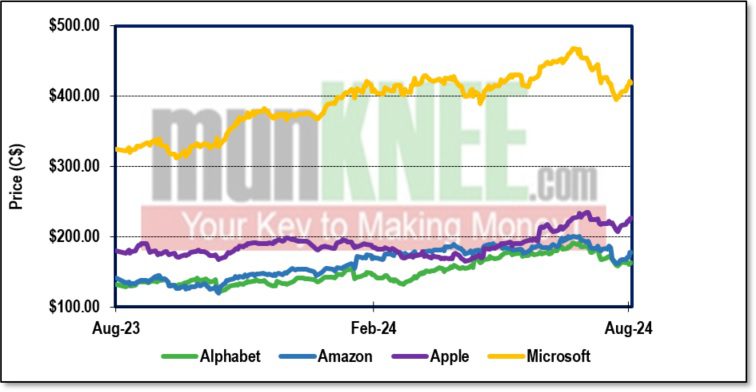

FIGURE 2: Stock Chart (1-Year)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money