“Follow the munKNEE.com” via twitter & Facebook

It would seem logical that the precious metals should be moving a lot higher after the FOMC announced its latest QE program. How is it possible that the market is dumping like this, in conjunction with a concomitant decline in the dollar? [Let me] explain from a technical perspective what is happening. Words: 700; Charts: 3

after the FOMC announced its latest QE program. How is it possible that the market is dumping like this, in conjunction with a concomitant decline in the dollar? [Let me] explain from a technical perspective what is happening. Words: 700; Charts: 3

So writes Dave Kranzler (www.truthingold.blogspot.ca/) in edited excerpts from his article* as originally posted on Seeking Alpha under the title What’s Going On With Gold And Silver?.

This article is presented compliments of www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Whether or not you want to believe that the Comex metals markets are manipulated, there is no question that there is a high correlation between sharp market moves in gold and silver and moves in the open interest of Comex gold/silver futures. This has been a pattern that has persisted and repeated for at least the 12 years I’ve been tracking this market.

The cycle goes something like this:

- As the metals move higher, the large hedge funds increase the size of their long position.

- This tends to accelerate as the market momentum to the upside increases.

- At the same time – being that futures are zero-sum market (i.e. for every buyer there’s a corresponding seller) – the commercial segment (largely the so-called bullion banks who make active markets in gold/silver futures, among other bullion market functions) – increases its concentrated short position by a like amount….

What happens to create these sharp sell-offs once the open interest has reached a certain level, is the market starts to experience large offerings of paper, often time in the more illiquid periods of overnight electronic trading during Asian market hours and always right at the Comex floor opens. This sets off the stop-losses set by the large hedge fund computer “black box” models and creates the well-known “waterfall” chart formation that occurs repeatedly over time on the Comex. This has occurred ever day this week on the Comex and this one is today’s:

March Comex Silver – today

As you can see, the price of silver has held steady throughout the overnight trading (attributable to the strong physical buying going on right in India and Asia) but, right as the gold floor is opening on the Comex, silver falls right off a cliff. If you run these charts over time, you’ll see that it’s serially repetitive and in conjunction with the liquidation of COT open interest. Call it manipulation or call it what you want, but it’s a real-time event. Eventually the large spec funds “sell out” of a large portion of their long positon, the commercials cover their shorts and the cycle repeats.

Visit FinancialArticleSummariesToday.com – A site for sore eyes and inquisitive minds!

Although the open interest in silver has only dropped about 10k contracts from its recent peak, the open interest in gold has dropped substantially from its peak of 492,000 in early October to yesterday’s 437.6k….

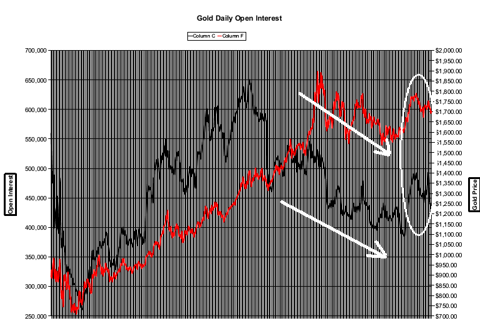

Here’s a chart which shows the dynamic of the open interest climbing and declining with the price of gold over 4 years:

Comex Gold Open Interest vs. Price of Gold

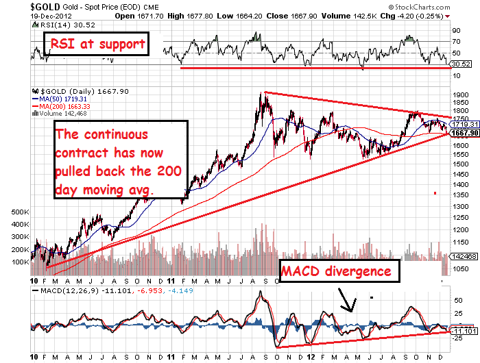

[The above] chart goes from January 2008 to last Friday’s COT report. The red line is the price of gold (right axis) and the black line is the net short interest (left axis) of the commercial segment on the Comex. The white arrows show the recent correlation in movement between the gold open interest on the Comex and the price of gold. You don’t need to be a regression expert to see that the correlation is pretty close to 1.The best chart to show just how irrelevant this current price correction is in the grand scheme of the gold/silver bull market is here:

3-yr Comex Gold

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money