…The gold-mining sector performs very well during the first 18-24 months of a general equity bear market as long as the average gold-mining stock is not ‘overbought’ and over-valued at the beginning of the bear market according to the historical record.

By Steve Saville (speculative-investor.com/tsi-blog.com). Originally posted* on Gold-Eagle.com under the title Gold Stocks During An Equity Bear Market.

[While the comments made in the introduction above are true the sample size mentioned unfortunately consists of] only two relevant cases.

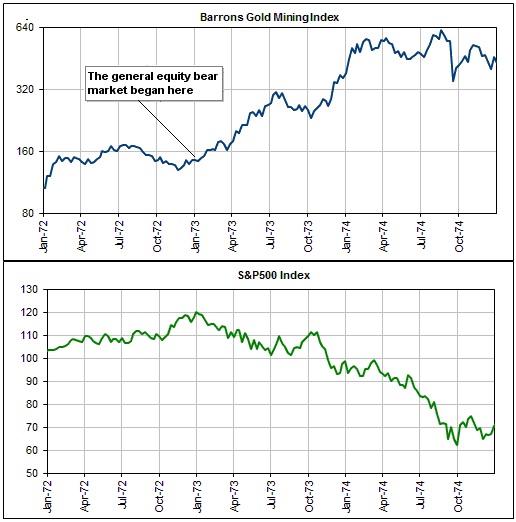

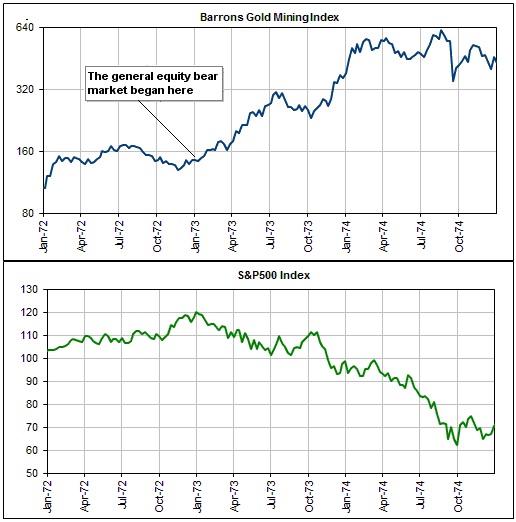

1. The general equity bear market that began in January of 1973 and continued until late-1974. This bear market resulted in peak-to-trough losses of around 50% for the senior U..S stock indices.

The following chart comparison of the Barrons Gold Mining Index (BGMI) and the S&P500 Index shows that the gold-mining sector commenced a strong upward trend near the start of the general equity bear market. During the bear market’s first 20 months, the BGMI gained about 300%.

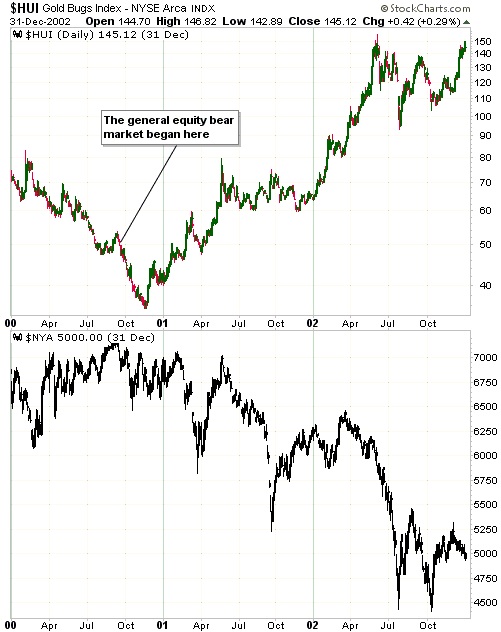

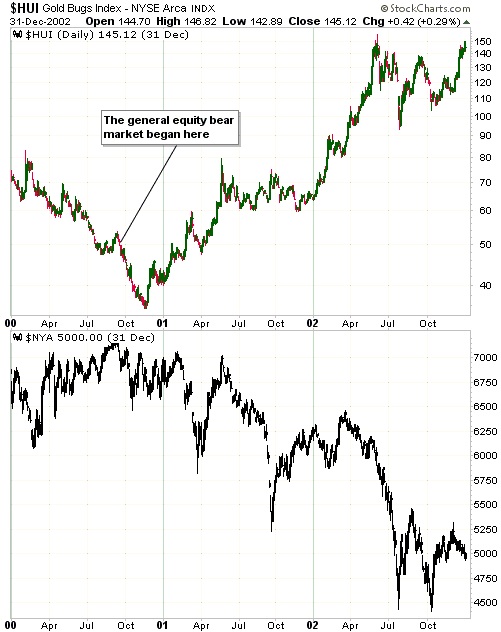

2. The general equity bear market that began in September of 2000 and continued until early-2003. This bear market also resulted in peak-to-trough losses of around 50% for the senior U.S. stock indices.

The following chart comparison of the HUI and the NYSE Composite Index (NYA) shows that the gold-mining sector commenced a strong upward trend about 2.5 months after the start of the general equity bear market. Despite the fact that the HUI suffered a substantial percentage decline during this 2.5-month period, it still managed to gain about 200% over the course of the bear market’s first 20 months.

