According to some pundits, the market’s dangerously close to a repeat performance of October, 1987. Today, I’m going to show you why they’re wrong.

of October, 1987. Today, I’m going to show you why they’re wrong.

So writes Greg Guenthner (dailyreckoning.com) in edited excerpts from his original article* entitled It’s Not 1987 Anymore…

[The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

Guenthner goes on to say in further edited (and perhaps in some instances paraphrased) excerpts:

The 1987 doomers are back. August is a slow month so every financial journalist on the planet has found time to tack on a Black Monday (October 19, 1987 when the Dow Jones Industrial Average endured its largest one-day collapse in history) question to the end of their interviews.

The Latest Fear-mongering Warnings

The latest round of Black Monday warnings…[come from] Dr. Doom himself, Marc Faber, who said last week on CNBC that investors should prepare for a 20% drop in the broad market before the end of the year:

“In 1987 we had a very powerful rally but also earnings were no longer rising substantially and the market became very overbought. The final rally into Aug. 25 occurred with a diminishing number of stocks hitting 52-week highs. In other words, the new-high list was contracting, and we have several breaks in different stocks.”

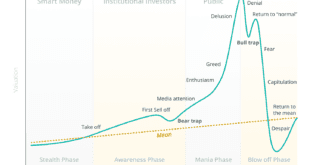

Faber’s warnings are pitch-perfect…. it’s August…stocks are looking a bit weak and investors are nervous. Comparing today’s market conditions in broad terms (overbought, breakdowns in “certain stocks”) with the 1987 crash can easily gain traction in this environment but if you move past the sweeping comparisons, you’ll see there’s not too much to the story [as the chart illustrates below].

There’s NO Comparison Between 1987 and 2013

The problem with the “pick a year to compare” game is that individual years don’t exist in a vacuum. You have to place them in context.

- The Dow was up almost 23% in 1986, setting up a 20-month run that saw the big index rise 76% by August 1987. That makes the 26% gains the Dow has posted from January 2012 – present appear positively mundane.

- The only similarity that 1987 has with 2013 is that both markets were up Jan. 1 – August. In 1987, the Dow rose as much as 44% by late August. As of today, the Dow’s up less than 18% year-to-date. That’s solid—but hardly the parabolic run-up that preceded the Black Monday crash.

Don’t get all wrapped up in these fear-mongering comparisons. It’s mostly a pointless exercise that won’t increase your returns by a single penny this year.

Conclusion

The consolidation we’re seeing (and could continue to see) in the markets is healthy. You should approach any upcoming correction as a potential opportunity—not a harbinger of disaster.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

* http://dailyreckoning.com/its-not-1987-anymore/ (© 2013 Agora Financial, LLC. All Rights Reserved.)

Related Articles:

1. Bernanke Has Created the Mother of ALL Stock Market Bubbles – Here’s Why

We have NEVER been this overextended above this line at any point in the last 20 years. Indeed, if you compare where the S&P 500 is relative to this line, we’re even MORE overbought that we were going into the 2007 peak at the top of the housing bubble. Read More »

2. A Stock Market Crash Followed This Occurrence In 1929, 2000 & 2007 – It’s Happening Again!

What do 1929, 2000 and 2007 all have in common? Those were all years in which we saw a dramatic spike in margin debt. In all three instances, investors became highly leveraged in order to “take advantage” of a soaring stock market but, of course, we all know what happened each time. The spike in margin debt was rapidly followed by a horrifying stock market crash. Well guess what? It is happening again. Read More »

Over the past 6 years, when the yield on high yield bonds (junk bonds) broke above resistance of bullish falling wedges, the S&P 500 ended up declining between 17% & 50%. Will it be different this time? Read More »

There are many, many different takes on why the stock market has been ripe for a fall and why it has finally happened. Below are 30 of the best-of-the-best such analyses to help you come to some sort of resolution. Read More »

5. Don’t Worry About the Threat of Higher Interest Rates Hurting Stocks – Here’s Why

History clearly shows that stocks don’t fall during periods of rising interest rates. Sure, they might fall a little when a rate hike is announced – maybe for a week or so – but they usually bounce back quickly – and then they go higher. Read More »

6. We Think the Prognosis for Stocks Looks Good – Here’s Why

Stocks have generally performed very well in rising-rate environments but the current rate cycle is unlike any other of the past 40 years, keeping investors on edge. A lot will depend on how inflation behaves. Read More »

