Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry.

- They provide some leverage to the growing metals prices, similar to the typical mining companies;

- Their incomes are derived from royalty and streaming agreements [whereby] the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

- They [also pay] some ongoing payments that are usually well below the market price of the metal. They can be set as:

- a fixed sum (e.g., $300/toz gold)

- or as a percentage (e.g., 20% of the prevailing gold price),

- or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price).

- The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments.

- They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

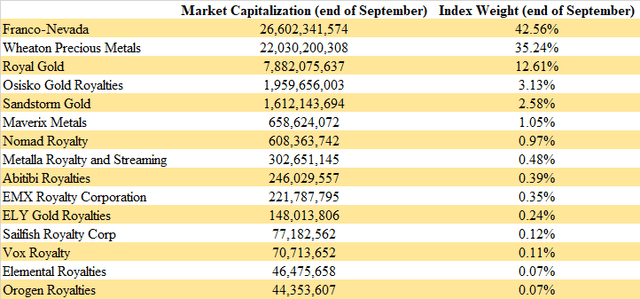

To track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 15 companies..[as well as] an equal-weighted version of the index. Both indices include the same companies and are calculated back to January 2019 [see below].

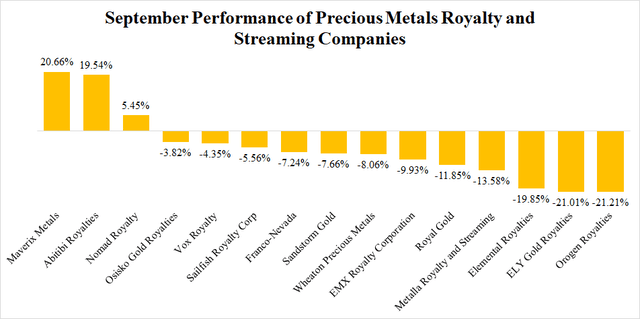

…September was not good for the precious metals royalty and streaming industry, as 12 out of the 15 followed companies recorded negative share price performance [see below].

…The month of September was poor on news. No major deals were closed, only Royal Gold and Maverix Metals announced some mid-sized deals. The situation should change in October, as the Q3 earnings season will start and also some of the royalty & streaming companies should report their results.

…Some of the companies will probably release their Q3 results before the end of October. Moreover, Osisko has already announced the spin-out of its mining assets but, just like in September, the gold and silver prices should set the direction. [Currently,] the gold, and especially silver, charts look better than one month ago, which means that there is a good chance for October to be more positive for the precious metals royalty and streaming companies than September was.

Editor’s Note: The original article by Peter Arendas has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

If you want more articles like the one above sign up in the top right hand corner of this page and receive our FREE bi-weekly newsletter (see sample here).

munKNEE.com – ” The internet’s most unique site for financial articles! Here’s why“

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money