Inflation enters the economy in stages. It’s not as though the Fed begins to print money and poof! Inflation appears. It takes time. This article explains the 3 stages of inflation and where we are at the present time.

appears. It takes time. This article explains the 3 stages of inflation and where we are at the present time.

The original article has been edited here for length (…) and clarity ([ ]). For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE tri-weekly Market Intelligence Report newsletter (see sample here)

The first stage of inflation:

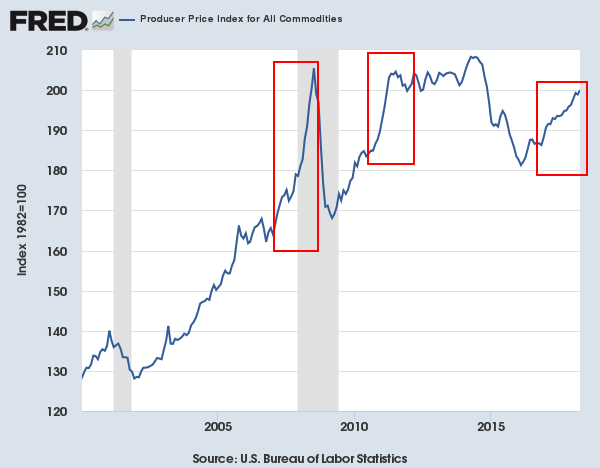

- occurs in the manufacturing/ production segment of the economy when you see producers suddenly paying more for the raw goods and commodities they use to manufacture/ produce finished goods. You can see this development in the chart below. The highlighted periods featured times in which Producer Prices for commodities or raw goods spiked approaching record highs.

One or two months of higher Producer Prices for commodities or raw goods is no big deal, but once you’re talking 6-8 months of steadily rising Producer Prices it’s significant. At that point manufacturers/ producers have to start raising the prices of finished goods or face shrinking profit margins. At that point you move into

The second stage of inflation:

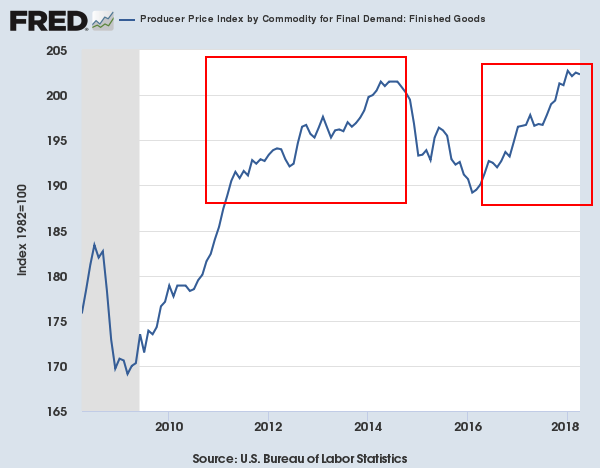

That didn’t happen in 2008 (the deflationary crisis removed the inflationary stresses) but it did happen in 2011 – and it’s happening again now. When the price of finished goods begins to rise, you’re in stage 2 for inflation. Again, this can be temporary, but if you have multiple months of this, you’re talking about a significant development.

Bear in mind, that phase 2 can happen in different ways. Management at companies don’t just say “raise the price now!” Instead they can do different things such as:

- charge the same amount for less of a finished product

- shrink the size of the container…

- start using cheaper/ lower quality raw goods (to reduce costs/ quality) while charging the SAME amount for the finished good. This too is inflation as the cost of the SAME item is MORE expensive, though it’s being masked because the QUALITY is LOWER and the price is the same.

You get the general idea.

I’ve marked periods in which “Stage 2” of inflation occurred in the last 10 years on the chart below.

