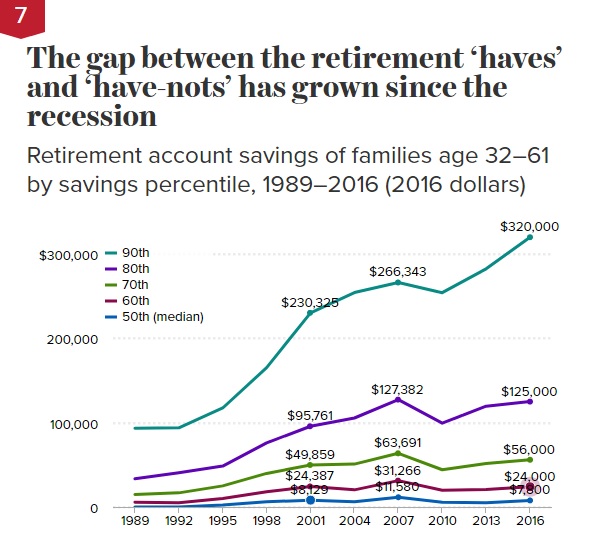

…The gap between the retirement ‘haves’ and ‘have-nots’ has grown since the recession ended…and it is only going to continue growing unless people are provided with enough financial guidance so they can plan accordingly.

The growing gap

The Economic Policy Institute came out with some new data that highlights this growing gap in rather stark terms. Take a look at this chart showing the retirement account savings for U.S. families:

The only tier that is better off since 2007 is the 90th percentile. The rest of the country is maintaining a flat rate of growth in retirement savings, if any…

When you look at this in context you realize that the retirement system is not working well for most workers. People are simply not putting away the necessary money in their 401K plans to secure a nest egg into later years. That is problematic and we are seeing those issues now hitting older Americans as they try to live in their later years. At that stage, there is only so much you can do to get your savings up given that your peak earning years are long gone.

To build up a nest egg you need to have the ability to save money. The challenge is that many Americans are living paycheck to paycheck and don’t have the ability to put money aside.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money