I believe that the economy is headed toward a deep recession and that the stock market is extraordinarily  overvalued based on unrealistically high expectations for economic output and corporate income…

overvalued based on unrealistically high expectations for economic output and corporate income…

The above are edited excerpts from an article* by Dave Kranzler (investmentresearchdynamics.com) as posted on SeekingAlpha.com under the title The U.S. Economy: Deep Recession Coming.

The following article is presented by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Kranzler goes on to say in further edited excerpts:

Driven by a downturn in private inventory investment, exports and nonresidential fixed investment, the Commerce Department’s Q1 Revised GDP fell from the initial .1% estimated gain to a 1% decline.

Two of the bigger drivers of GDP are retail sales and the housing market…

1. Retail Sales

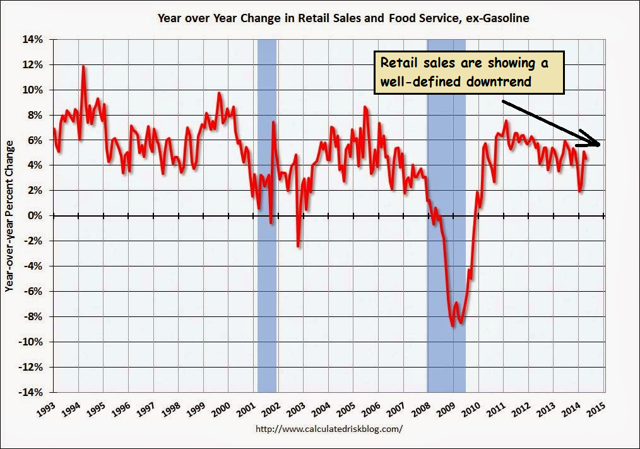

As you can see from the graph below, retail sales and food service ex-gasoline, are showing that a definitive downtrend has started (source: Calculated Risk, edits are mine):

Furthermore, if you take into account the affect of inflation on the nominal retail sales which the Government estimated at 1.3% in its GDP report, real retail sales expressed in unit volume declined by well over 1%…[In addition,] the Dept of Commerce’s Personal Income and Outlays report for April… showed personal consumption expenditures declined in April by .1% and by .3% after stripping out inflation. If retail sales continued to deteriorate in May from April, it will have an adversely negative effect on the Q2 GDP.

2. Housing Market

…There has been a definitive downtrend in month-to-month sequential sales volume that began in July 2013…The big buy-to-rent institutional investment buyer, which has been the primary driver of home sales and price gains over the last 18 months, has largely withdrawn as a buyer of homes this year. To be sure, the individual “flipper” buyer is still active, although I suspect that segment of demand will begin to fade as new and existing home inventory continues to build and sales continue to decline.

While April new and existing home sales showed seasonal gains from March to April, they both registered declines year over year, with existing home sales down 6.8% and new homes sales down 4.2%. The year-over-year declines have been persistent for several months now. In addition, it is likely that the May existing home sales report released later this month will show a continuing deterioration in the housing market based on the recent Pending Home Sales report …[which] reflects both declining demand despite rising home inventory. With the recent housing market data showing a probable continued slowdown in homes sales, I believe it confirms that the housing component of GDP will likely affect the GDP calculation negatively in Q2.

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Other Factors

…I also believe that auto sales, which have been largely fueled by subprime auto lending will soon start to track negatively month to month on a consistent basis and contribute to further contraction in the U.S. economy.

How to Take Advantage

If you have a bearish view on the economy, I recommend shorting the retail and housing sectors…

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

* http://seekingalpha.com/article/2249803-the-u-s-economy-deep-recession-coming?ifp=0 (© 2014 Seeking Alpha )

Related Articles:

1. Many Economic Cycle Theorists Believe 2014 to 2020 Is Going To Be Pure Hell For the U.S.!

Many mainstream economists want nothing to do with economic cycle theorists, but it should be noted that economic cycle theories have enabled some analysts to correctly predict the timing of recessions, stock market peaks and stock market crashes over the past couple of decades – and there are many economists who believe that the period from 2014 to 2020 is going to turn out to be pure hell for the United States. Read More »

2. Is An Economic Collapse of U.S. Possible, Likely or Imminent?

Much has been written by a variety of analysts on the health of the U.S. economy, its susceptibility to a collapse, and possible/likely/imminent (depending on who the author is) of an impending stock market crash, falling U.S. dollar and future hyperinflation. Below is a cross-section of opinions on the subject to help you get a more enlightened understanding of the factors at play and what influence, if any, they may have on how things unfold. Read More »

The impending emergence of The Four Horsemen of the Apocalypse (Debt, Derivatives, Deficits & Dollar) may soon sound the death knell of the entire U.S. economic recovery [we have seen] since early 2009 and eventually and sadly morph into mass Unemployment, Home Foreclosures, Stagnant Wages & Shrinking Retirement. Read More »

4. 5 Red Flags of Imminent Economic Collapse

These 5 red flags will give you anywhere from a few days to a few months of warning that things are about to change drastically…and well before those around you grasp the full extent of what is going on. This is hopefully a scenario that never happens as this will truly be the end of the world as you knew it. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money