The Rule of 72 is a time-proven method to predict how long is needed for a portfolio or income stream to double. Take a moment and learn more about the benefits of this time-tested tool and how to use it to determine the yield necessary – or the time frame needed – to achieve your goals.

What Is The Rule of 72?

The Rule of 72 is a classic investment and saving rule to easily determine how long it will take an investment to double in size.

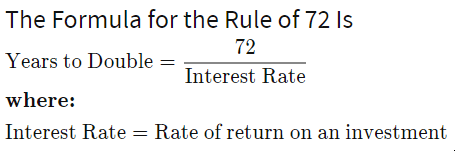

How Is the Rule of 72 Calculated?

It is calculated by taking 72 and dividing it by the percent of return from your investment or savings account. The Rule of 72 can be applied more broadly to any type of compounding growth.

What Is the Advantage of the Rule of 72?

This Rule of 72 can help careful investors calculate how long they need to achieve a desired portfolio size or how many years they need to keep investing all of their returns to achieve a set goal…

What Are the Shortcomings of the Rule of 72?

The problem many savers and investors have with this rule is that they are forced to add in many of their own assumptions to the formula.

- Some will mix in the expected price appreciation of their shares – essentially using the Rule of 72 attached not to the yield of the portfolio but its total return. This assumes an even or flat return in relation to price appreciation. I’m hesitant to advise anyone to do this, ever. Why? The market does not grow at a steady rate, but it moves up and down based on numerous factors that you cannot readily project years into the future…[so] it would be next to impossible to accurately predict portfolio growth using this rule.

- Those using the 72 rule for a “savings account” where there is no “market exposure” will have greater success projecting many years into the future. However, savings accounts carry very low yields, or near zero in today’s interest rate environment. Therefore, they will need significantly more time to achieve the required results.

How To Use The Rule of 72

Knowing a rule and applying it are two different steps altogether…We focus on the income stream vs. the price appreciation aspect…because we understand that market prices will move up and down…[and] you can control the amount of income your investments produce by selecting securities to achieve the desired portfolio yield. As you invest your capital and dividends into new or existing securities, you can maintain the overall portfolio yield and achieve the planned Rule of 72 results – regardless of underlying price action. Retirees or investors building their portfolio for retirement or to produce income to live off should focus more on the cash flow of their portfolio than short-term price movements.

This is the beauty of an income-based target vs. an account balance target. Your portfolio size may rapidly increase but it won’t help you achieve your goal if your goals are income-oriented. Setting targets based on your actual goals will keep you focused.

Examples of How the Rule of 72 Works

If an investor starts with a portfolio of $100,000 and aims to have $80,000 in income annually from his investments alone in retirement, how long does he need to be investing?

| Yield of Portfolio | Years to Reach Goal |

| 10% |

21.6 years |

| 5% | 57.6 years |

| 3% | 120 years |

The time frame it takes to achieve your goal expands exponentially the lower your portfolio yield is. This is because your portfolio yields less income, and that income compounds at a slower rate…

How to Hedge Against Market Volatility

Keeping a yield target in mind is essential when applying the Rule of 72. To hedge against market volatility, you should:

1. adjust your portfolio to contain 45% fixed-income securities – preferred shares, bonds, and baby bonds or funds that contain these items….[because]:

-

- the income produced by these items is more secure than the income from common stock dividends, as they must be paid prior to common dividends and, right now, fixed-income makes a great contrarian investment as investors rapidly move to a risk-on approach. This is creating higher than normal yields in a sector that historically has low yields available.

By being already invested in these securities, you can expect to see strong income generation and price appreciation during a recession that typically lowers portfolio values overall…

2. A second means of hedging is through diversification. We encourage every investor to be invested in no fewer than 40 individual securities or funds…[so that] no individual fund or security can overwhelmingly harm your portfolio. Typically, we suggest an allocation of no more than 1%-3% for the vast majority of the securities we recommend. These securities should not be invested in a single sector but spread across multiple sectors…[so] you have protection via a diversity of both securities and sectors.

Conclusion

The Rule of 72 is a time-proven method to predict how long is needed for a portfolio or income stream to double…I encourage you to take a moment and use this time-tested tool to determine the yield necessary or the time frame needed to achieve your goals….

Editor’s Note: The original article by Rida Morwa, has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The authors’ views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Related Articles from the munKNEE Vault:

1. Rule of 72: A Method To Predict the Time Needed For A Portfolio Or Income Stream To Double

The Rule of 72 is a time-proven method to predict the time needed for a portfolio or income stream to double.

2. The Rule Of 72 Can Help You Reach Financial Goals – Here’s Why & How (+2K Views)

Compounding can be tricky to calculate in your head, however, unless you’re a math whiz. The good news is you can use a mathematical shortcut called the “rule of 72” to quickly estimate how long it takes an investment with a fixed annual return to double in size.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us provide more articles of interest to you.

- Comment below to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money