It’s HERE that inflation begins to appear in the economy. However, it doesn’t become a SERIOUS problem until you reach the point at which the price of finished goods remain elevated long enough that people start to demand raises/ higher wages to maintain their living standards. THAT is

Stage 3 for inflation

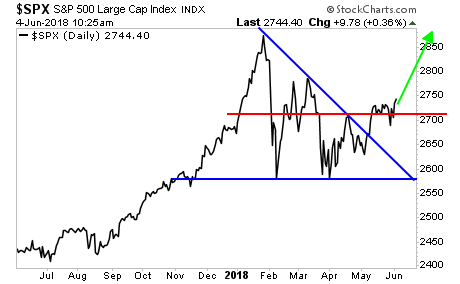

…the inflation that most people think about when they use the word and it marks when it’s fully seeped into the economy. We are now hitting this stage. We hit phase 1 back in mid 2016. We hit phase 2 in early/mid 2017. We are now hitting phase 3.

…While the CPI and other inflationary measures show inflation only slightly above 2%, WAGES have been rising by over 2.5% year over year for months (since at least January 2018). Put another way, “INFLATION” as most refer to it, is finally seeping into the economy. By multiple measures it’s already north of 2.5%…and the Fed is hopelessly behind the curve with rates at a mere 1.75%. This is THE trend going forward for financial markets and those who are well prepared for it will do extremely well.

…Stocks LOVE inflation at first but that relationship quickly goes south once inflation becomes so aggressive that it eats into profit margins no matter WHAT the company does.

Related Articles From the munKNEE Vault:

1. A Return to Double-Digit Inflation Of 1970s Extremely Unlikely – Here’s Why

Everyone seems to be preoccupied with rising inflation nowadays. While I agree that inflation will rise over the next 1-3 years, I don’t think it will even reach high-single digit levels. A return to the 1970s’ double-digit inflation is extremely unlikely. [Here’s why.]

2. Do Oil Prices Affect Inflation Expectations?

The claim that, in normal times, energy prices have a direct influence on long-term inflation expectations is puzzling, as it seems to imply that monetary policy is not able to offset price shocks even five or ten years down the road. If confirmed, it could have significant implications on how inflation dynamics are forecast. Hence, we believe that the claim warrants further scrutiny.

3. What Is the Likelihood Of High Inflation?

Recent economic data has bond yields jumping a little bit on the worry of higher future inflation. According to many this is the main concern behind the recent volatility in stock and bond markets so let’s see if we can’t put some of this data in perspective so we can better understand the risks to our portfolios.

4. These 3 Charts SCREAM “Inflation” In 2018

The 3 charts below of the financial system strongly suggest that we are in for an inflationary shock in 2018 that is going to ignite a HUGE rally in commodities and other inflation hedges.

5. These 5 Drivers Of Higher Inflation Are Starting To Kick In – Got Gold?

Investors got lulled into a state of inflation complacency [with] persistently low official inflation rates in recent years that depressed bond yields along with risk premiums on all financial assets – but that’s changing in 2018. Five drivers of higher inflation rates are now starting to kick in.

6. Inflation: What Is It? What Causes It? What Constitutes It? Why Worry About It?

General increases in prices, which follow increases in money supply, is an indication — as it were — that the erosion of peoples’ purchasing power has taken place…It is not the symptoms of a disease, but the disease itself, that causes the physical damage.

7. Inflation Shouldn’t Be Feared – Here’s Why

A growing chorus of forecasters see inflation pressures emerging. Even if that’s true, it should be welcomed – not feared. Here’s why.

8. Inflation: What Is It? What Isn’t? Who’s Responsible For It?

Inflation is the debasement of money by the government. PERIOD. It is NOT a general increase in the level of prices for goods and services. These statements are critical to an understanding and correct interpretation of events which are happening today – or expected to happen – that are casually attributable to inflation. Let’s go one step further as to what inflation is, what it isn’t and who’s responsible for it.

Support our work: like us on Facebook, follow us on Twitter, or share this article with a friend. munKNEE.com – Voted the internet’s “most unique” financial site! (Here’s why)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money