The Dow has begun a major rally 13 times over the past 112 years which equates to an average of one rally every 8.6 years so, as it stands right now, the current Dow rally that began in March 2009 would be classified as well below average in both duration and magnitude. Read More »

8. Pop a Pill & Relax ! There’s NO Immediate Danger Threatening Stocks

Right now there’s nothing to be bearish about. I say that with conviction, because my “Bear Market Checklist” is a perfect 0-for-9. Heck, not a single indicator on the list is even close to flashing a warning sign. We’ve got nothing but big whiffers! Take a look. Pop a pill and relax. There’s no immediate danger threatening stocks. Read More »

9. Latest Action Suggests Stock Market Beginning a New Long-term Bull Market – Here’s Why

There are several fundamental reasons to believe that this week’s stock market activity, where the S&P 500 has moved more than 4% above the 13-year trading range defined by the 2000 and 2007 highs, could mark the beginning of a long-term bull market and the end of the range-bound trading that has lasted for 13 years. Read More »

10. Sorry Bears – The Facts Show That the U.S. Recovery Is Legit – Here’s Why

Today, I’m dishing on the unbelievable rebound in residential real estate, pesky rumors about the dollar’s demise and a resurgent U.S. stock market. So let’s get to it. Read More »

11. Stocks Are NOT In Another Bubble – Here’s Why

U.S. stocks are off to one of their best starts in years. Most indices are up 10% year to date, prompting many investors to ask: “Are we in another bubble?” The answer is no, at least when it comes to equities. Here are three reasons why:

12. Research Says Stock Market Bull Should Continue Its Run Until…

The mainstream financial press would like us to believe that because the S&P 500 and Dow 30 are at or near their record highs that it must mean we’re nearing the end of the current bull market and, as such, now must be a terrible time to buy stocks. Let’s not jump to any conclusions, though. Instead, let’s do our own due diligence to find out. Hint: If you’ve been stuffing cash under the mattress since the last market crash, you might want to finally go deposit it in your brokerage account. Here’s why… Words: 420

13. These 4 Indicators Say “No Stock Market Correction Coming – Yet”

While I remain cautious on stocks and the risk trade, the technical picture shows that the uptrend to be intact and the bulls should still be given the benefit of the doubt for now. At this point, any call for a correction is at best conjecture [as evidenced by the following 4 indicators]. Words: 399; Charts: 4

The Swimsuit Issue Indicator says that U.S. equity markets perform better in years when an American appears on the cover of Sports Illustrated’s annual issue as opposed to years when a non-American appears on the cover. [What is the nationality of this year’s cover model? Can we expect returns above the norm or will we see a year of underperformance for the S&P 500 this year? Read on.] Words: 323 ; Table: 1

15. Bull Market in Stocks Isn’t About to End Anytime Soon! Here’s Why

As we all know, money printing always leads to inflation. It’s just a matter of figuring out which assets get inflated. This time around gold is not the only beneficiary, stocks are, too, and I’m convinced that the chart below holds the key to the end of the bull market. Words: 475; Charts: 1

16. QE Could Drive S&P 500 UP 25% in 2013 & UP Another 28% in 2014 – Here’s Why

Ever since the Dow broke the 14,000 mark and the S&P broke the 1,500 mark, even in the face of a shrinking GDP print, a lot of investors and commentators have been anxious. Some are proclaiming a rocket ride to the moon as bond money now rotates into stocks….[while] others are ringing the warning bell that this may be the beginning of the end, and a correction is likely coming. I find it a bit surprising, however, that no one is talking of the single largest driver for stocks in the past 4 years – massive monetary base expansion by the Fed. (This article does just that and concludes that the S&P 500 could well see a year end number of 1872 (+25%) and, realistically, another 28% increase in 2014 to 2387 which would represent a 60% increase from today’s level.) Words: 600; Charts: 3

17. 5 Reasons To Be Positive On Equities

For the month of January, U.S. stocks experienced the best month in more than two decades [and the Dow hit 14,009 on Feb. 1st for the first time since 2007]. Per the Stock Traders’ Almanac market indicator, the “January Barometer,” the performance of the S&P 500 Index in the first month of the year dictates where stock prices will head for the year. Let’s hope so…. [This article identifies f more solid reasons why equities should do well in 2013.] Words: 453

18. Start Investing In Equities – Your Future Self May Thank You. Here’s Why

As Winston Churchill once said: “A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty” and in that vain I challenge all readers to fight off the negativity, see long-term opportunity in global equity markets and, most importantly, remain invested. Your future self may thank you. Words: 732; Charts: 6

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money