The LIBOR scandal is, in effect, “the world’s biggest banks stealing money that would otherwise have gone toward textbooks and medicine and housing for ordinary Americans, and turning the cash into sports cars and bonuses for the already rich. It’s the equivalent of robbing a charity or a church fund to pay for lap dances.”

would otherwise have gone toward textbooks and medicine and housing for ordinary Americans, and turning the cash into sports cars and bonuses for the already rich. It’s the equivalent of robbing a charity or a church fund to pay for lap dances.”

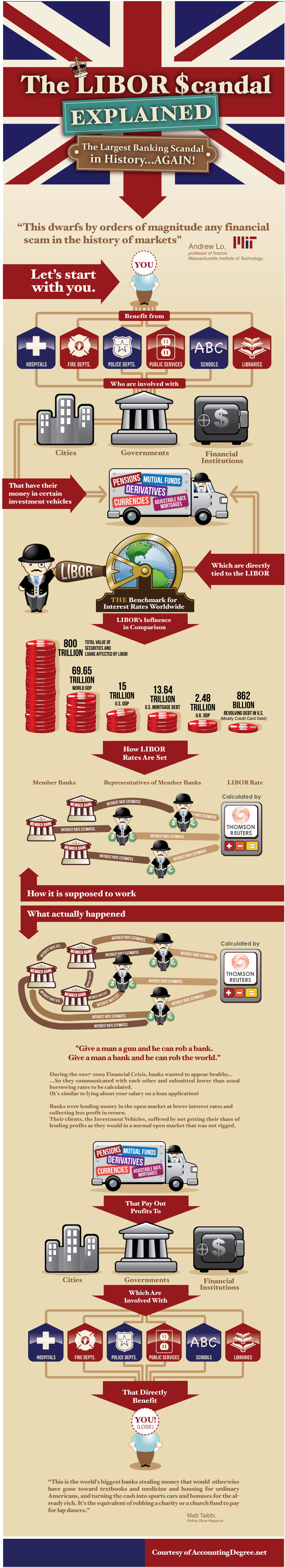

So says Matt Taibbi of Rolling Stone Magazine in a somewhat over-stated but graphic explanation of just what the current LIBOR (or should we more accurately refer to the LIBOR process as LIE-BOR) $candal is really all about in the most fundamental terms. Below is an infographic from www.AccountingDegree.net presented to you by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) It gives you an illustrated view of the full scope of the scandal to help you better understand this rather complicated process and how it has been manipulated.

A further excellent article on the subject entitled “LI(e)BOR: All You Need to Know – and Why You Should Care” can be found here.

*http://www.accountingdegree.net/numbers/libor.php

Take Note:

Related Article:

1. LI(e)BOR: All You Need to Know – and Why You Should Care

The very nature of the question used to solicit rates from the contributing banks to establish the LIBOR (London Interbank Offered Rate), tells you all you need to know. The banks are asked, in effect, “At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?” The bank is supposed to submit a rate where they think they could borrow, not where they actually borrowed, or where they would lend to other contributors…and, as such, LIBOR has always had an element of “gamesmanship” if not outright lying. [Here’s what you should know about what LIBOR is, how it is established and why you should really care.] Words: 1100

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Add to this all the insider trading and Stock-less short selling and you begin to understand how “rigged” the system is… Making money in the stock market is an accident and everyone that gets a commission for “handling” your money is in on the “game”…

I expect to see ever more “insiders” start spilling the beans on the crooked system, which has done them wrong, as the MSM tries to control the “truth” about just how bad the fiscal system really is in order to prevent yet another “run” on the banks…