One of the (many) fascinating things about this latest global financial  crisis is that there’s no single catalyst. Unlike 2008 when the carnage could be traced back to U.S. subprime housing, or 2000 when tech stocks crashed and pulled down everything else, this time around a whole bunch of seemingly-unrelated things are unraveling all at once. [Let me explain.]

crisis is that there’s no single catalyst. Unlike 2008 when the carnage could be traced back to U.S. subprime housing, or 2000 when tech stocks crashed and pulled down everything else, this time around a whole bunch of seemingly-unrelated things are unraveling all at once. [Let me explain.]

By John Rubino (dollarcollapse.com)

- China’s mal-investment binge is crashing global commodities,

- an overvalued dollar is crushing emerging markets (most recently forcing China to devalue),

- the pan-Islamic war has suddenly gone from simmer to boil,

- grossly-overvalued equities pretty much everywhere are getting a long-overdue correction,

- developed-world political systems are being upended as voters lose faith in mainstream parties to deal with inequality,

- corporate power,

- entitlements,

- immigration.

Really pretty much everything.

Causes matter at times like this because, where previous crises were “solved” with a relatively simple dose of hyper-easy money, it’s not clear that today’s diverse array of emerging threats can be addressed in the same way.

- Interest rates, for instance, were high by current standards at the beginning of past crises, which gave central banks plenty of leeway to comfort the afflicted with big rate cut announcements. Today rates are near zero in most places and negative in many.

- Cutting from here would be an experiment to put it mildly, one with an uncertain outcome and myriad possible unintended consequences including a flight to cash that empties banks of deposits and a destabilizing spike in wealth inequality as negative interest rates support asset prices for the already-rich while driving down incomes for savers and retirees.

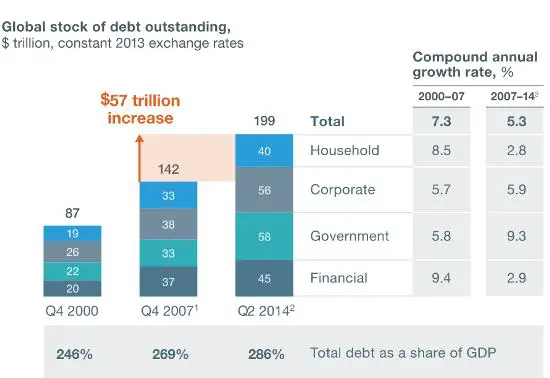

- And with debt now $57 trillion higher worldwide than in 2008, it’s not at all clear that another borrowing binge will be greeted with enthusiasm by the world’s bond markets, currency traders or entrepreneurs. Here’s that now-famous chart from McKinsey:

- Easier money will have no effect on the supply/demand imbalance in the oil market, which is still growing. The likely result: Sharply lower prices in the year ahead, leading to a wave of defaults for trillions of dollars of energy-related junk bonds and derivatives.

- As for stock prices, in the previous two crises equities plunged almost overnight to levels that made buying reasonable for the remaining smart money. Today, virtually every major equity index is still high by historical standards, so the necessary crash is still to come — and will add to global turmoil as it unfolds.

The upshot?

It really is different this time, in a very bad way, and this fact is just now dawning on millions of leveraged speculators, mutual fund and pension fund managers, individual investors and central bank managers.

- Right this minute virtually all of them are staring at screens, scrolling over to the sell button, hesitating, pulling up Bloomberg screens showing how much they’ve lost in the past few days, calling analysts who last year convinced them to load up on Apple and Facebook, getting no answer, going back to Bloomberg and then fondling the sell button some more. Think of it as financial collapse OCD.

What happens next?

At some point — today or next week or next month, but probably pretty soon — the dam will break. Everyone will hit “sell” at the same time and find out that those liquid markets they’d come to see as normal have disappeared and yesterday’s prices are meaningless fantasy.

The exits will slam shut and…the whole world will be stuck with the positions they created back when markets were liquid and central banks were omnipotent and government bonds were risk-free and Amazon was going to $2,000.

[The original article was written by John Rubino (dollarcollapse.com) and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – sign up in the top right corner) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]Related Articles from the munKNEE Vault:

1. A “perfect storm” Is Coming To Global Stock Markets In 2016

Batten down the hatches, because a “perfect storm” is coming to global stock markets in 2016 according to the technical analysis team at UBS.

2. The Stock Market Will Tank In 2016 – Here Are 10 Reasons Why

The top 14 investment banks ALL project that the S&P 500 will go up in 2016 with an average increase of 6.5%…This is understandable. A falling stock market is bad for business and these banks depend and thrive on the bullish excitement and expectations of their clients. However, we at Carden Capital, have adaptive strategies that can handle up and down markets, so we can tell it like it is, and in this case, we are highly confident that the projections of those 14 investment banks are going to be dead wrong. In fact, we are confident that the market will be down in 2016, and will enter into a corrective phase. With that introduction, we present to you the top 10 reasons the stock market will tank in 2016.

3. 1 (or more) of These 6 Things Could Poison Stock Market Returns In 2016

I am convinced that trouble is coming in 2016 that could poison your returns if you are not careful. Here are 6 possibilities.

4. A Reminder Of What Usually Happens to Stocks When the Fed Raises Rates: Ouch!

I know, I know, no one likes the bearer of bad news — especially when it comes to stock prices – but someone needs to remind you what usually happens to stocks when the Fed raises rates so it might as well be me. They drop. Let me explain.

5. Coming Stock Market Crash Will Mirror Debacles Of 2001 & 2008

Given that this imminent recession will begin with the stock market flirting with all-time highs, the next stock market crash should be closer to the 2001 and 2008 debacles that saw the major averages cut in half.

6. If You Own Stocks Then This Article Is a MUST Read

Don’t be one of the people who don’t understand the vital importance of the bond market and what it’s telling you right now. This knowledge could help you avoid a huge hit to your net worth over the next 12-24 months. Here’s why.

7. Get Ready: Stock Market Crash Coming in 3-6 Months – Here’s Why

The deteriorating junk bond market, along with rising credit spreads, is indicating that we will have a stock market correction in about 3-6 months. Here are the details.

8. This Ratio Is An Ugly Warning Sign For the Stock Market

Historically, the performance of the S&P 500 Index relative to the U.S. Dollar Index has been a good indicator of bull and bear markets but it has underperformed the Dollar Index since mid-2014. It’s an ugly warning sign for the market. I see the stock market moving downward from here.

9. Will It Be China That Pricks the Stock Market Bubble?

Let’s imagine the stock market as a whole bunch of balloons. One or two can pop loudly and everyone will jump and then laugh it off but, eventually, enough balloons will pop that the weight of the debris overwhelms the remaining balloons’ ability to keep the string aloft. Then your whole bunch falls down. In like manner, some kind of catalyst sets off every market collapse.The last balloon to pop isn’t any bigger or smaller than the others; it just happens to be last. What are some candidates for that last balloon?

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money