…The gold-mining sector:

- performs very well during the first 18-24 months of a general equity bear market, as long as the average gold-mining stock is not ‘overbought’ and over-valued at the beginning of the bear market, and

- [performs poorly during]…those times when the gold-mining sector has trended upward with the broad stock market during the 6-12 months prior to the start of the general equity bear market. Consequently, in the unlikely event that the current bull market in U.S. equities continues for another 6-12 months and gold-mining stocks [also] trend upward during that period, the gold-mining sector will then be vulnerable to the downward pull of a general equity decline.

Conclusion [Given the fact that] the gold-mining sector is currently a long way from being ‘overbought’ and over-valued (by some measures it was recently as ‘oversold’ as it ever gets) the historical cases cited above would therefore be relevant if a general equity bear market were to begin in the near future.

[The above article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com, www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This paragraph must be included in any article re-posting to avoid copyright infringement.]

*Original Source: http://www.gold-eagle.com/article/gold-stocks-during-equity-bear-market

Stay connected!

Related Articles:

1. Gold & Silver Miners Are Taking Off – FINALLY!

The recent double bottom is a very bullish pattern from which the market usually explodes upwards. This article looks at the performance of the HUI, XAU, GDX & GDXJ over the last few months of decline to their lows and their most recent ascent.

Read More »2. Now’s the Time To Buy the Better Mining Stocks – Here Are 3 Major Reasons Why

There is compelling evidence that the gold mining sector is either at, or very close to, a major bottom, and the chances are high that the sector will rally strongly this year. Here’s why.

Read More »3. Don’t Be Misled – There are Major Differences Between the HUI, XAU & GDX

The number, market cap and currencies of the constituents of the HUI, XAU, GDX, XGD and CDNX indices differ considerably from each other and, as such, each index presents a different picture of what is really happening in the precious metals marketplace. This article analyzes the make-up of each index to reveal the biases of each to arrive at the answer to the question in the title. Words: 1026

Read More »4. What You Need To Know About Investing In Microcap (Penny) Stocks

Microcap stocks are inherently volatile, but for those that can stomach it, there is a big profit opportunity. Furthermore, hidden in the market are companies that do have game changing plans or discoveries that could see their valuations rise more than 10x (a ten-bagger, as industry people call it). The key is being able to put in the time, due diligence, and using the right strategy to discover these companies. This infographic covers some of the ins and outs of trading such stocks.

Read More »5. Are the Benefits Of Including Gold/Silver Stocks In Your Portfolio Really Worthwhile?

If there’s been a worse place to be as an investor over the past few years than gold & silver stocks then I haven’t found it. Over the past three years a diversified basket of these metals and mining companies is down over 65%. In that same time the S&P 500 is up nearly 75%, an enormous difference in performance. Here’s a look at the historical numbers to get a better sense of how they tend to act.

Read More »

6. Gold Shares Have Bottomed & Will Now Outperform Physical Gold Over Next 5.5 Years

2014 could end up being the turnaround year for precious metals and a bull market ascent could develop in 2015 – especially so in gold shares. Here’s why.

Read More »Precious metals shares are breaking out again after a brief consolidation. It’s time to channel your inner Old Turkey, realize this is a bull market and act accordingly.

Read More »8. It’s Time To “Swap” Your PM Stocks For Physical Gold & Silver – Here’s Why

We are of the opinion that the miners and explorers (and their indexes GDX and GDXJ} should be “swapped” for the precious metals – gold, silver, and their proxies (GLD and SLV). This way investors will maintain exposure to precious metals while reducing their exposure to the more volatile miners as some of the share dilution and recent investor exuberance play out – and at least hedge themselves if the price continues to rise.

Read More »9. Get on Board – NOW! We’re On the Verge of a Major Bull Market Advance Across the PM Sector.

The charts below make it crystal clear that we are on the verge of a major bull market advance across the PM sector. While these charts are for the Market Vectors Junior Gold Miners ETF, what happens to the GDXJ has major implications for the whole sector, for the simple reason that it is not going up without the entire sector going up too.

Read More »10. Incredible Bounce Coming Soon In Gold & Silver – Here Are 5 Reasons Why

Get ready for an incredible bounce higher in the gold & silver junior miner sector. Here are five reasons why.

Read More »11. The Most Explosive Turnaround to the Upside — EVER — Is Coming In the Precious Metals Sector

I am 100% confident that 1) precious metals will bottom this year and resume a new leg to the upside, 2) the extreme emotions right now regarding gold and silver are typical at major turning points and 3) all the underlying fundamental, cyclical and technical conditions for a new bull market in gold and silver are in place. Here’s an update on the latest action in gold, silver, platinum and palladium

Read More »12. Gold Stocks Could Jump 100% in the Coming Year – Here’s Why

It’s not crazy to think that gold stocks could easily double from their current levels if you realize the extreme condition the gold-stocks-to-gold ratio is in – and if you know your market history. Let me explain. Words: 336; Charts: 1

Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money