Today’s market/economic conditions strongly suggest that tomorrow:

- the Fed

- will not raise interest rates but, instead,

- will introduce more quantitative easing and

- we will experience

- a continuing decline in the stock and bond markets and

- an upsurge in precious metals.

Here’s why that is the case.

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by Albert Sung (katchum.blogspot.be) originally posted on SeekingAlpha.com under the title Is The Dow Jones Bottoming Out Or Crashing? and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

1. Total Market Cap – to – GDP Ratio Is Far Too High

…The market is still significantly overvalued (117.5%) compared to GDP…[In fact,] we would have to drop more than 30% to get a fairly valued stock market.

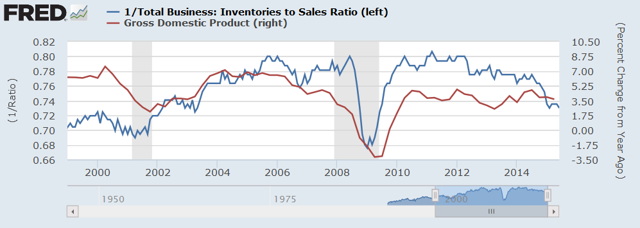

2. Business Inventory – to – Sales Ratio Is Hitting New Highs

We don’t expect that GDP will be rebounding anytime soon as the business inventory – to – sales ratio is hitting new highs. Inventories can be considered a part of a group of leading indicators of business cycles. Whenever inventories surge, a possible reason could be a decrease in consumer demand. The result is that producers will cut output and sales. This will translate in a lower GDP growth.

The chart below shows that the inverted business inventory to sales ratio is declining, pulling GDP growth with it.

We also see confirmation of a slowdown in GDP growth in the ISM Purchasing Manager Index, which fell to a low of 51.1 in August.

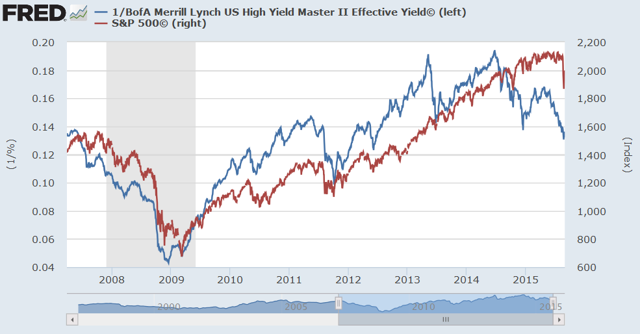

3. Junk Bond Market Is Plunging

…The junk bond market (high yield corporate bonds) is plunging (see chart below). Since mid 2014, high yield bonds have been dropping and we are only seeing the consequences in the stock market today. The yield spread between high yield corporate bonds and the 10 year U.S. treasuries is rising and this means that the stock market bubble is popping.

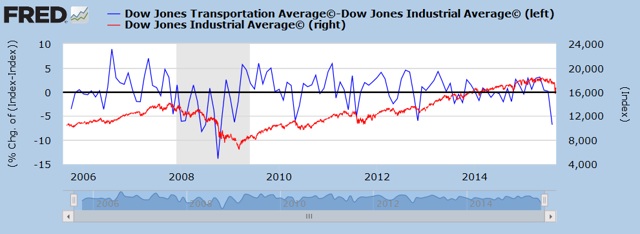

4. Dow Theory Revelation

When we look at the Dow Theory, the Dow transportation average (leading index) has been plunging as compared to the Dow Jones (see chart below). When both indices don’t confirm each other’s movement, it is clear that the Dow Jones will be following the leading Dow transportation average lower.

