For the last 10 months or so we have watched the precious metals mining sector try in vain to put in a decent rally only to run out of steam and disappoint some of its most ardent supporters – including us. Stock prices have tumbled and now present us with cheaper entry levels. Are they worth buying now? We don’t think so. Here’s why we still hold that view. Words: 415

try in vain to put in a decent rally only to run out of steam and disappoint some of its most ardent supporters – including us. Stock prices have tumbled and now present us with cheaper entry levels. Are they worth buying now? We don’t think so. Here’s why we still hold that view. Words: 415

So says Bob Kirtley (www.gold-prices.net) in edited excerpts from his most recent article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Kirtley goes on to say, in part:

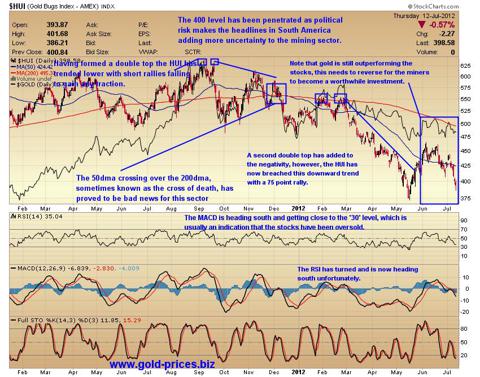

Taking a quick look at the chart below we can see that the 400 level has been penetrated on the HUI index…The MACD is heading south and getting close to the 30 level, which is usually an indication that the stocks have been oversold but, unfortunately, the RSI has turned and is now heading south as well. [Also read this excellent article on the near term prospects for the HUI, gold and silver.]

Click to enlarge image.

We remain unimpressed by the performance of the mining sector and are relieved that we have kept our powder dry for the last 18 months or so, as stock prices have tumbled and now present us with cheaper entry levels. Are they worth buying now? We don’t think so. From today until Labor Day in the United States, Sept. 3, a holiday mood will take over with the markets trading in a narrow range and remaining flat. This time last year the precious metals stocks did rally heartily on the back of a massive move in gold prices. However, we are not expecting a repeat of that event.

Take Note:

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE!

An easy “unsubscribe” feature is provided should you decide to cancel at any time.

There could be a black swan event putting fear into the markets, which could drive a small rally in the price of gold and silver. Again, when its a “fear on” trade, the main beneficiary appears to be the U.S. dollar, which has reached a recent high of 83.66 on the U.S. dollar index. A year ago it was struggling to hold the 74 level. It would appear that bad news, normally good for gold, is no longer boosting gold and silver prices, but restraining them.

Conclusion

We need a turnaround in sentiment and interpretation of these factors to cause gold prices to rally strongly, thus setting the stage for a massive rebound in the mining sector. Until we have some indication that this is happening, we will not increase our exposure to the mining stocks. Instead, we will continue to look for opportunities in the options arena (it’s not for the fainthearted and you should never deploy money that you cannot afford to lose,) where a small move in the underlying asset leverage can result in a profitable trade.

*http://seekingalpha.com/article/724611-gold-stocks-fail-to-sparkle (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

Gold is exhibiting 2 distinct patterns both of which suggest that if the support lines in both patterns are breached we could have a sharp decline in the price of gold to the level of $1,345 – $1,400/ozt. Likewise, silver could drop to $14.50. Were the aforementioned to happen the HUI index could re-test its previous low of 386 . Let me show you some charts that show you why that is the case. Words: 666

2. Don’t Bet On Gold Mining Stock Prices Going Higher! Here’s Why

All the fundamental factors that have made gold such a stellar investment for the last decade are still intact…[but] there are several things that have been affecting gold negatively over the past few months, much to our dismay. Words: 367

Martin Armstrong provides a remarkable explanation of what is going on right now with the U.S. dollar, bond yields and the current price of gold. It would be well worth your time to read and reflect on what he has to say. Words: 822

4. Gold & Silver Will Soon Collapse to $1,380 and $18 Resp. & Then Surge to $3,950/$117 in 2013

Due to the severe financial crisis in Europe, capital will continue to take refuge in the U.S. Dollar and gold and silver will collapse to US$1,380/oz. (Fibonacci Retracement 61.8% level) and US$18/oz. (Fibonacci Retracement 76.8% level) respectively, in the third quarter of 2012.

5. The Gold Bubble Is About to Burst and the Upcoming Drop Could Be Severely Sharp! Here’s Why

The gold bubble is about to burst…the decisive move is coming within weeks! Selling has been heavy, key technical levels have been broken, important moving averages have been violated, and momentum is building to the downside. The upcoming drop could be severely sharp. [Let me explain why that is the case.] Words: 1239

6. I Love Gold but I’ve Turned Bearish! Here’s Why

I love gold but I’ve turned bearish. [While I admit] if the Greeks were to quit the euro that gold could face a short-term bull wave I believe gold’s fundamentals are [too] weak to support the current price. [Here are 8 solid reasons why.] Words: 685

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money