The United States has been keeping a close eye on its trade relationships over the years. In 2023, trade deficits with many key partners were a major focus. These deficits are influenced by everything from policy changes to shifts in the global economy.

While the numbers may change, the fundamental challenges frequently remain the same: striking a balance between free trade and preserving domestic businesses.

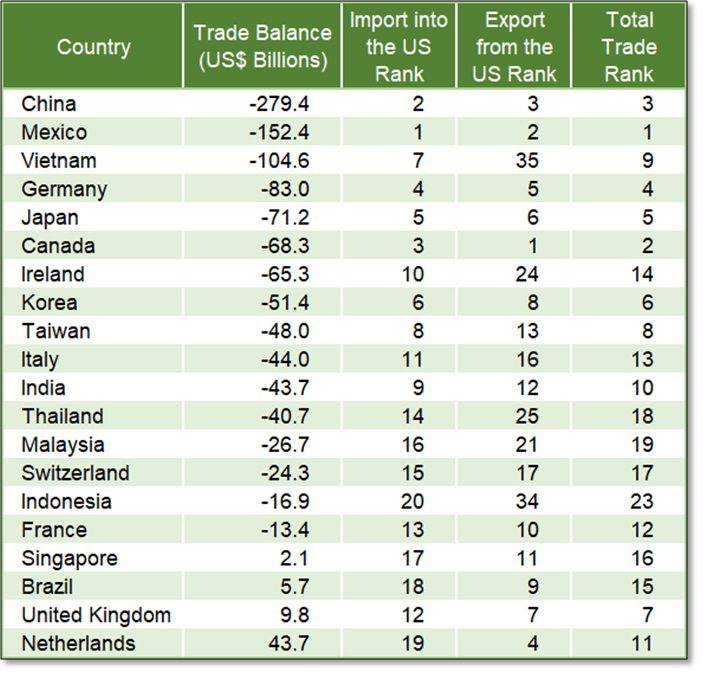

Top Trading Partners and Trade Deficits

In 2023, the US’ biggest trading partners were Mexico, Canada, and China. Together, these three countries made up 42% of all US trade. Mexico led with $798.8 billion, followed closely by Canada and China, although the gap between Canada and China is getting smaller. While they are important trading partners, the trade balance isn’t always equal.

In fact, the US had a trade deficit with over 100 of its 234 trading partners last year. The six largest deficits give us a sense of where the US is spending more than it’s earning:

- China: $279.4 billion

- Mexico: $152.4 billion

- Vietnam: $104.6 billion

- Germany: $83.0 billion

- Japan: $71.2 billion

- Canada: $68.3 billion

Deficits like these frequently spark disputes about fairness in trade procedures. Some believe that these figures demonstrate the necessity for tighter restrictions, while others view them as part of the normal give-and-take of global trade.

Current Trade Agreements

The US has various trade agreements that govern how it conducts business with other countries. These agreements attempt to decrease trade barriers, such as tariffs, and make it easier for goods and services to traverse borders.

Here are some of the most important ones:

- USMCA: This agreement between the US, Mexico, and Canada replaced NAFTA in 2020. It’s designed to make trade fairer and includes a review process set for 2026. If not renewed, it has a 16-year sunset clause.

- The African Growth and Opportunity Act (AGOA): It facilitates African countries’ access to US markets and will expire in 2025 unless renewed.

- Bilateral Free Trade Agreements (FTAs): The US has individual agreements with countries like Australia, South Korea, and Chile. These don’t have specific end dates, so they remain in place indefinitely unless revised.

- Generalized System of Preferences (GSP): This program was meant to help developing countries by giving them duty-free access to the US market. Unfortunately, it expired at the end of 2020, and Congress hasn’t renewed it yet.

Each agreement has its own objectives and obstacles. Some concentrate on certain industries, while others seek to increase commerce overall.

FIGURE 1: US Trade Balance and Import/Export Rankings by Country (2023)

Tariffs and Key Focus Areas

Tariffs are taxes on imports, and they’re often used as tools to address trade imbalances or protect domestic industries.

In recent years, the US has placed a lot of attention on three key countries: China, Mexico, and Canada.

- China: The US has a significant trade deficit with China, a long-standing issue. Concerns about unfair tactics, intellectual property theft, and market access have resulted in significant tariffs. The expectation is that these sanctions will encourage China to adjust its trade policies and lower the imbalance.

- Mexico and Canada: As major trading partners and members of the USMCA, these countries are scrutinized to ensure they are following the requirements. Tariffs have been used as leverage to address concerns in industries like agriculture and automotive manufacturing.

Even though other countries like Vietnam and Germany also have large deficits with the US, the sheer volume of trade with China, Mexico, and Canada makes them a bigger focus. Geopolitical factors also play a role, as these countries are either geographically close (Mexico and Canada) or have a major impact on global supply chains (China).

What’s Next for US Trade?

Looking ahead, the US trade landscape is likely to keep evolving. The joint review of the USMCA in 2026 could bring changes to how the US trades with Mexico and Canada. If the agreement isn’t renewed by 2036, it will expire, which could lead to new negotiations.

At the same time, the focus on reducing trade deficits isn’t going away, especially with China. Trade deficits aren’t just about policy as they are influenced by a lot of factors, such as currency exchange rates, savings and investment levels, and the overall health of the global economy.

Another big shift is the growing importance of digital trade and services. As these sectors become more important to the economy, the US may have to reconsider how it analyzes trade agreements. Future agreements may place a greater emphasis on intellectual property protection and digital economy regulation.

Final Thoughts

Trade is a complex balancing act. While the US seeks to lower its deficits with key partners such as China, Mexico, and Canada, the figures do not tell the whole story. Services, digital trade, and strategic goals all influence trade policies.

As the global economy evolves, the US will need to adapt. Whether it’s updating existing agreements or finding new ways to compete, staying ahead in the global market will take a mix of strategy and flexibility.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money