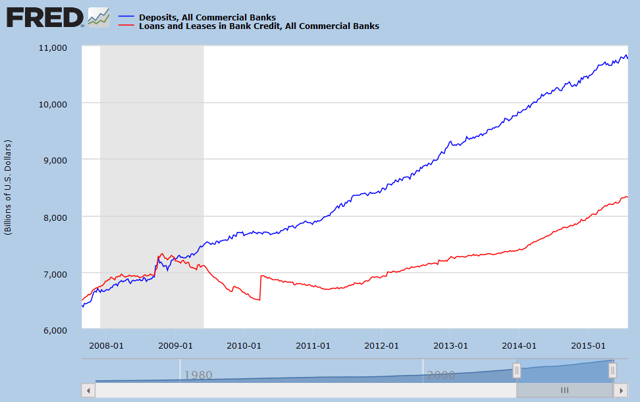

5. Federal Reserve Has Run Out Of Bullets

The Federal Reserve can not increase interest rates because…[if they were to do so] they would attract more money from the banks into the Fed balance sheet. That would worsen the lending environment in the economy and that would be the opposite of what the Federal Reserve wants, namely sending money from the Fed balance sheet into the economy.

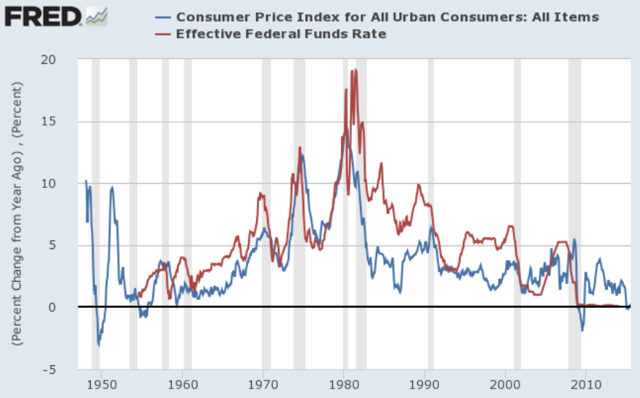

6. Inflation Remains Low

The Federal Reserve is also reluctant to increase interest rates because of the low inflation number…We can easily see in the chart below that inflation dropped to 0% year – over – year growth. There is no way the Federal Reserve will increase interest rates with these numbers.

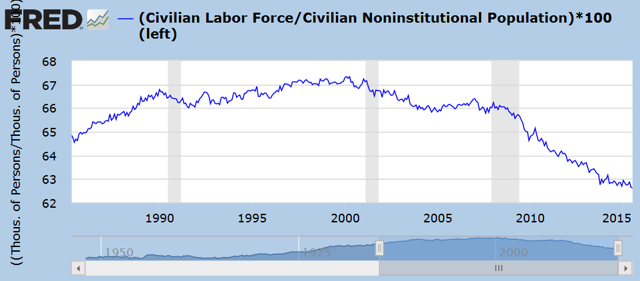

7. Labor Force Participation Rate Is Weak

When we look at how many people have dropped out of the labor force (labor force participation rate of 62.8%), there is little incentive to increase rates (see chart below).

8. U.S. Treasuries Under Pressure

…The Chinese are selling their foreign U.S. reserves (U.S. treasuries) via Belgium and Switzerland so we are not even safe in U.S. treasuries. If the Federal Reserve were to increase the Fed funds rate, this would put even more pressure on U.S. treasuries.

9. More Quantitative Easing Coming

The above strongly suggests that an interest rate hike is pretty much off the table. Instead, I believe we will see more quantitative easing. [Why? Because]…it is expected that the Treasury Department will run out of money mid-November and, as such, the debt ceiling will then have to be raised. Each time we saw a debt ceiling problem in 2011 and 2013, the stock market had a dip down because QE was exhausted (see chart below). Now in September 2015, due to tapering, QE is exhausted once again while a new debt ceiling crisis is emerging. The only way to resolve this is QE4 and this would sink the U.S. dollar and ignite a surge in precious metals.

My Advice

I advise investors…to:

- make trades away from the U.S. dollar (due to QE4),

- make trades away from stocks (due to high valuations and plunging high yield credit) and

- make trades away from bonds (due to selling from China and a lower U.S. dollar) and

- buy into precious metals.

*http://seekingalpha.com/article/3484546-is-the-dow-jones-bottoming-out-or-crashing?ifp=0&app=1

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money